What is Float? | Insurance Companies Get Paid to Take Loans (Sometimes)

I am here to make it clear what float is and why it is valuable to insurance companies.

The insurance industry from the outside can look complicated but once you understand how it works and can focus on the most important metric (float) things get very simple. I have spent hundreds of hours studying all of Warren Buffets annual letters and shareholder meetings to bring you an overview of what float is, (hopefully), in a simple to understand format. This article will be useful if you want to analyze an insurance company’s quality.

You will learn what float is, why it is important, how much it costs, and what returns can be generated from it. Once you know those things you will be able to make a facts-based decision about how good an insurance company is compared to its peers.

What is Float?

First, let’s understand what float is. When an insurance policyholder pays their premium, the insurance company holds this money until it is needed to pay claims. This held money is known as float. Simply put, float is the money held temporarily by the insurance company from its policyholders. During this period, the insurance company will invest the float to generate more income.

Why is Float Important?

Float is important because it provides necessary money that insurance companies use to generate investment income, without which they may not be profitable. Many insurance companies might pay out more in claims and expenses than they collect in premiums, relying on the investment income from the float to stay profitable.

Consider an auto insurance company that collects $200 monthly from 10 drivers, totaling $2,000 per month. Over a year, they collect $24,000. If they invest this float and earn $500 in interest, they have $24,500 at year's end. If they have to pay a $21,000 claim and $3,200 in agent commissions, their expenses total $24,200, resulting in a net profit of $300 due to the investment income from the float.

This situation is simplified but useful to understand the basics of how the industry works.

What is the Cost of Float?

Now, let’s dive into the cost of float. Warren Buffett explained in his 2002 Berkshire Hathaway shareholder letter, "An insurance business has value if its cost of float over time is less than the cost the company would otherwise incur to obtain funds." In other words, if the cost of float is less than the market rate for borrowing money over a period of many years, the insurance business is high quality.

To calculate the cost of float:

Combined Ratio: This metric shows the percentage of earned premiums spent on claims and expenses. A combined ratio below 100% indicates the company pays less in claims and expenses than it receives in premiums, suggesting a low or negative cost of float.

Underwriting Profit/Loss: Calculate using the income statement.

Underwriting Profit (Loss) = Net Earned Premium - (Claims Paid + Operating Expenses)

If the combined ratio exceeds 100%, this calculation helps determine the underwriting loss.

Average Float: Calculate using the balance sheet.

Average Float = (Unpaid Losses + Loss Adjustment Expenses + Unearned Premiums + Other Policy Liabilities) - (Insurance Premiums Receivable + Reinsurance Recoverable + Deferred Policy Acquisition Costs)

Cost of Float

Cost of Float = (Total Underwriting Loss / Average Float) * 100

Compare the cost of float with the yield of the 10-year government bond at year-end. If the cost of float is lower, the insurance company is obtaining funds at a favorable rate. If it is higher and stays that way for a period of years, the company may be at risk of going out of business.

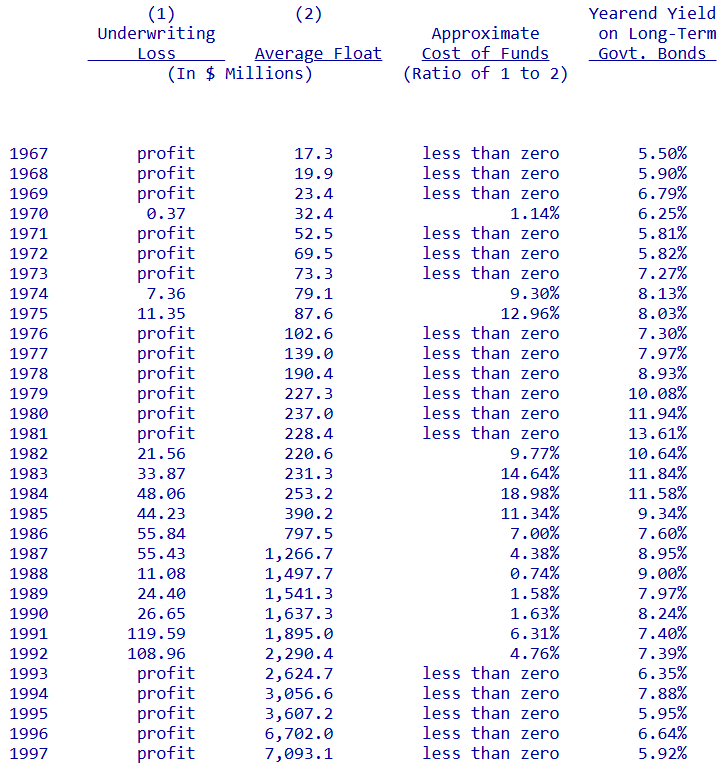

Berkshire as an Example

Berkshire Hathaway's cost of float over decades is a great example of the what the cost of float should look like. Despite occasional periods with a combined ratio above 100%, Berkshire's ability to maintain a low cost of float compared to government bond rates signifies a high-quality insurance operation.

Understanding that insurance results can be volatile, a high-quality company will generally perform well over the long term, even through challenging periods. So don’t be concerned if a company pays more for their float than market rates only occasionally.

Generating Returns of Float

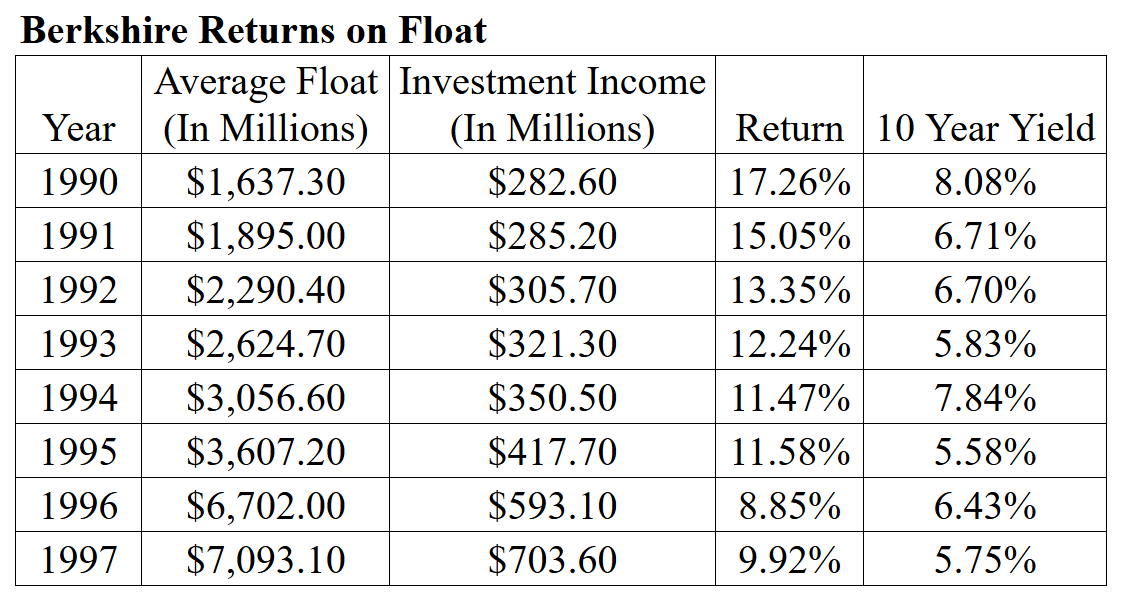

After you understand what a company pays for their float it is important to know how much income they are able to generate with the float they have. This is done by finding what rate of return they generate on the money they have.

How to calculate return on float.

Average Float: Calculate using the balance sheet.

Average Float = (Unpaid Losses + Loss Adjustment Expenses + Unearned Premiums + Other Policy Liabilities) - (Insurance Premiums Receivable + Reinsurance Recoverable + Deferred Policy Acquisition Costs)

Return on Float

Return on Float = Interest Income / Average Float

Using Berkshire 1990 to 1997 as an example you can see below the returns, they made which can be reasonably compared to the long-term bond rates as insurance companies must generally invest conservatively so they can protect capital in case a large number of claims come in at the same time.

It is clear that Berkshire achieved a greater return than the 10-year yield which is again another great marker of a high-quality insurance company with the ability to allocate capital.

If companies were not able to generate returns on float almost all would be unprofitable or only barely so. This situation of the insurance industry means the company’s ability to get float profitably and then to generate income from that float are absolutely critical to their performance.

Conclusion

I hope after this article what float is and why it matters is far clearer. Any time you evaluate an insurance company you should review what they are paying for their float and how well they can invest the float they do have. Most companies you will find do not have a sound business despite showing the appearance of one which is why the work is necessary

When you find a company that often gets paid to take out loans from their policy holders’ overtime, they will be a fantastic investment when purchased at a reasonable price.

I appreciate you taking the time to read my article! I put in a lot of work to provide high quality information and give you all the tools you will need to identify high quality companies so that you can generate excess returns.

Nice write-up Kyler! Curious if you have looked deeper at any specialty insurance names such as Skyward (SKWD) and American Financial Group (AFG). I know there is a lot of coverage of some others like MKL and KNSL.

Planning a write-up at some point on SKWD myself.