Credit Bureau Asia | Singapore Small Cap with a Serious Moat

Detailed analysis of Credit Bureau Asia's potential for investment.

Welcome to to this edition of Busy Investor Stock Reports

I want to make your life easy by bringing quality names to you. Trust me, it takes a long time to find an opportunity like this one.

Credit Bureau Asia is a small cap with an impressive economic moat. And this article is a full breakdown of the company.

If you like this type of content subscribe to get these posts right in your inbox.

Do you have a stock you want me to review? Submit it below and I will include it in a quick review article.

Quick Summary 🏃

Company: Credit Bureau Asia

Ticker: TCU.SI

Market Cap: SGD 251.13M

Industry: Credit Risk Services

Free Cash Flow: SGD 26.43M

Revenue: SGD 57.38M

Thesis: This company has a monopoly in 3 countries in their FI data segment and a 40% market share in their non-FI data segment. They have virtually no major risks and operate in a growing industry. Their management could be better capital allocators but the nature of the industry is even mediocre leaders will have great results.

Their growth will come from a wave of Singapore population entering prime spending years and an increase in the banked population of other countries. With the potential for acquisitions to drive inorganic growth.

The Business 📃

Credit Bureau Asia as its name implies provides credit rating services. Think Experian in the US.

The company compiles data to help others manage risk, provide marketing solutions, and offer commercial insights. Because their business models rely on large amounts of data early movers usually have a huge advantage.

They are able to create relationships that compound. As more institutions provide data to CBA they gain access to more data themselves through the relationship. Then so on as more and more companies join the network. This means the network becomes more and more valuable to institutions and CBA as more join.

This is a fantastic business model with natural economic moats built in. The best part though I will pull from themikrokap report on the company. (Highly recommend checking them out.)

CBA has a 99.9% market share in Singapore and operates as an effective monopoly, capable of meeting all the needs of the market.

It is not everyday you find a small cap company with a monopoly and pricing power. In not just one country but 3 for their FI data segment.

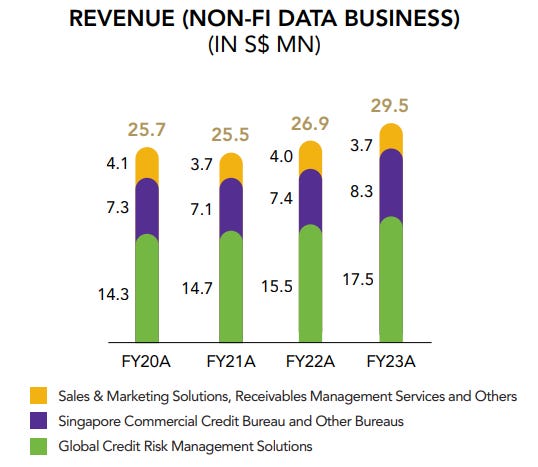

CBA operates in two main segments. (% of Revenue)

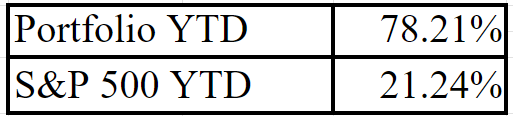

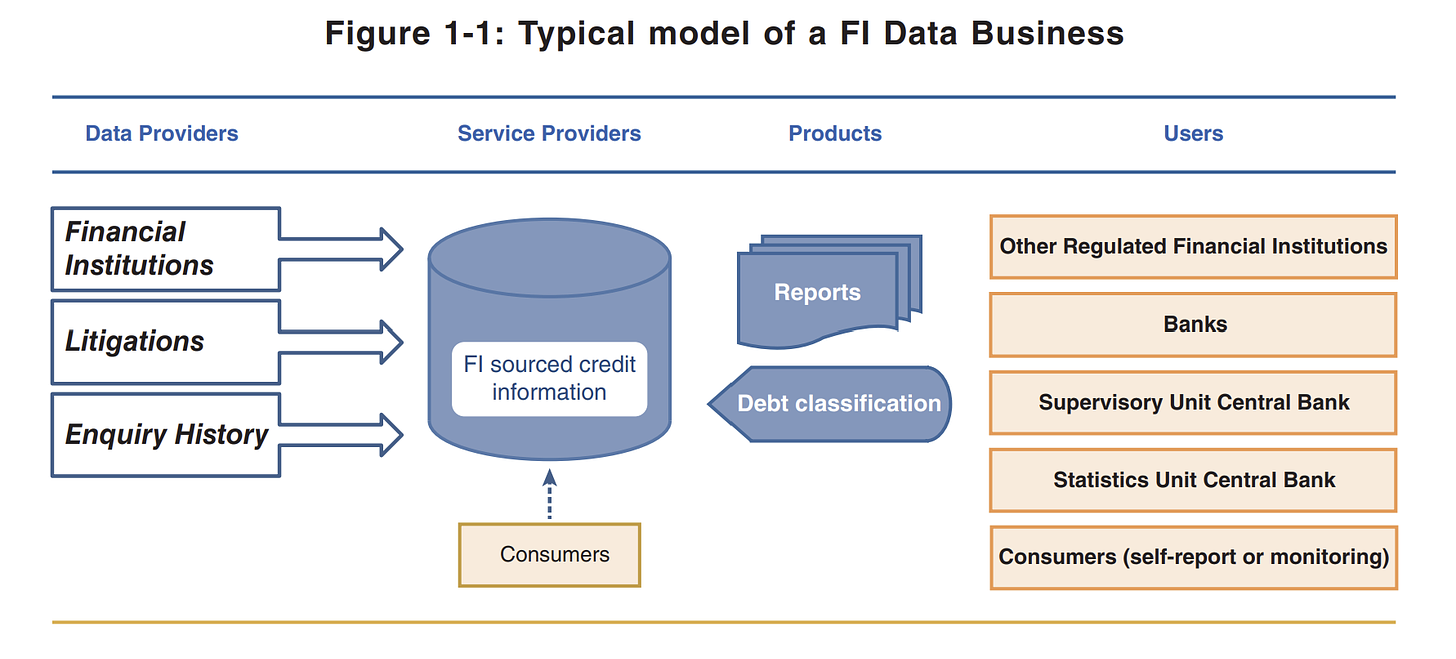

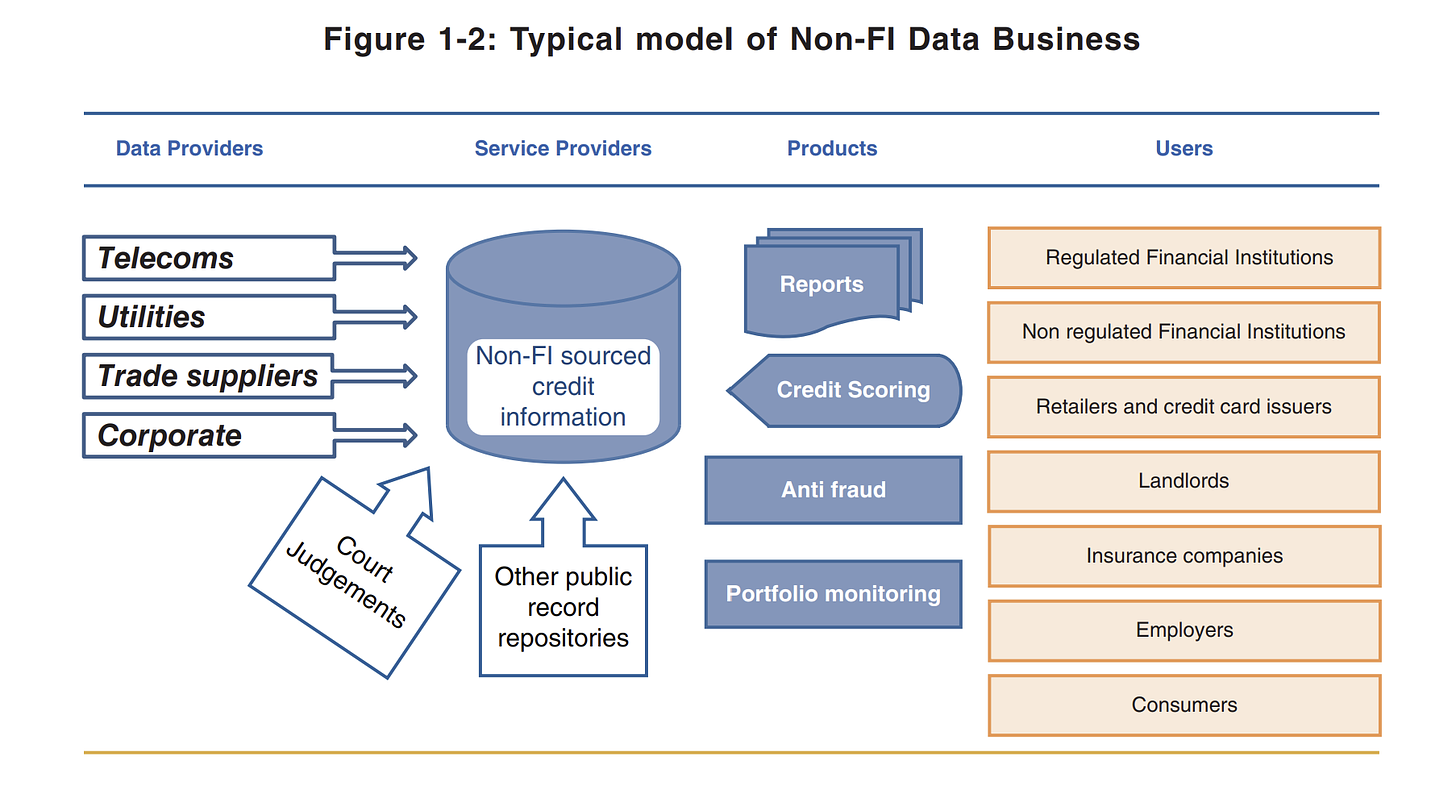

FI Data (45.6%): Through partnerships with financial institutions the company maintains and provides up to data and detailed reports with credit relevant data.

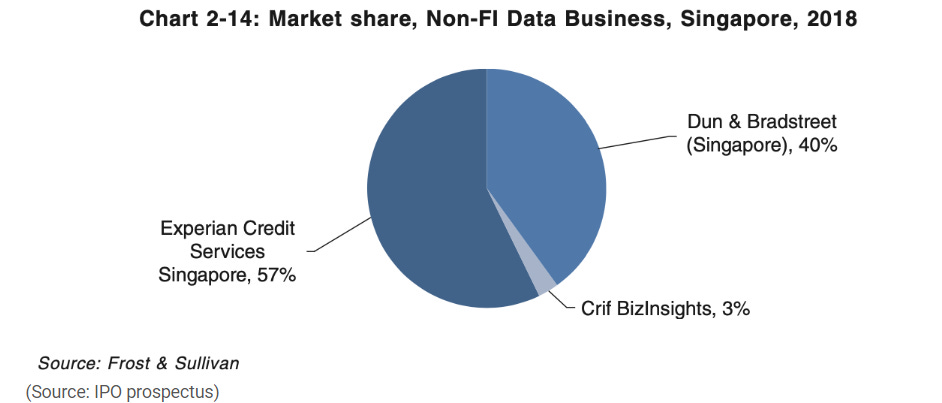

Non-FI Data (54.4%): Through partnerships with Dun & Bradstreet, non-financial institutions, and publicly accessible registries. CBA provides customers with risk management services, sales and marketing solutions, monitoring services, commercial insights, and other services.

The revenue from these segments comes from subscriptions, per report charges and data sales. It is good to keep in mind as well the vast majority of revenue comes from Singapore, over 95%.

Industry Forecast 🔮

Things get interesting when you get into the details of the industry. In southeast Asia, where CBA operates, the total addressable market for Credit and Risk Management is valued at $221 million.1 And expected to grow at around 11% per year.

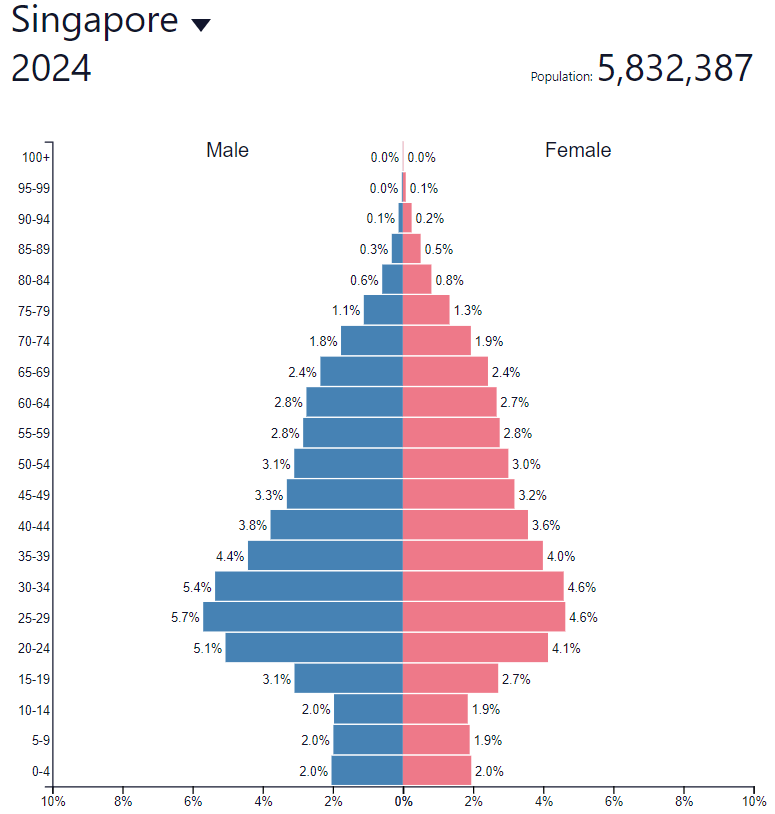

This is driven by the continued development in Singapore and a large part of the population entering peak spending years between 30-45. That age range is when most people buy homes, start families, and have quickly increasing incomes.

In both the FI and non-FI industries once a company has a dominant position it is incredibly difficult to dislodge them.

That is good news since CBA has essentially 100% market share in Singapore, Cambodia, and Myanmar in the FI segment. With an estimated 40% market share in Singapore for their non-FI segment.

This is a very stable industry that will be around for decades to come. Another driver that could impact its growth would be a growing percentage in the banked population in developing nations.

“Did you know that over 70% of Southeast Asia’s population are unbanked or underbanked?”2

This is compared to 2% of the population in Singapore. A huge difference that if it changes could be a massive driver of growth. I won’t include it in more forecasts though because it is hard to predict when or if it will happen.

Risks ⚠️

Due to the monopoly position in their FI data segment there are no major risks they face in that industry. Turning to their non-FI data segment their largest risk is how reliant they are on D&B for data and revenue.

Almost 40% of their non-FI revenue comes from D&B and they currently pay a fixed royalty to access D&B’s reports.

If D&B was to terminate their relationship it would cause their revenue to fall sharply and allow opening for competitors to take share. This is the worst case scenario for CBA.

There are not any other risks worth diving into. CBA is essentially immune to economic downturns, in fact they would likely thrive during them. They have massive market share in a winner take all industry so competition is not a large concern.

The only real risk besides that mentioned would be changes in regulations that allow competition to gain a foothold. This is incredibly unlikely which is why I won’t go any deeper into it.

Addressing Risks 🛠️

To address the risk in the relationship between D&B and CBA I am pulling from The Mikro Kap again and their analysis of CAB Give Credit Where Credit Is Due.

“Going forward, I think there’s only a minuscule likelihood the license won’t be renewed since CBA and D&B have a close, interdependent relationship. CBA is the sole and exclusive distributor of D&B reports on foreign companies to their Singapore customers, while D&B is the sole and exclusive distributor of CBA reports on Singapore entities to their international customers. Meaning, one is encouraged to do business with the other since they would otherwise lack critical international or domestic information, required to sell reports.”

It is clear even this largest risk is unlikely to ever materialize.

Financial Health ❤️🩹

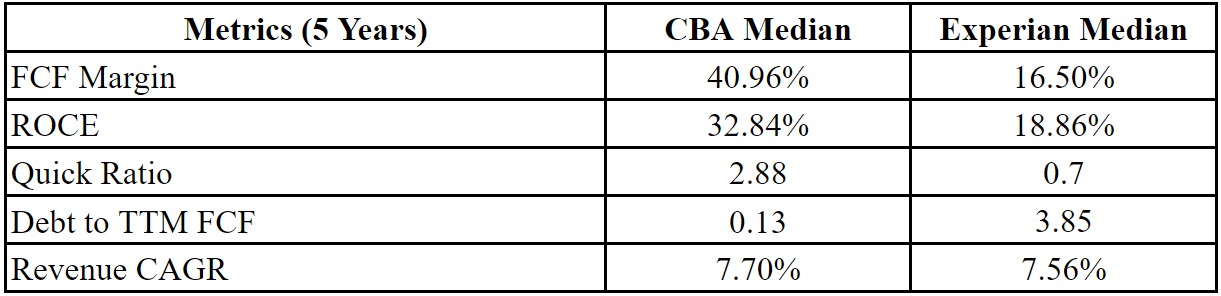

CBA crushes Experian on every metric. Keep in mind people view Experian as a good enough company it is trading at 40x FCF. I have nothing but good things to say.

CBA is incredibly profitable and because they are a capital light business earn fantastic returns on the capital they do need to employ.

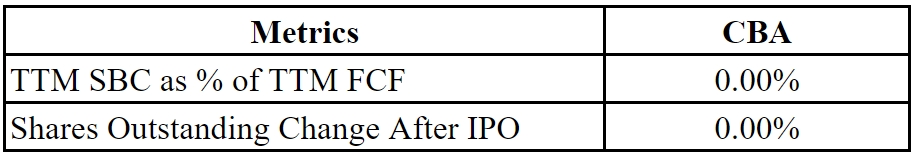

Again great news that the company is not diluting shareholders. My only issue with the company right now is they have a lot of cash on their balance sheet (SGD 62.3M) that they could be using to buyback shares.

The management does state they are holding it for a strategic acquisition but they may be hard to come by. It is likely a better use to just buy back shares with a portion of the money.

Potential Growth 📈

Often when I am reviewing a company’s potential growth there is more to consider than the industry growth but honestly there is not much else to look to. They have monopolies and can’t grow faster than the market unless they make an acquisition which is unlikely in the near term.

With that said 9% growth in revenue feels reasonable to be conservative below industry forecasts.

Valuation 💰

With the company and growth mapped out, the big question remains: what kind of returns can actually expect?

My assumptions are the following. 9% revenue growth for the next 10 years. A slightly lower than current 40% FCF margin. Then a 25x multiple on FCF.

The 25x multiple is far above market average because this company operates as a monopoly in a growing and incredibly stable industry. Even that multiple is far below Experian’s 40x.

Using those assumptions you get the following financials at the end of 2034.

Revenue: SGD 141.95 Million

Free Cash Flow: SGD 56.78 Million

Share Price: SGD 6.22

Market Cap: SGD 1.42 Billion

These figures imply 522% upside in the next 10 years or a 19.7% CAGR. Note this does not include the current dividend yield of over 3%. Depending on how that yield evolves your actual CAGR would likely sit at around 23%. This scenario makes only a couple assumptions.

CBA maintains massive market share in both FI and non-FI data.

CBA maintains its relationship with D&B.

In an industry where it is hard for new entrants to compete these feel like very safe assumptions.

Conclusion 🏁

This was a really fun company to research. It is not very often you find a company under a $200 million market cap that has a monopoly in a growing industry.

The main thing that will determine the future of the company is how quickly the credit risk services market grows. It is almost certain to have a good future with the potential to be great. Not to mention the possibility for the company to make acquisitions or turn into a buyback machine.

Overall this company sits as a high conviction play with great potential returns. Certainly one I will keep an eye on and am willing to add if it falls modestly from current levels.

(I am starting to find too many quality companies! I can’t have meaningful positions in all of them!)

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

See you in the next edition!