Daqo New Energy | The Cheap Polysilicon Stock

This article is a full analysis of Daqo New Energy as a business and potential for investment.

Solar has fallen a long way from grace. And for good reason, most companies are unprofitable with deteriorating balance sheets. In this article I break down one company being tossed out like a diamond in the trash.

As always my goal is to save you time by giving you my research reports and helping you make more money with better informed decisions. What’s not to like!

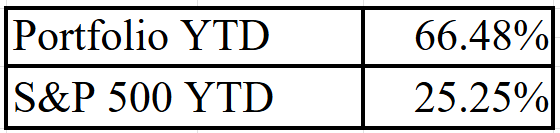

It is this analysis that has allowed me to outperform by a wide margin this year so do yourself a favor and save time by getting the picks and analysis right in your inbox!

First let’s lay out how we got to where we are.

After Covid solar companies saw an explosion in demand. Families had extra money to put solar panels on their homes. States and countries started large solar projects in an effort to be more green.

This sharp increase in demand outpaced supply and drove prices for key materials sky high. For the companies that make those materials their profits went up many fold. Along with the profits so went stock prices. Many stocks were up 5x or more in a couple years.

With profits rolling in many of these companies, especially the manufactures, built new facilities to ramp up production to meet the demand. Soon supply surpassed demand and it turned into a race to the bottom. Manufacturers' needed to keep cutting prices to move product. This naturally resulted in profits drying up.

Now we come to today where most solar companies are burning money like it is going out of style. It is in dire situations like this you can find some of the greatest opportunities. Everyone is running the other direction from all solar names regardless of their fundamentals or opportunity. Meaning you can see companies trading at ridiculously low valuations.

Exactly the place I want to be looking.

It was in this environment that I came across the polysilicon manufacturer Daqo New Energy. They currently have a market cap of about $1.16B and operate out of the highly competitive China.

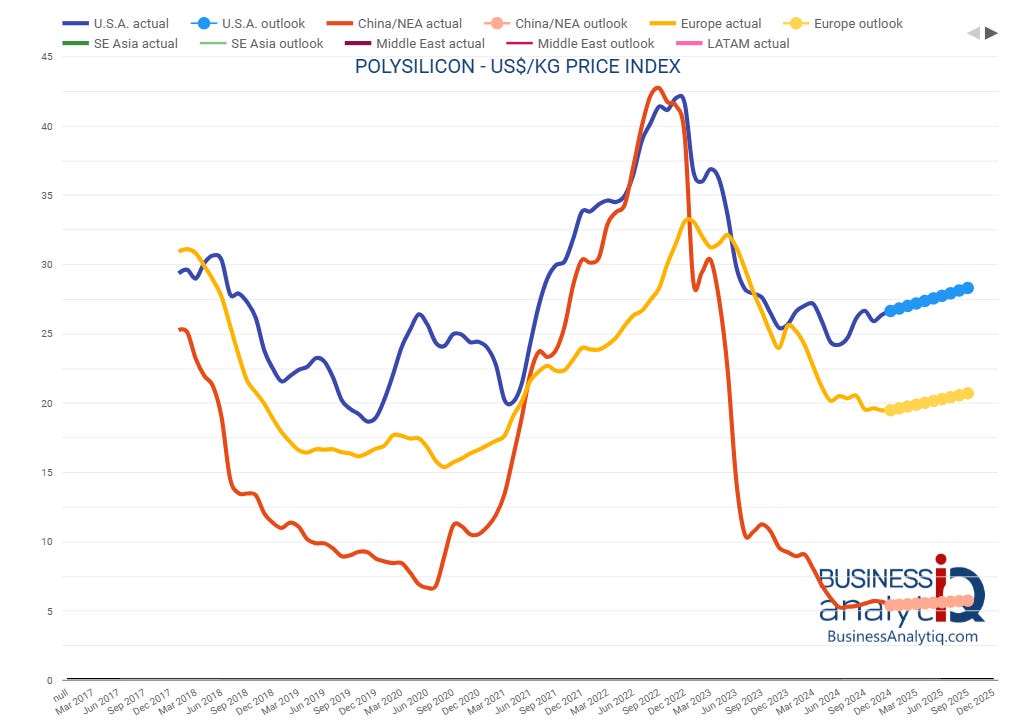

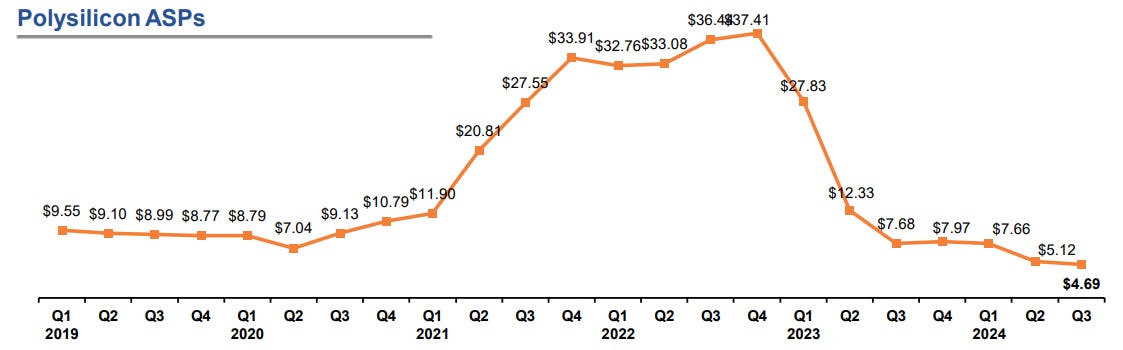

In China their recent boom and bust cycle was more pronounced than other parts of the world. From its peak Chinese polysilicon prices have fallen over 75% and as you can guess many companies are bleeding cash.

The glut in this market is going to have some interesting affects that make Daqo New Energy an exciting opportunity so stick around to learn about this potential multi-bagger no one wants to touch.

What you are going to read:

Understanding the Company

Understanding the Industry

Financial Fundaments

Management Integrity

Risks

My Thoughts

Valuation

Key Takeaways

🎯Daqo operates in a commodity industry where low price is king and they are one of the lowest cost producers in the world.

🎯The polysilicon industry has a history of booms and busts. Currently it is likely at or near a trough in prices indicating the start of a new boom.

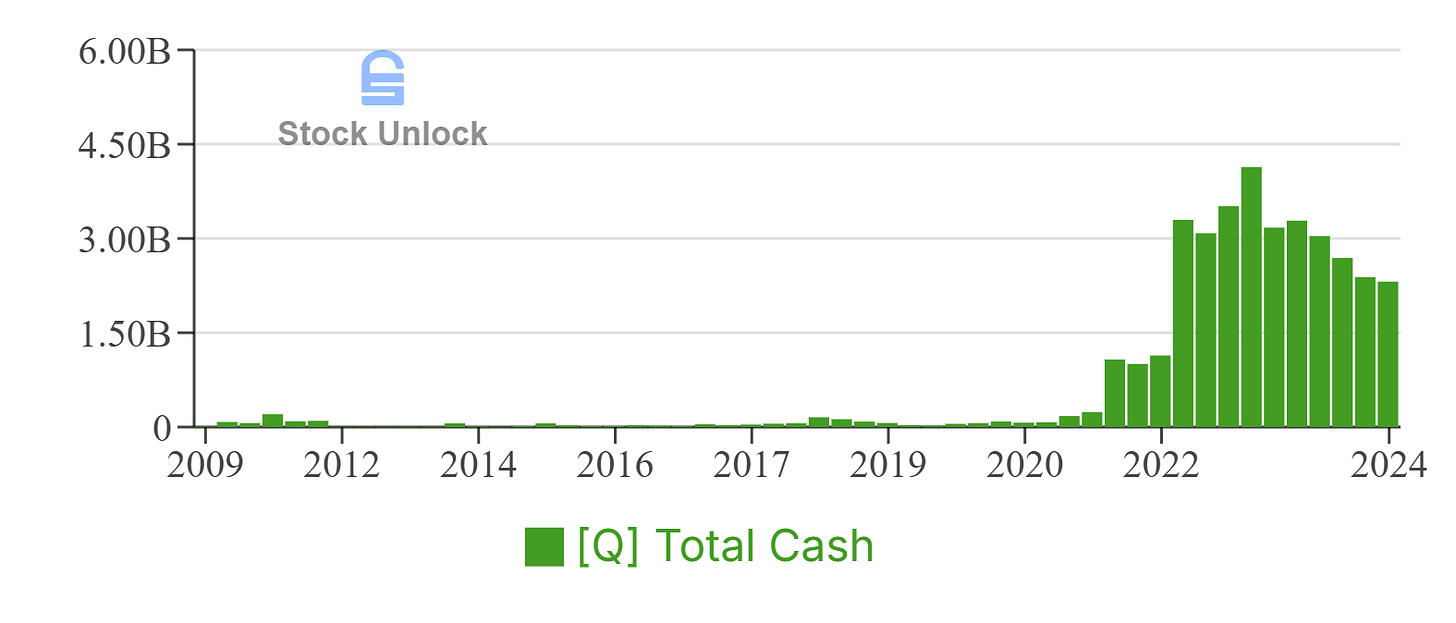

🎯The company has a massive $2.3B cash pile and no debt. They can wait out low prices while competitors go bankrupt leaving them to reap the rewards after.

⚠️The largest risk is the Chinese government stepping in with regulations to prevent the natural bust from happening. They could prop up weak players keeping supply higher and price low. This would cause profits to remain subdued but still there.

💰If a new boom cycle occurs and prices reach a level about 25% lower than during the recent peak Daqo could return over 500% or a 30%+ CAGR over the next 6 years.

Understanding the Company

Daqo New Energy has navigated a complex and volatile market since its founding in 2007. Originally established as Mega Stand International Limited, the company identified an early opportunity in the growing demand for high-purity polysilicon. A critical component in solar panel production.

Over the years, Daqo expanded its operations with manufacturing facilities in Chongqing and Xinjiang, China, which enabled it to scale production capacity and meet industry demands.

The polysilicon market has been characterized by cyclical pricing, with downturns that often push prices below production costs. During these periods, Daqo focused on improving operational efficiency.

It is that operational efficiency that is key to my investment thesis and the company’s future. Importantly as well the company is still run by the founding family. It was only in 2023 that Guangfu Xu, the founder, gave control over to his son, Xiang Xu, to run the company.

While this might seem like a small detail, the father and son have seen what has caused many polysilicon manufactures to go bankrupt. They are consistently working to be more efficient and it has made them one of the lowest cost polysilicon producers in the world.

A great competitive advantage to have in a highly competitive industry.

More detail on what polysilicon is:

Daqo New Energy supplies polysilicon and polysilicon products for solar panels globally. They produce high-purity polysilicon through a chemical vapor deposition process which involves the reaction of purified silicon tetrachloride with hydrogen.

High purity polysilicon is the foundational material for manufacturing photovoltaic (PV) cells, which convert sunlight into electricity. The purity of the polysilicon significantly impacts the efficiency and performance of solar panels. Higher purity polysilicon allows for the creation of more efficient and reliable solar cells, enhancing overall energy conversion.

Understanding the Industry

The polysilicon industry has many players globally all with products primarily differentiated by price. And with over 90% of the world's polysilicon supply coming from China, the Chinese market is highly competitive.

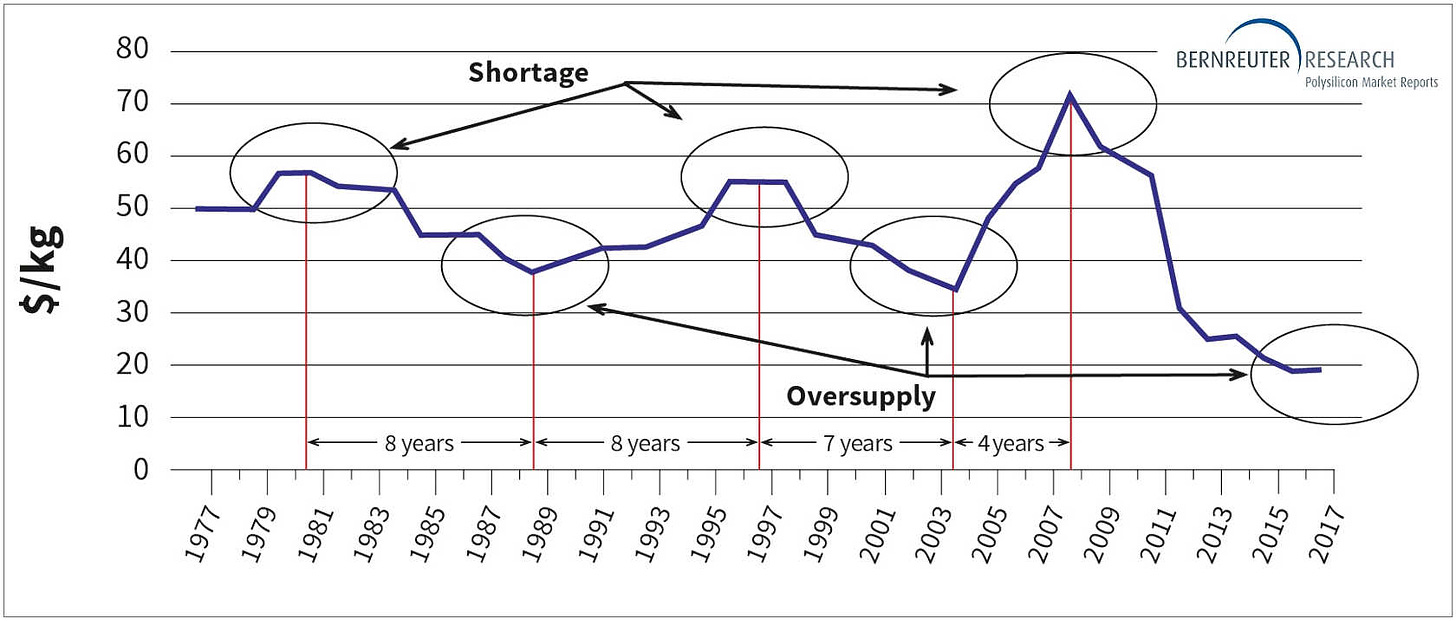

Such a competitive environment is prone to boom and bust cycles, leading to significant profit fluctuations. The first chart below illustrates three complete boom and bust cycles from 1977 to 2017, while the second chart picks up from there, showing the latest boom in 2022 and the current bust with exceptionally low prices, especially in China.

Due to the industry's fluctuating commodity prices, new entrants often join the market during price increases, causing oversupply. Conversely, as prices fall, high-cost producers exit the market, frequently going bankrupt. This is exactly the situation unfolding now. Daqo's management stated in a recent earnings report that they expect competitors to start going bankrupt the end of 2024.

Despite this bleak picture, the average of 5 industry forecasts suggest demand will grow by about 12.8% per year globally.

To summarize the situation, supply will decrease as high-cost producers go bankrupt, while demand will continue to rise. This is exactly what has happened during each boom and bust cycle. It seems simple but the pattern keeps repeating.

On average from trough to peak it takes a little under 5 years. Now our sample size of only 3 cycles is certainly small but history tends to rhyme. And for that reason I expect another boom peak within the next 5-6 years IF the industry is left to operate naturally. This will depend on if we have in fact troughed here but I think with the signally of bankruptcies in the industry it is sensible to say we have.

Financial Fundamentals

Margin’s

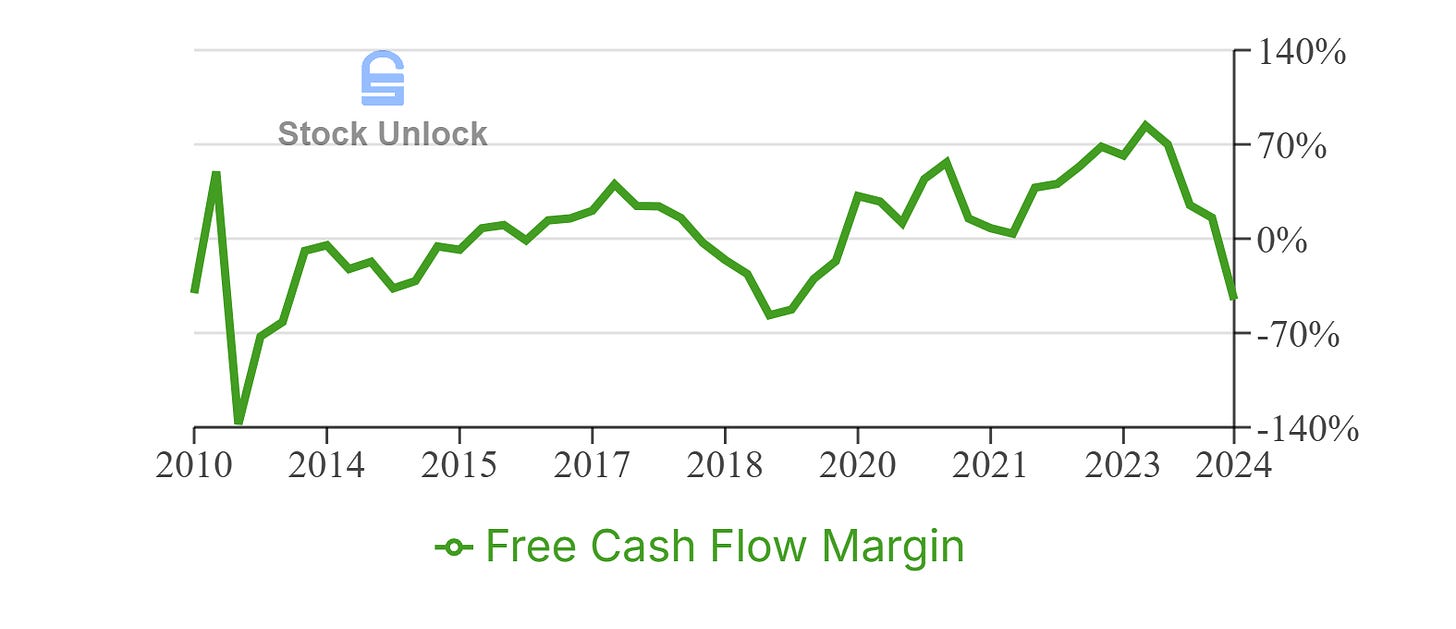

Since the end of 2010, on a TTM basis, Daqo has maintained a median FCF margin of 9%. While their competitors averaged a median FCF margin of -5.94%, with none achieving positive margins.1

This should make it obvious we are dealing with a low cost producer. DQ consistently has higher margins than competitors but this doesn’t mean it is always pretty. If you look at the chart carefully you can see in each downturn margins went deeply negative. Another sign of why their competitors are going bankrupt.

Capital Efficiency

Since the end of 2010, on a TTM basis, Daqo has achieved a median ROIC of 10.81%. Nothing incredible but certainly good enough that they make more investing back in the business than sending all of the capital back to shareholders.

It is hard to see passed the massive returns in 2022 but important to note ROIC was 20%+ in 2010 and 2018.

Debt and Cash

Another incredibly attractive point of Daqo is their massive, but shrinking, cash pile of $2.3B. And the fact they have $0 debt.

Important fact here the DQ 0.00%↑ listed US ADR represents only a 72.4% ownership in the company. The remaining ~27.6% of Xinjiang Daqo is owned by other investors on the Shanghai Stock Exchange.

This means only $1.66B is attributable to the DQ 0.00%↑ shareholders. (Still pretty good considering the $1.17B market cap.)

Management’s Integrity

Shares Outstanding

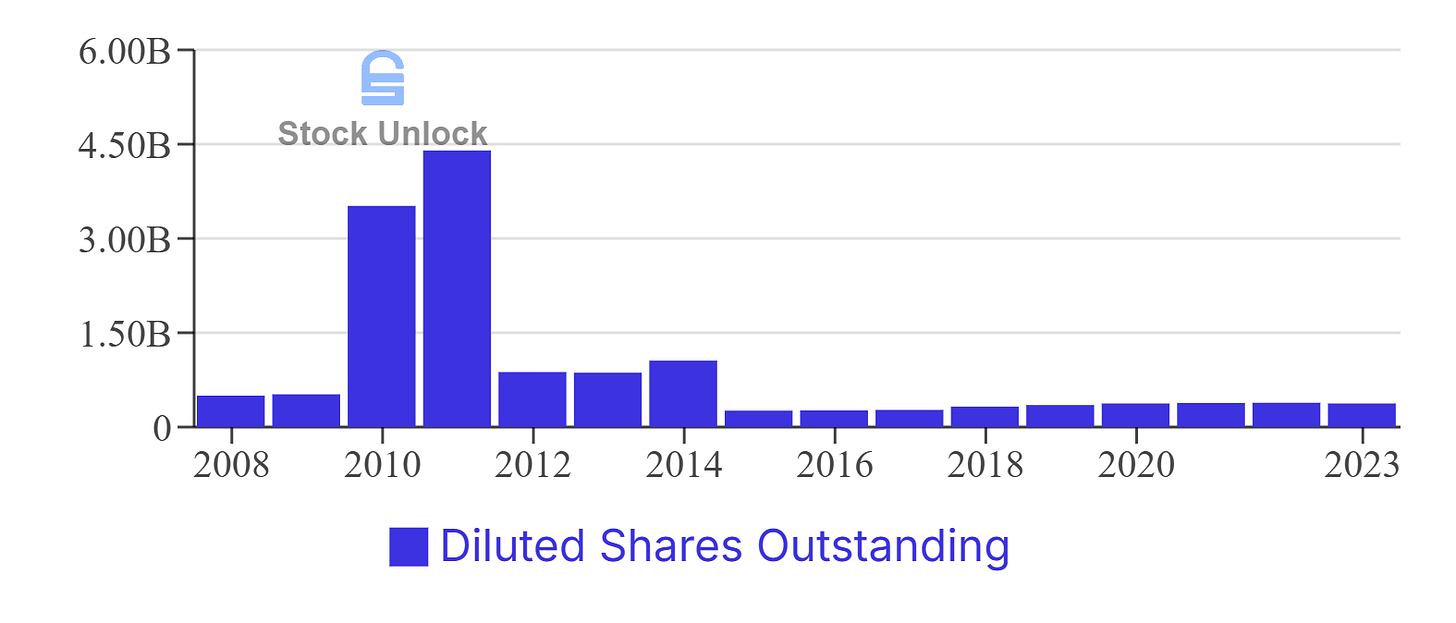

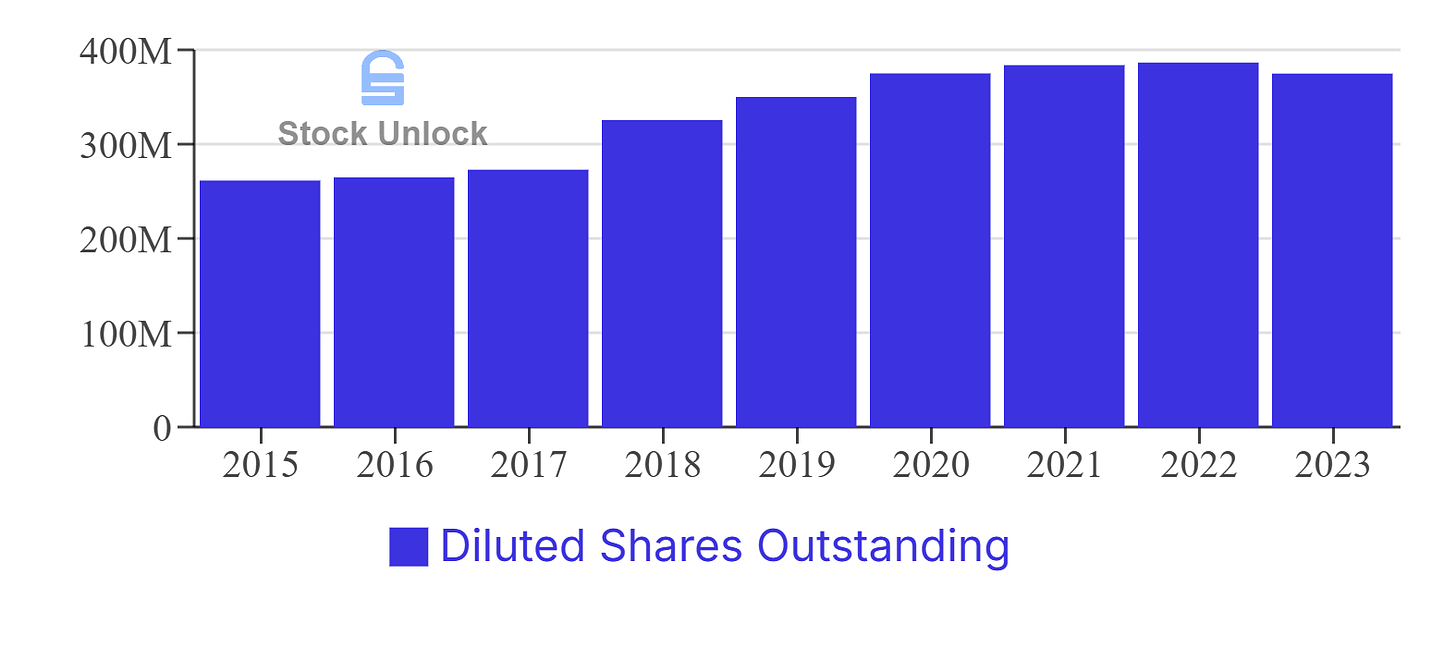

Since 2008, Daqo's outstanding share count has decreased by 1.9% per year.

However over the shorter term since 2015 shares outstanding have been increasing at 4.6% per year.

You can see this in 2023 though and continuing with that the company recently announced a $100 million buyback program. So I expect share count to drop slowly over time.

Quick Break

You probably notice I use Stock Unlock for all of my financial data. They are a fundamental analysis tool I have been really impressed with. They give access to essentially all markets across the world, data back decades, and DCF valuations.

I stumbled on them searching for a good tool to use but just found the other options expensive or not user friendly. Stock Unlock was a great affordable and user friendly option. And to my delight has only been getting better since.

Use my link below and get $10 in credits towards your subscription. I definitely recommend checking it out!

Now back to the content!

Risks

There are no issues with the company's actual operations that I can find. The decline in their stock price is primarily due to a sharp drop in polysilicon prices, which have plummeted around 80% from their peak. This has raised concerns that prices may continue to fall, potentially severely impacting the company’s profitability.

Low polysilicon prices have undoubtedly impact Daqo. But as one of the lowest-cost producers in China with a substantial cash reserve, they are well-positioned to endure the downturn longer than their competitors. Because of the major cash pile this is not the largest risk the shareholders take on.

The main risk lies in Chinese policies.

In November 2024, China's Ministry of Industry and Information Technology released revised guidelines for the photovoltaic (PV) industry, which will significantly impact polysilicon production and the broader solar manufacturing sector.

The key changes affecting polysilicon include:

Stricter energy consumption standards: New polysilicon facilities must achieve energy consumption of ≤53 kWh/kg, down from the previous requirement of ≤60 kWh/kg.

Increased capital investment requirements: The minimum capital ratio for new and expanded PV projects, including polysilicon, has been raised from 20% to 30%.

These policy changes are expected to have several effects on the polysilicon industry:

Supply consolidation: About 70% of announced polysilicon capacity expansions may not materialize due to the new regulations, leading to industry consolidation.

Short-term price volatility: Polysilicon prices are likely to increase in the short term as supply adjusts to the new requirements.

Long-term market stability: Over time, production is expected to concentrate among large, efficient players, leading to lower costs and more predictable pricing.

Technological upgrades: Existing facilities may need to invest in upgrades to meet the new energy consumption standards.

Potential supply shortage: If suppliers decrease utilization rates to meet energy consumption requirements, it could result in a polysilicon supply shortage.

On paper I think this seems like a good change but it has the potential to affect the natural boom and bust cycle discussed previously. With supply dropping and prices rising it could prop up desperate manufacturers that, without the intervention, would have gone bankrupt.

It is unclear at this time if the measures above will save struggling companies or the increased requirements will sink them.

In the end the affect may be just to push the cycle trough out longer while players consolidate. Either way though if the boom is less exciting than expected Daqo will still do exceptionally well. So the real questions is just how well will they do? And are the returns attractive enough?

My Thoughts

Examining Daqo’s operations reveals a complex regulatory situation but a high-quality company with industry-leading margins. I do like the company a lot largely because it trades at 70% of the cash value on their balance sheet and they are a low cost producer in a commodity industry.

They do however, have more uncertainty than most of my positions which is why I trimmed it slightly during one of their recent pops.

My main concern for returns is that I may be too early. This could take a long time to play out and prices to rebound meaningfully. They could rise just to the level of some profitability for Daqo and no higher depending on regulations. In that scenario I still expect meaningfully positive returns on the position just not the blockbuster ones we could see if things run their natural course.

All in all you can probably tell this is a far more mixed picture than my other reports but as you will see with the valuation. It is still well worth paying attention to.

Valuation

Valuing Daqo involves some degree of imprecision, as predicting the height of the next boom is challenging. For simplicity, first I’ll assume that Daqo’s production will be 50% higher than during 2022 as they have already added enough plants they would easily achieve this.

Next I will assume polysilicon prices will reach an average selling price of $25. A level about 25% lower than the most recent peak. Which would result in Daqo’s revenue being about 10% higher than during the 2022 peak.

With that assumption, their revenue would be as follows:

Revenue: $5.07B

During the peak revenue period, they achieved a free cash flow (FCF) margin of 53.4%. In this scenario, I’ll use a conservative estimate of a 35% FCF margin. This results in the following FCF:

Free Cash Flow: $1.77 Billion

At their peak, Daqo was valued at approximately 3.1x their peak free cash flow. Assuming similar valuations at 4x (5.5x FCF attributable to DQ 0.00%↑ ADR shareholders). This would translate to the following share price and market capitalization:

Share Price: $107.83

Market Cap: $7.1 Billion

These numbers suggest a potential return of about 507% from a $17.75 share price or a 35% CAGR.

This estimate doesn’t account for potential share repurchases or further production expansion, so the outcome could be even more favorable. However, there is also the risk of potential drawbacks if the company issues shares, reduces production, experiences lower margins, or if polysilicon prices don’t reach similar peak levels.

The key assumptions for this scenario to materialize are:

Polysilicon prices follow a similar boom and bust pattern as the last cycles.

Daqo survives the low price environment solely by leveraging its cash reserves.

Daqo maintains operational efficiency comparable to the 2022 boom.

These are significant assumptions, but they seem reasonable given that the industry has experienced similar cycles over the past 50 years, and there is increasing global emphasis on solar energy for renewable power.

Daqo is currently a smaller position in my portfolio, and it will require considerable patience to realize the potential rewards. However, I believe the investment will be well worth it in the end.

Questions or comments? Be sure to leave them below!

Check out some of my other articles!

Do you have a stock you want me to review? Submit it below and you may just see it in an article!

It only takes 1 minute to share this article. If you liked it, hit that share.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.

Daqo Competitors: GLC Technology Holdings, Xinte Energy, OCI Holdings, and REC Silicon

Hey Kyler, thanks for taking the time to provide this overview! I'm going to be a bit of a party pooper, but I believe you're only seeing the surface of this iceberg. I'll approach this comment with a bunch of questions ;D

- Have you looked at ferro and metallurgic silicon?

- Have you tracked energy prices and regulation?

- Have you looked into unit economics for polysilicon?

- Have you broken down the economics of a solar panel?

- Have you looked at milky quartz producers?

- Have you looked at Brazil's production capacity?

Great overview, but I think you're overly optimistic with the prices of the next peak. It would require a massive supply shortfall and I don't see that happening.