Kinsale Capital | The Overlooked Economic Moat

Detailed analysis of Kinsale Capital's potential for investment.

Most economic moats are found in large, well-known companies, which is why Kinsale Capital is a fantastic surprise. Keep reading to discover why this high-quality insurance company presents an exciting opportunity.

If you enjoy this type of content, consider subscribing below to get these emails directly in your inbox. This year has been fantastic so far and I would love to have you along for the ride!

The Plan

What does Kinsale Capital Do

Potential Issue the Company Could Face

General Industry Outlook

Market Share

Business Fundaments

Review

Valuation and Assumptions

Kinsale Capital

Kinsale Capital is an excess and surplus (E&S) insurance company. E&S insurance is for businesses with unique risks that traditional insurance companies won’t cover. Businesses like construction companies, bars, amusement parks, and commercial transportation often need E&S insurance, but there are many others as well.

Within E&S insurance Kinsale Capital focuses on small to medium-sized businesses to write higher premiums with less competition and they have had great success doing so which is clear from their stock chart over the past eight years.

Potential Issues

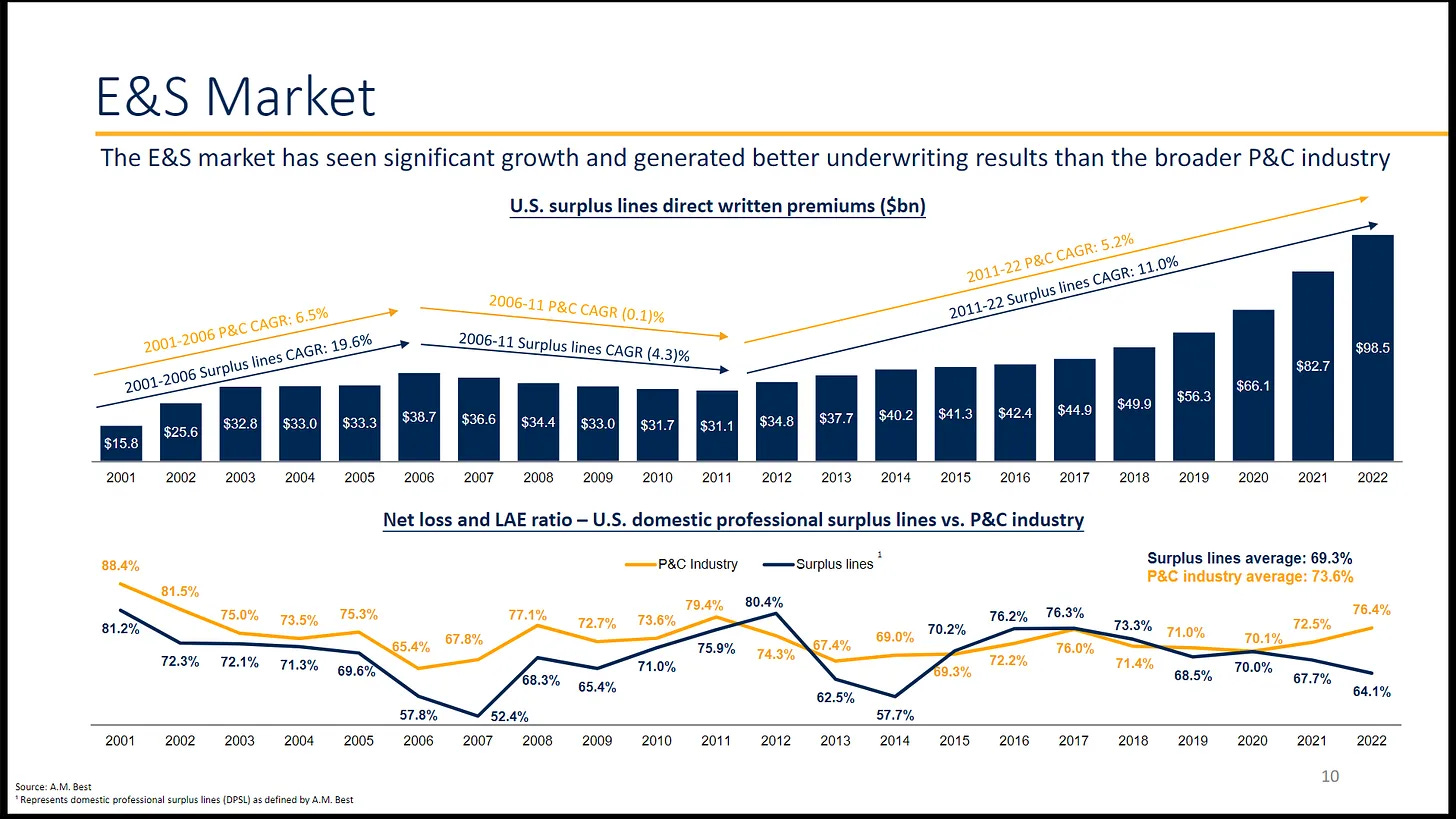

Due to the E&S industry’s very cyclical nature a slowdown is expected soon. This shouldn’t be a shock that nothing goes up forever, but never underestimate how irrational the market can be.

Even though a slowdown is expected after the industry's great run over the past 13 years if this means you can buy great companies at fair or even amazing prices, that's a good thing. This industry isn't going anywhere and should have strong growth over the long run.

General Industry

“AM Best is revising its outlook on the excess and surplus (E&S) lines insurance segment to positive from stable, citing increased business due to declining capacity in commercial lines and some personal lines markets, along with strong underwriting results driving favorable operating profitability and strengthened capital positions.”

Over the long run, say the next 20 years, I expect solid industry growth around 7%. This will certainly not come in a flat 7% every single year but most likely a bumpy next few years for the industry to normalize followed by a return to growth.

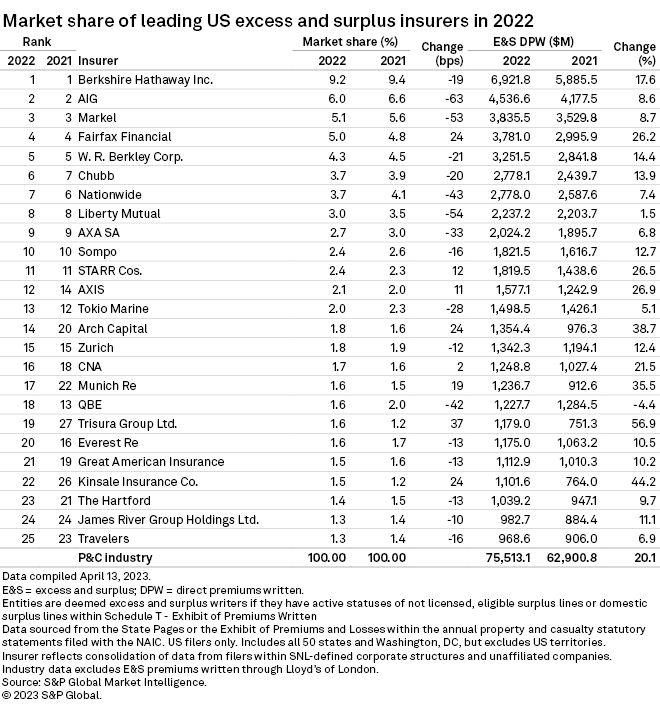

Market Share

It's important to note that Kinsale had less than 2% market share in 2022, which means they have TONS of room for growth.

Business Fundamentals

Insurance works differently from most traditional businesses, so you should look at different metrics when evaluating Kinsale than the tradition FCF margins or ROIC. When I search for a high-quality insurance company, I look for one with industry-leading low cost of float.

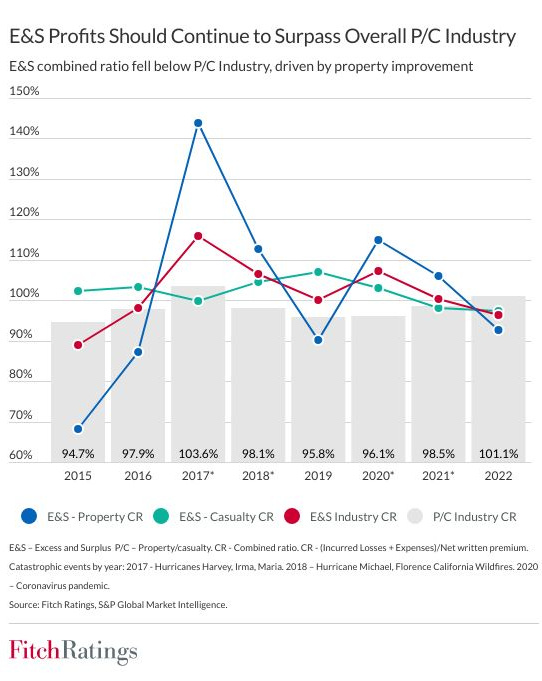

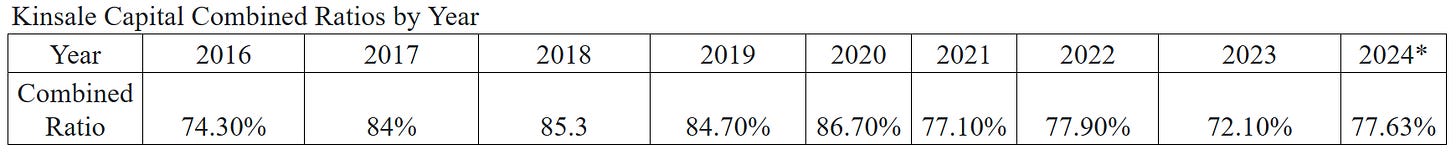

The combined ratio, which shows what percentage of premiums earned were paid in claims and expenses is the best place to start. It gives you an idea of how the company operates when compared to its peers over a long period of time.

The breakdown above shows the average combined ratio for different segments of insurance each year. Most years, the combined ratio is around 100%, meaning the average insurance company pays out almost all the premiums they collect in claims and expenses.

Below are the details of Kinsale's incredible performance. Every year, they beat the market with lower losses on their policies and, more importantly, lower expenses to run their business. This results in an impressively low combined ratio.

When you find a company that operates at this level, it gives them a sustainable competitive advantage in their industry. They will be more profitable when things are good and more likely to weather the storm when things get bad. And things will get bad someday.

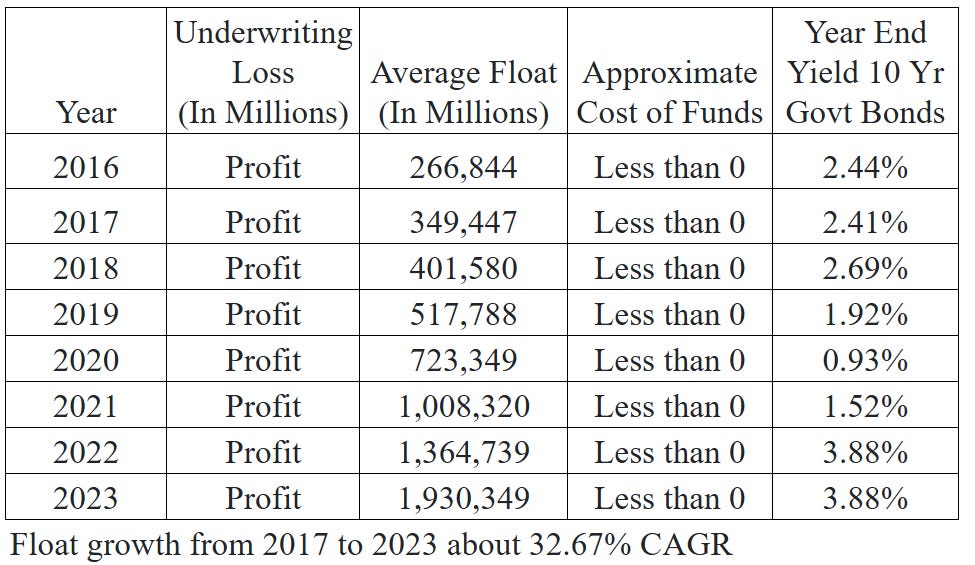

Next, let's look at the important aspect of the cost of float. If you are interested in learning about float you can go to this quick article here.

Kinsale Capital has an exceptionally low-cost structure. Over the past 8 years, they have actually earned money from the loans they take from their policyholders. This is the most important metric for an insurance company, and Kinsale performs as well as you could hope for. Next, let’s see how well Kinsale uses their float.

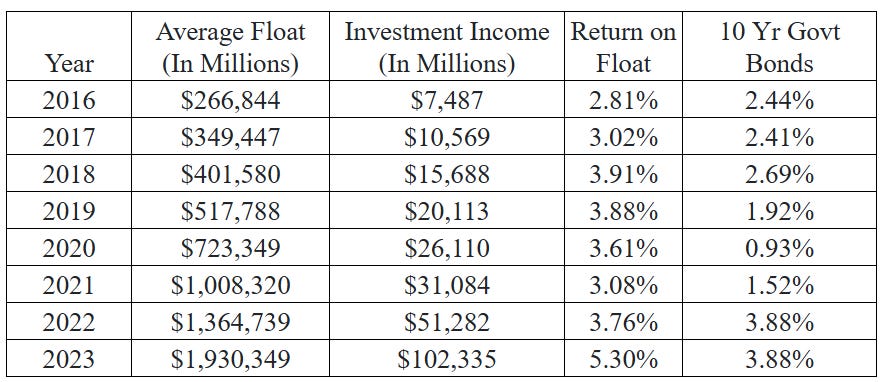

Most years, Kinsale earns slightly higher returns than 10-year bonds, but not by a large amount. This doesn’t worry me because interest rates were very low for a long time, and their low-cost structure meant they got paid to use the money and generate these returns. You can also see that in 2023, their returns jumped significantly as they took advantage of higher interest rates on government notes and bonds.

Review

Kinsale Capital is a fantastic company that is growing quickly with an incredibly low-cost structure. Making them much more profitable than most insurance companies. However, it’s important to remember that the insurance industry has long cycles, and Kinsale has not yet faced a major downturn, which could reveal hidden problems. Still, if they keep their low-cost structure and set aside conservative loss reserves, they should handle any challenges better than most insurance companies.

Valuation and Assumptions

Kinsale has shown it can grow faster than the industry, so I’ll assume a 12% annual growth in book value over the next 3 years, followed by around 20% annual growth for the following 7 years.

While this might seem high this is a major step down from 40%+ growth rate in book value per share year over year seen in the past 5 consecutive quarters. Even before which most quarters were 20%+ growth rates.

On that book value lets a assume a price to book of 5x which is lower than their average but higher than the industry. This reflects their economic moat and incredible profitability while staying conservative.

Assuming those figures you get the following data for the year end 2034.

Book Value: $7.49B

Market Cap: $37.45B

Share Price: $1,608

This implies a 240% return over the next 10 years or a 12.9% CAGR from the current share price around $470.

I consider Kinsale Capital to be a “wonderful company”. It has a strong competitive advantage in an industry that is unlikely to change much in the near future making it easier to predict how much cash the company will generate.

The average market return is around 9%, so you can buy a great company at a fair price and expect similar returns with minimal risk.

Assumptions

Stay the Course

Lower Than Industry Average Combined Ratio

Grow Market Share

The combination of the incredible company and very stable industry make this an exciting one to own for the long run and why I decided to add it to my portfolio.

Side Note

My biggest hope for this stock is that its price drops significantly from where it is now. That might seem odd for a stock I already own, but since I plan to keep this company forever, I’d get more value if the stock falls to very low levels while the company's long-term outlook stays the same. This would let me buy more shares at a better price and expect much higher returns.

I appreciate you reading my article! I spend dozens of hours on business analysis to put these together to pass on the lessons and tools I am using to outperform the market over the long run. If you enjoyed it subscribe below to get these each week in your inbox.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.