50% Market Share and Growing | Janus International ($JBI)

Investment report on Janus International.

Janus International is a niche company trading at a low 7.4x FCF valuation. On top of that the company currently has over 50% market share in the self storage door systems. And an 80% market share with institutional self storage facilities.1

They are a solid company and have opportunities for sustained growth. Keep reading as I dive into the company and why I think they deserve your attention and maybe a spot in your portfolio.

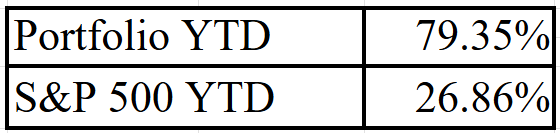

It is this analysis that has allowed me to outperform by a wide margin this year so do yourself a favor and save time by getting the picks and analysis right in your inbox!

What you are going to read:

Understanding the Business

Investment Thesis

Fundamental Analysis

Moat Analysis

Valuation

Conclusion

Key Takeaways

🎯Janus International Group has 50% market share in self storage door systems. That along with other competitive advantages like pricing power, innovation, established relationships, and efficiency of scale put them in a strong industry position.

🎯The company has a strong balance sheet they can use to buy back shares or make more profitable acquisitions.

🎯The self storage industry has several key long term tailwinds that will drive growth. Urbanization, small & medium businesses, population growth, aging population. In the short term the catalyst will be falling interest rates.

🎯Fair value for the company currently sits at $17.35 based on 9% revenue growth, 15% FCF margins and a 17x multiple.

Understanding the Business

Founded in 2002 and headquartered in Temple, Georgia Janus International Group is one of those companies you find and think. “I never thought about it before but I guess someone does have to make that.”

They specialize in producing a range of building components for self storage including:

Roll-up and swing doors.

Yep, exactly the doors you are thinking of.

Hallway systems.

Their hallway systems cover things like corrugated panels, headers, kick plates and burglar bars.

Relocatable storage units.

This product includes both MASS and Vault units. Which are designed to help self-storage facilities maximize their rentable space, utilize unused land, and provide flexible storage solutions. These relocatable units offer a cost-effective way to expand storage capacity. Or test new markets without permanent construction

Facility and door automation technologies.

The Nokē suite combines cutting-edge technologies for smart access. Nokē Ion offers a sleek, hardwired locking system built directly into doors for a seamless experience. Nokē ONE is a portable, battery-powered smart lock designed for flexibility. For broader access control, the Nokē Smart Entry system streamlines digital management across facilities. Finally, Nokē Elevate takes automation to the next level. Letting users open and close doors effortlessly through a custom-branded app.

Brief Company History

In 2002, David Curtis founded Janus International Group in Temple, Georgia. With 18 employees and a single manufacturing plant. The company's initial focus was on providing building solutions for the self-storage industry.

It wasn’t long though before the company expanded rapidly, opening facilities in Arizona and Texas within its first few years. Impressively despite the 2008 financial crisis, the company continued to grow through innovation. Introducing Moveable Additional Storage Structures to diversify its product offerings.

Strategic acquisitions over the years have played a crucial role in Janus's expansion:

2009: Acquired Epic Doors

2011: Purchased US Door & Building Components

2015: Formed joint ventures in the UK and Mexico

In 2013, Saw Mill Capital acquired Janus, providing additional resources for growth. This led to further expansion in Europe and product line diversification.

A significant turning point came in 2018 when Clearlake Capital Group acquired Janus. This partnership accelerated the company's technological advancement. Culminating in the acquisition of Nokē, Inc. and the launch of the Smart Entry product line.

In 2021, Janus made its debut on the New York Stock Exchange, marking its transition to a public company.

Today, Janus International Group serves over 50% of the market for interior building solutions in the self-storage industry. Geographically over 90% of the company’s revenue comes from the US while the other 10% comes from countries like the UK, Mexico and Australia.

Investment Thesis 📃

My investment thesis is based on 3 main pillars.

Self Storage Spending Recovery & Growth

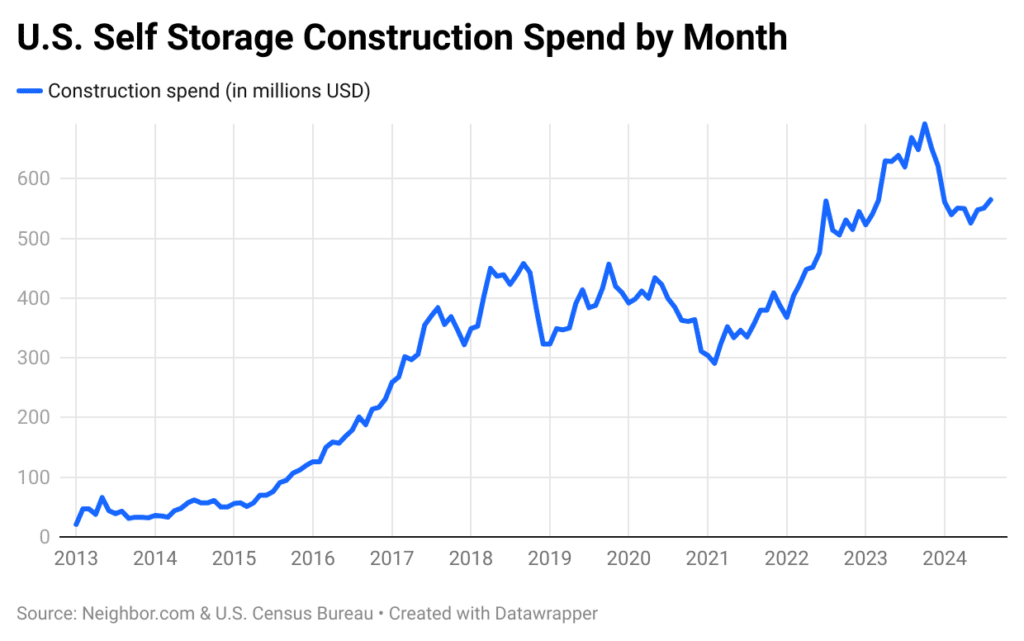

Monthly self storage construction spend, according to the U.S. Census Bureau, has dropped 18% (as of August 2024) since the October 2023 peak of $692 million.

It is because of this sustained drop that the company's stock is down about 50%. This is a short term decline in the face of long run tailwinds that will propel spending back to all time highs.

A few long term key drivers are as follows:

Urbanization: A larger and larger percentage of the population live in cities where spaces are smaller. And the need for extra storage is high.

Small to Medium Businesses: More businesses are turning to self storage as a cost effective way to store their products.

Population Growth: This one is pretty obvious.

Downsizing and Death: As the large baby boomer generation ages they will likely downsize their homes and need a place to store the extra. Or as they pass away their families need a place to store their possessions.

Then there is one very important short term driver to push a turnaround:

Falling Interest Rates: As interest rates fall owners of these self storage facilities will start financing the projects they have put off. It is hard to predict exactly when this will happen but with a projected rate cut this month it will certainly help.

While these are not flashy or exciting tailwinds they are consistent. And essentially guaranteed to continue. This gives me extreme confidence that we will see growth for Janus for years to come.

Strong Balance Sheet

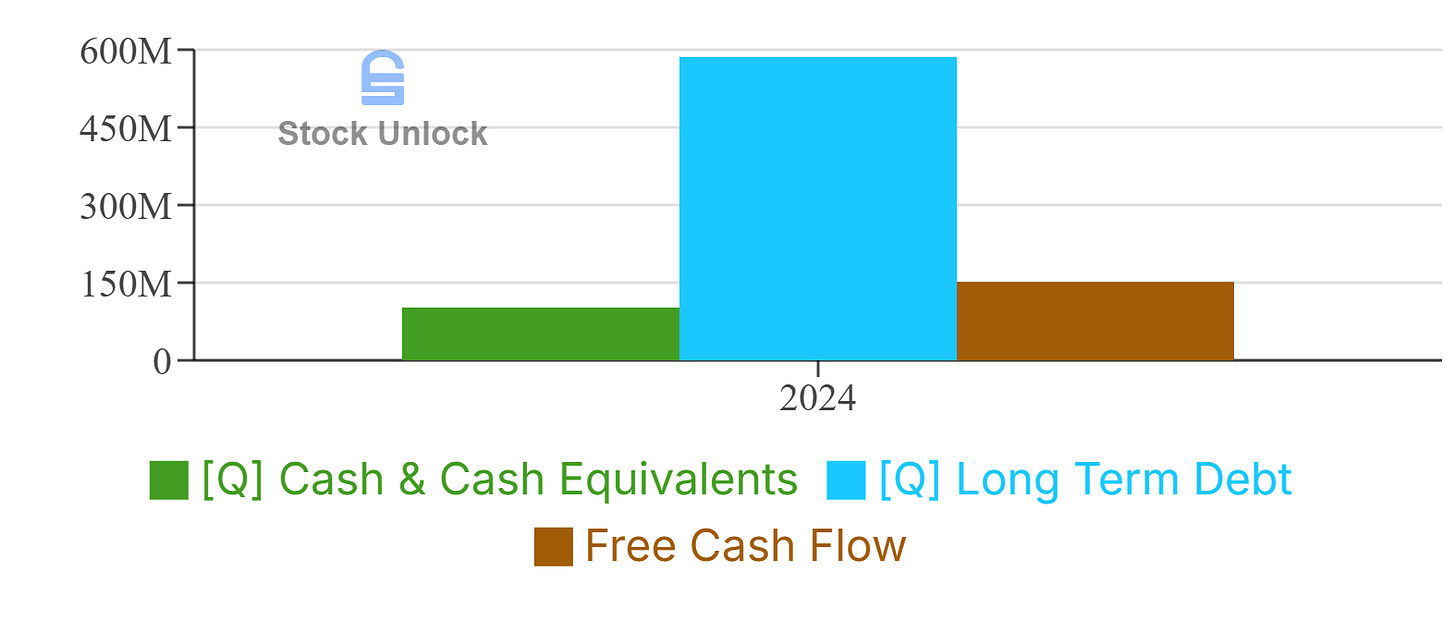

Janus International has about $600 million of long term debt, $100 million of cash, and is generating $150 million in FCF during the TTM. The $600 million in debt is not due until all the way out to 2030.

This puts the company under no pressure to pay their debt down quickly. They can focus on great capital allocation to buy back shares and grow the business.

Competitive Advantages

In this boring industry Janus has managed to compile several competitive advantages.

Efficiency of Scale

Pricing Power

Established Relationships

Innovation & Product Selection

According to Global Growth Insights2 Janus is the fastest growing self storage door maker despite being ranked in quality #2. This tells me all their advantages play together to make them more attractive even if their products are not considered #1.

Janus Group is far larger than competition in self storage. Betco currently generates $63 million a year in revenue. While DBCI sits at about $75.3. In the TTM JBI generated $1B in revenue. $646M of which is directly attributable to self storage just to illustrate how dominant of a position they have.

I will discuss their competitive advantages more in the moat discussion section. They are in a phenomenal position within the market that will not be changing any time soon.

Fundamental Analysis📊

Business Performance

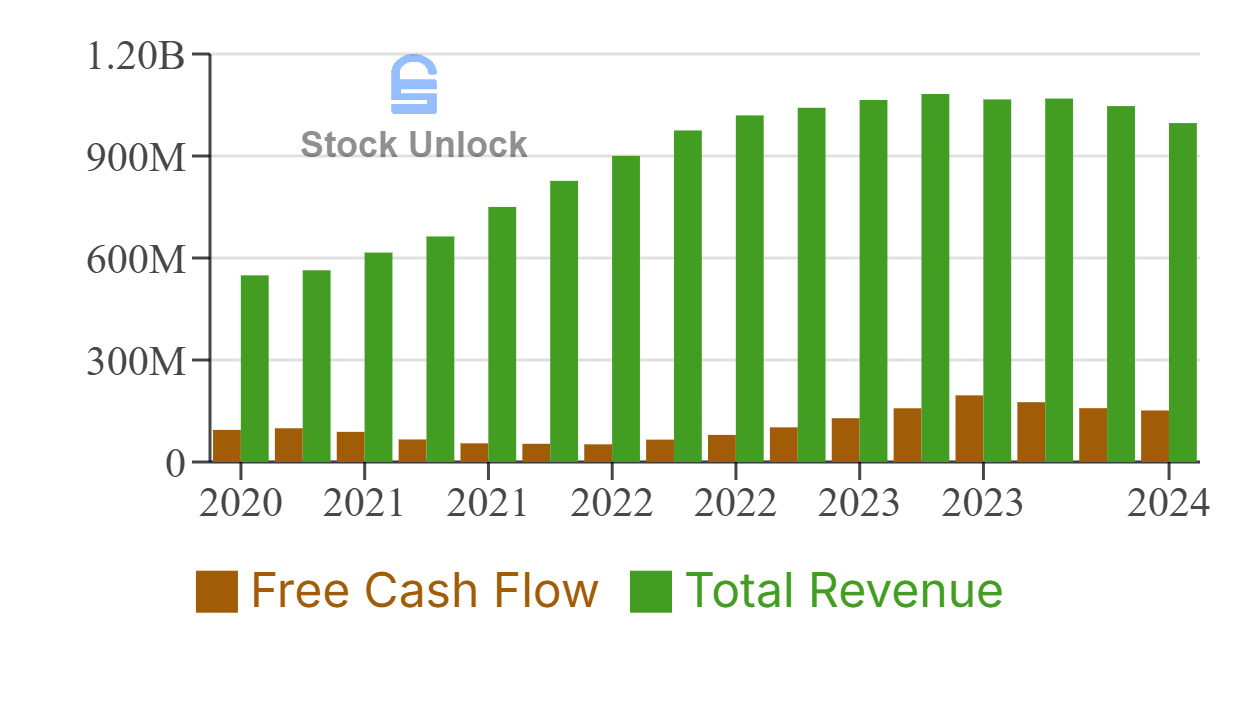

Since 2020 the company has grown revenue at 17.2% per year and FCF at 13.4% per year even after the recent quarters decline.

Financial Position

The company is in a great financial position as discussed previously with a current ratio of 2.8 and debt to EBITA at 2.4.

Profitability

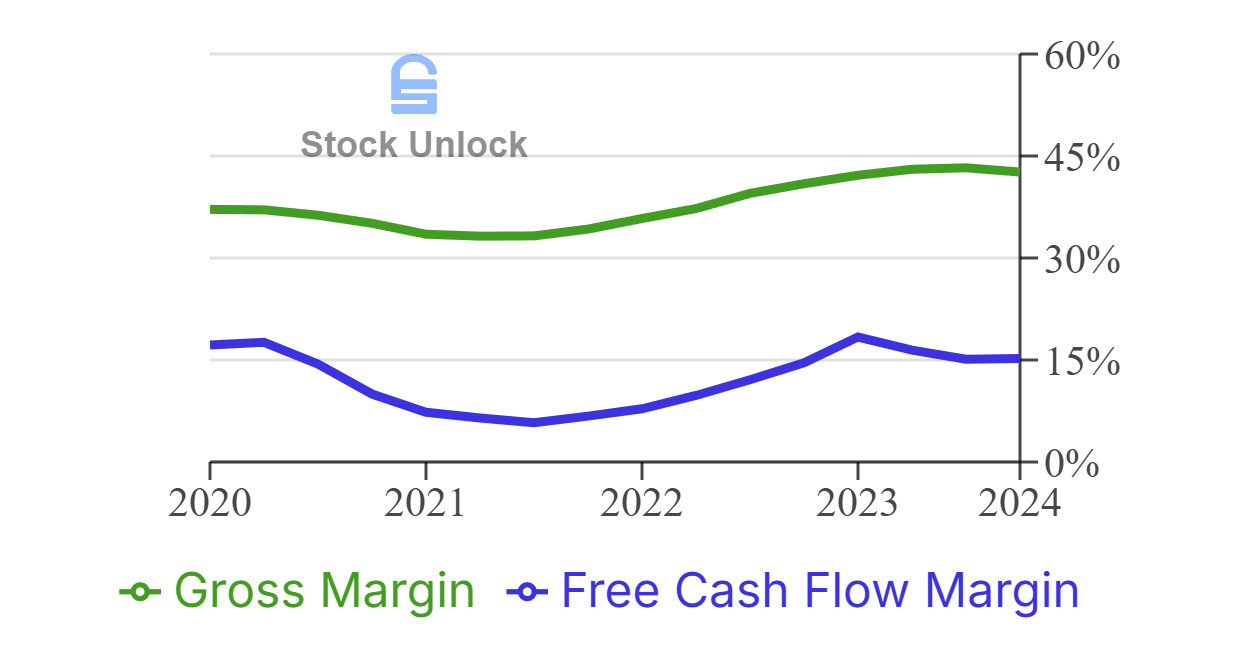

The company’s margins have remained stable with gross margins trending slightly up. It is likely after Covid they were slightly over earning so I expect FCF margins to level out around 15% depending on the growth of their Nokē system which is very high margin.

Capital Efficiency

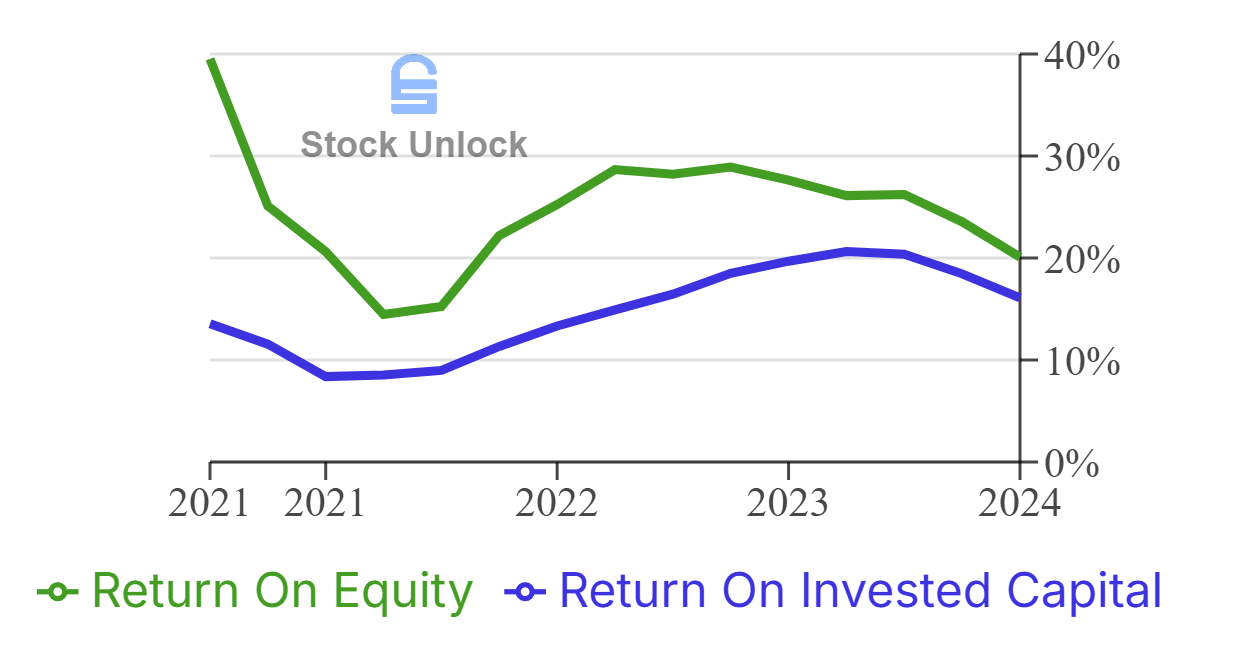

Over the last 3 years Janus has averaged a 24.8% ROE and a14.7% ROIC.

The company does a solid job allocating their capital. Most of their cash generated has been used to make acquisitions which have been very profitable for the company. Now in recent quarters after a severe decline in stock price they are also buying back shares.

I really appreciate a management who only starts buyback programs when their stock is cheap.

Moat Analysis

Any company you invest in should have some competitive advantage or ideally a sustainable competitive advantage. Otherwise known as an economic moat.

Janus International Group has a few things that give them an advantage over their competitors.

Efficiency of Scale

As the largest provider of self storage doors, hallway systems, and automation technologies. Janus can manufacture these products at a cost no small competitor can match.

This boosts their margins, freeing up more capital to reinvest back into the business.

Pricing Power

Janus is recognized as the highest quality self storage door manufacturer in the industry. They are known to be ultra reliable and long lasting.

It is because of that quality that the company can have premium pricing. This allows the company to weather downturns better and have higher margins across the board.

Established Relationships

Janus has the largest installation network in the industry, with 135+ partners and covering all 50 states. These relationships are built over many years and help build the company brand.

Innovation & Product Selection

In an industry that is considered generally low tech if a facility does have 24/7 smart access through an app and top notch security. They can charge a premium. And when looking for those products the largest and highest quality player is Janus. This applies even for the basic needs like hallway systems as well and means that for all these products Janus becomes the default.

In construction if you can have one company provide the materials or work for more of the project. It makes sense to use them for everything they offer. This is where the wide range of products offered becomes a competitive advantage for Janus. Why work with 2 or 3 companies to get everything you need when you can just turn to Janus?

Moat Conclusion

Janus clearly has some competitive advantages but do they rise to the level of an economic moat? The company does clearly have competition but they appear to be falling behind as Janus grows faster and takes more market share. They also have higher than average returns on capital along with higher margins.

But if competition starts offering similar product selection and quality then they could end up in a race to the bottom price war. This is unlikely but not out of the question. For that reason I can only say they have a competitive advantage although they could build it into an economic moat.

Valuation🔮

It is likely the last quarter of 2024 will still be weak for Janus however I expect revenues to start rebounding in 2025. Once they do start to rebound, 9% revenue growth is very reasonable. Driven by the tailwinds described before and the adoption of automation in the industry.

On that revenue I already stated 15% FCF margins are likely so all that’s left now is the multiple. For a company like this with a solid balance sheet, dominant market position, and good returns on capital a 17x FCF multiple makes sense.

With all those assumptions we arrive at the following market cap and share price year end 2029. (This assumes no change in outstanding share count.)

Market Cap: $3.78 Billion

Share Price: $26.70

Based on these figures I would expect to generate a 235% return over the next 5 years or an 18.6% CAGR from the current share price of about $8.00. This puts my fair value for their stock at $17.35. 117% above the current share price.

For another take, lets get a range of assumptions by looking at 7% and 11% revenue growth. With those figures you get the following 2029 share prices.

7%: $24.36

11%: $29.27

Conclusion🏁

Janus International Group is certainly not a flashy company. They are not in a crazy fast growing industry with insane margins or returns on capital but I expect them to quietly keep growing.

The will be driven by tailwinds of an aging population, urbanization, population growth, and small to medium business in the long run. Short term the catalyst is falling interest rates although the timing of this is uncertain.

They have a strong balance sheet to wait for the spending to turn and buyback shares or make acquisitions when it makes sense.

This is a high conviction opportunity but for now will just remain on a watchlist. Purely because other companies offer even higher returns.

If you are curious which companies those are, check out my other articles and stay tuned for my 2024 portfolio review.

Extra Footnotes

Check out some of my other articles!

Do you have a stock you want me to review? Submit it below and you may just see it in an article!

It only takes 1 minute to share this article. If you liked it, hit that share.

Questions or comments? Be sure to leave them below!

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

See you in the next edition!