Keller Group ($KLR) | Cheap Geo-Engineering Stock Every Investor Should Know

Keller Group investment report.

The Keller Group is a Geotechnical Engineering powerhouse trading at under 6x free cash flow.

There are a few key reasons why they are an interesting opportunity.

Growth tailwinds will continue for a long time.

Cheap valuation.

Entrenched market position.

High quality operation.

In this article we will dive in to understand the business and their potential to create massive returns so stick around!

It is this analysis that has allowed me to outperform by a wide margin this year. So do yourself a favor and save time by getting the picks and analysis right in your inbox!

The Plan

What does the Keller Group do?

What is my investment thesis?

What risks does the company face?

What is the company worth?

Conclusion

Keller Group

Keller Group is a Geotechnical Engineering company which is a very fancy way of saying they make sure buildings and structures stand on a solid foundation.

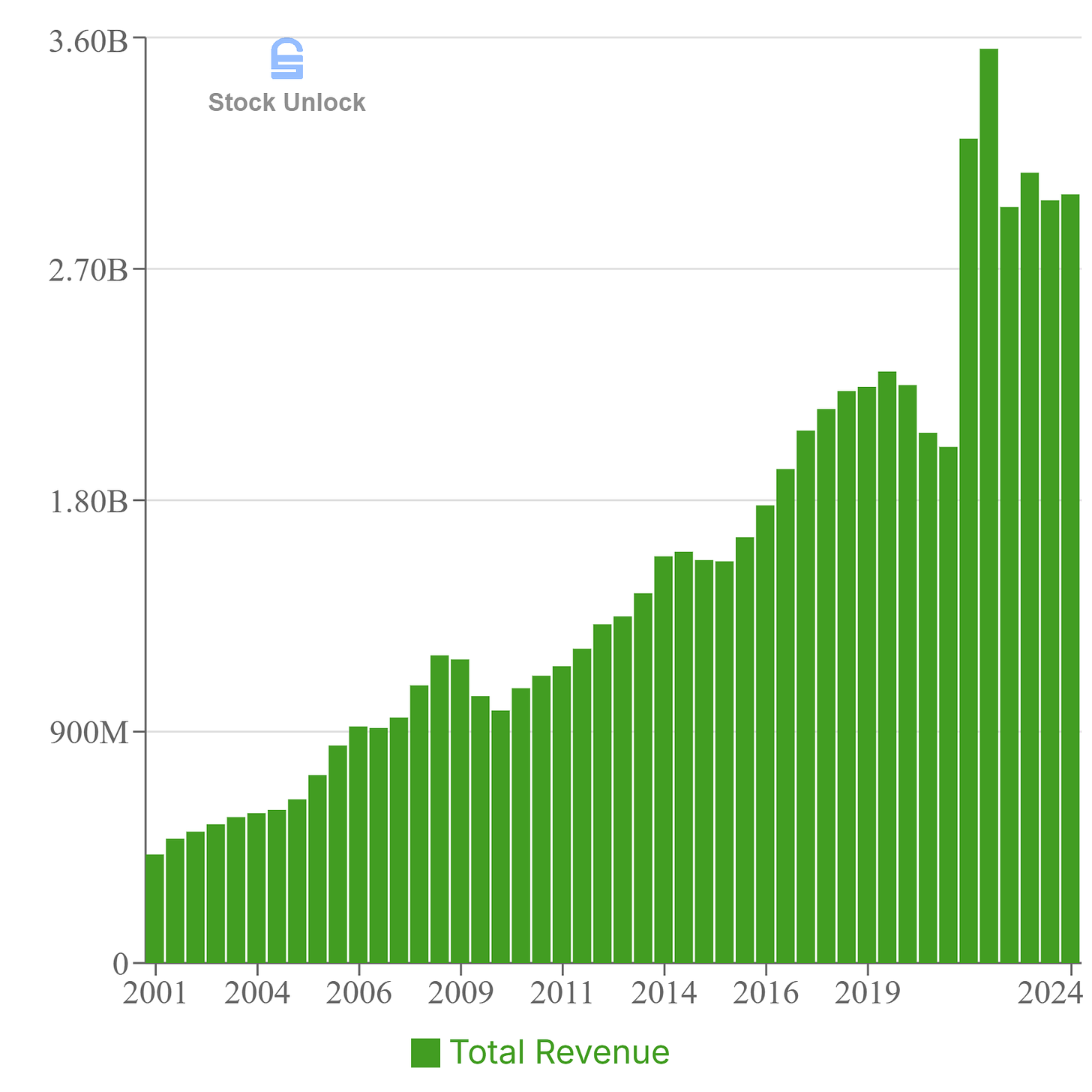

Through their history they have grown organically and through acquisitions. Since 2000 the company has made 27 acquisitions which helped them grow revenue at 9% per year over the last 24 years.

In the trailing twelve months the company generated just under £3B or $3.8B in USD across their operating regions.

The operate across 3 main regions:

North America

(EME) Europe and Middle East

(APAC) Asia Pacific

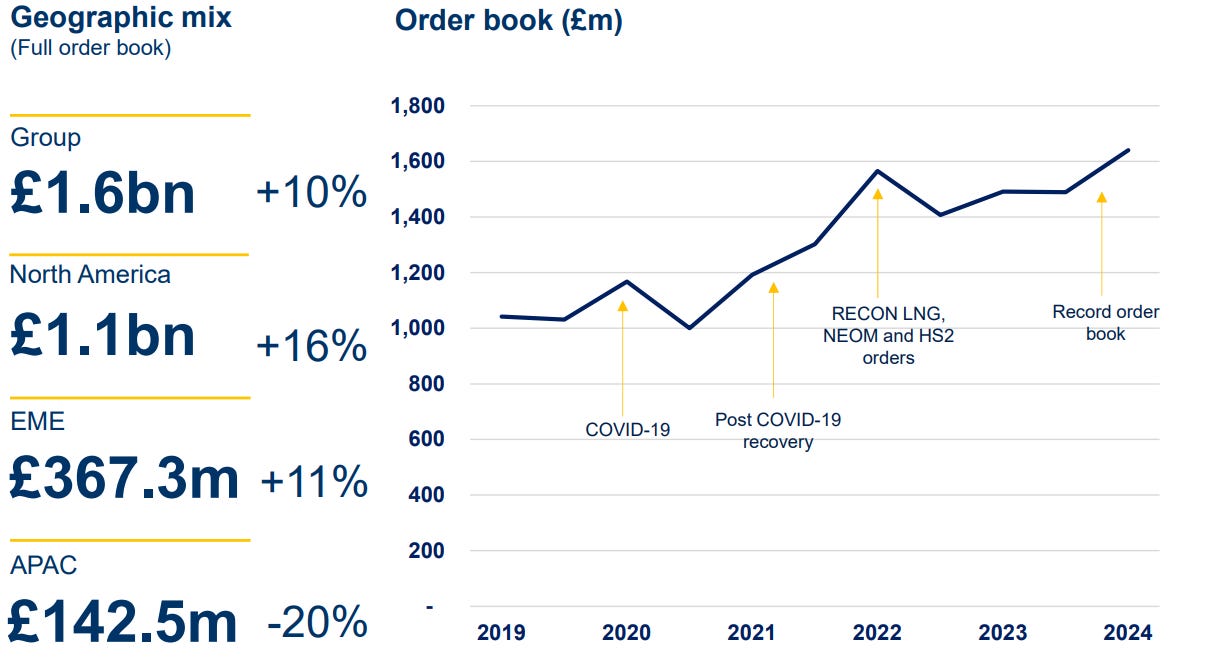

North America accounts for 59.3% of revenue, EME 28.1%, and APAC 12.6% as of the first 6 months of 2024. All of the company’s revenue is project based and the pipeline constantly needs to be refilled.

They do that by placing bids for potential projects against other competition and if they are chosen they take on the work.

So far in 2024 the company has seen marginal improvements in revenue of 4% but a huge jump in free cash flow. From H1 2023 free cash flow of £-7.3M to H1 2024 free cash flow of £81.3M.

Importantly as well they have a record order book scheduled with £1.6B in the pipeline.

Investment Thesis

There are a few key reasons why Keller Group is an interesting opportunity.

Growth tailwinds will continue for a long time.

Cheap valuation.

Entrenched market position.

High quality operation.

Tailwinds

The Keller Group is benefiting from the transition to more complex engineering requirements for any construction project.

Just think about it. As the world becomes more advanced, construction projects are analyzed more intensely for any potential issues. This means more work is done to understand risks and how to combat them by engineers in all stages of construction

That is a recipe for the Keller Group to have growing demand globally. Not to mention nations in Asia and Africa that are developing quickly. And will need massive amounts of infrastructure built or upgraded.

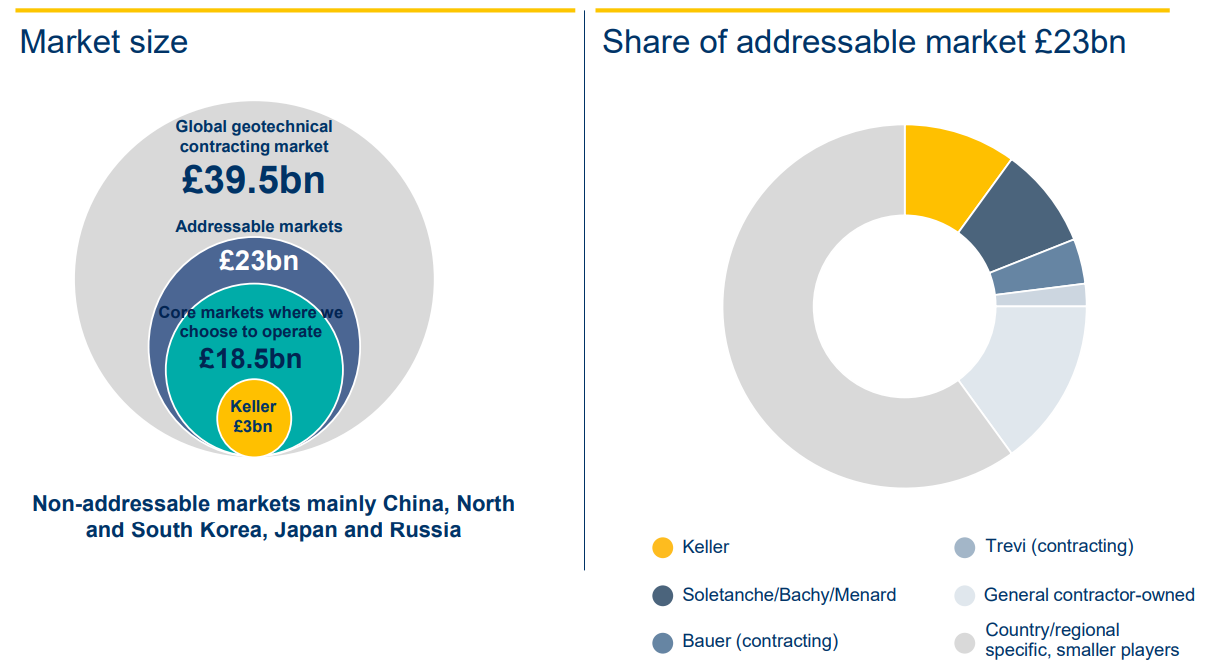

According to forecasts growth for the industry will be robust in the years to come between 5.7% to 12.6% per year.123

Those forecasts make sense when you figure infrastructure and construction spend will likely grow at least the rate of GDP if not slightly faster. So around 4% to 5% then geotechnical engineering will likely grow a little faster than construction.

Expect revenue growth for the company to fall around 8% for many years to come.

Cheap Valuation

Another reason I like the Keller Group is their cheap valuation. They currently trade at under 6x FCF or a 16.6% FCF yield. Pretty incredible for a company with a bright future still ahead.

It is important to note the company had very high margins in the TTM that even the management stated is unsustainable at 6% FCF margins. Historically they have been closer to 3%. If it were to fall back down to normal then the stock would trade at about 12x FCF. Which is still cheap for a quality company though not the screaming deal it seems at 6x.

Entrenched Market Position

The Keller Group is the largest Geotechnical Engineering company in the world and they employ over 1,600 engineers.

In any construction project the builder wants to know if the company they hire is capable and will deliver a quality product. The Keller Group has a history going back to 1860 of delivering on their promises.

The relationships and connections they have built will place them top of mind for potential projects.

On top of this the industry requires huge teams of highly skilled workers. Which means they have a natural competitive advantage over smaller operations. The Keller Group has more experience with a wider range of situations so they can deliver a more thoroughly tested product.

The Keller Group is a tough company to compete with and will likely continue to take market share.

Quality Operations

There were a couple things that stood out indicating this is a well operated company.

Returns on capital.

Low debt levels.

Since 2001 the company has a median ROE of 13% and ROIC of 12.9%. So for every dollar they retain or take on as debt they make about 13% per year on that capital. This is a really solid return and will allow them to compound over time.

Currently the Keller Group has a debt to EBITA ratio of 1.39 and a quick ratio of 1. This tells me they have plenty of capital on hand to cover any debt.

Risks

Keller Group, as they currently stand, are not facing any imminent threats. However there are a couple risks that are worth mentioning.

Loss of Reputation

Global Recession

If the company had issues leading them to lose reputation they could start losing market share. In the construction industry in particular a bad reputation can follow you for a long time so that could be devastating.

Then more obviously they rely on global construction projects to create revenue. If there was a global recession then it would certainly mean few of those available to bid.

Both are valid concerns but are not currently on the horizon. The company just needs to keep operating like they have and their future will look very good.

Valuation

When deciding current valuation for the company I estimate revenue growth and free cash flow margins. Then apply an appropriate multiple. Below are my estimations for the Keller Group over the next 5 years.

8% Revenue Growth per Year

3% Free Cash Flow Margins

16x Free Cash Flow Multiple

With those assumptions you get the following figures through the first half of 2029.

Revenue: £4.39B

Free Cash Flow: £131.7M

Market Cap: £2.11B

Share Price: 2,875

The levels above assume an 86.7% return from the current share price of 1,540 over the next 5 years or a 13.3% CAGR said another way.

Fair Value: 1,869 (21% above current price.)

Conclusion

The Keller Group is a solid company with a good competitive advantage. And in an industry with attractive tailwinds.

They will grow revenue at 8% per year for a long period while the world upgrades their infrastructure. They have an entrenched market position as the largest geotechnical engineering company in the world that will make them hard to compete with. Then lastly they are a well operated company compounding capital internally at about 13% per year.

I really like this company for all the reasons above and that they are easy to understand. Often companies have very complex inner workings or just sit in a quickly changing industry. The Keller Group is simple and will likely remain mostly unchanged for years to come.

All of this to say I like this company.

I really only have one hesitation to adding this company to my portfolio. At their current price they don’t offer enough returns to be attractive to me. I will certainly be keeping an eye on the company though and have a watch price at 1,200. It is at this level they offer returns around 20% per year based on my valuation and where I would seriously consider adding them.

Check out some of my other articles!

Do you have a stock you want me to review? Submit it below and you may just see it in an article!

It only takes 1 minute to share this article. If you liked it, hit that share.

Questions or comments? Be sure to leave them below!

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

See you in the next edition!

https://www.fortunebusinessinsights.com/press-release/global-geotechnical-services-market-10541

https://straitsresearch.com/report/geotechnical-services-market

https://www.thebusinessresearchcompany.com/report/geotechnical-services-global-market-report

Finally had time to read it entirely. Very good, thanks for the work. 👌