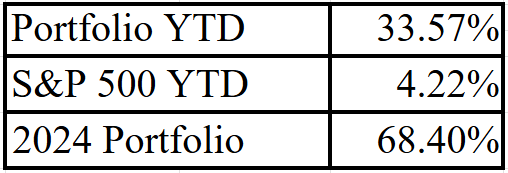

Pipes and Packaging | GXO, LESL, ATKR

An update on my holding GXO Logistics and analysis on Leslie and Atkore to see if they offer attractive opportunities.

One stock I own. One stock I’m researching. One key investing question. Every week, I break down my portfolio, explore new ideas, and answer what’s on your mind. Let’s dive in!

Follow Up On My Radar

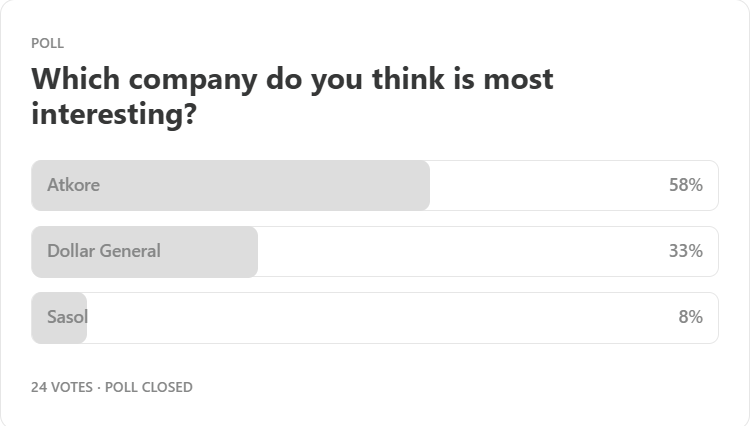

Atkore ($ATKR-Write Up Here)

Last week I covered 3 stocks and Atkore was voted the most interesting. Below are the key questions I was researching at the time.

“My focus has been in researching the fundamental turnaround in prices of these two materials (Steel Conduit & Resin) so far. Do they have normal cyclical patterns? How will tariffs affect them? Etc.”

As I researched both material prices my key was finding if prices had troughed. I feel reasonably confident they have based on the cyclical price patterns over the past couple decades. To reinforce that I need to find a strong catalyst(s) that would cause the material prices to rebound sharply and help Atkore’s margins.

It just so happens that soon after last week’s newsletter we got news that 25% tariffs on steel products would be implemented starting March 12th. This would obviously buoy prices for steel but there are a couple reasons why this is not enough.

Trump has a history of delaying, changing, or just not implementing tariffs at all. From my perspective he uses them as leverage to get what he wants so it is not locked in that they will actually happen though it is probably more than a 50/50 chance.

Tariffs will have a marginal effect on steel conduit prices but are likely not large enough to really bring Atkore roaring back.

The other catalyst I see is the expected investments in US infrastructure.

Stargate Project proposed $500 billion for AI infrastructure.

Government is willing Intel to compete with TSM which has already taken $10’s of Billions.

Massive Capex spending by Mag 7 and most other tech companies.

These however are likely not enough as non-residential construction spending despite all this investment in 2025 is expected to be soft. Decelerating to about a 2.2% increase YoY1 compared to 5.8% growth in 2024. This makes it hard to assume much organic revenue growth for the company. Or that the supply-demand forces will push up prices.

So for now I think 2025 will likely still be a struggle for Atkore. My base assumption is PVC and steel prices continue to fall through the first half of 2025 then stabilize the second half.

My target price to watch for is $50-$55 which will prompt me to take a look to see how the catalysts have changed for the company. At its current price it did not offer attractive enough returns for me to want to take a position.

What other questions would YOU ask? Are my assumptions reasonable?

New Stock On My Radar

Leslie - ($LESL)

Leslie is a leading provider of pool maintenance services, goods, and chemicals founded all the way back in 1963. You can see pretty quickly in their stock chart the last few years have been a massive struggle. So lets get into what is going on behind the scenes.

Why is Leslie interesting?

Stock prices down massively from all time highs.

Median ROIC and ROCE since IPO of 26.7% and 27.9%.

Market cap of $290M on Rev on $1.3B and peak FCF of $140M

What caused their massive drop?

There are a couple reasons why Leslie has fallen so far.

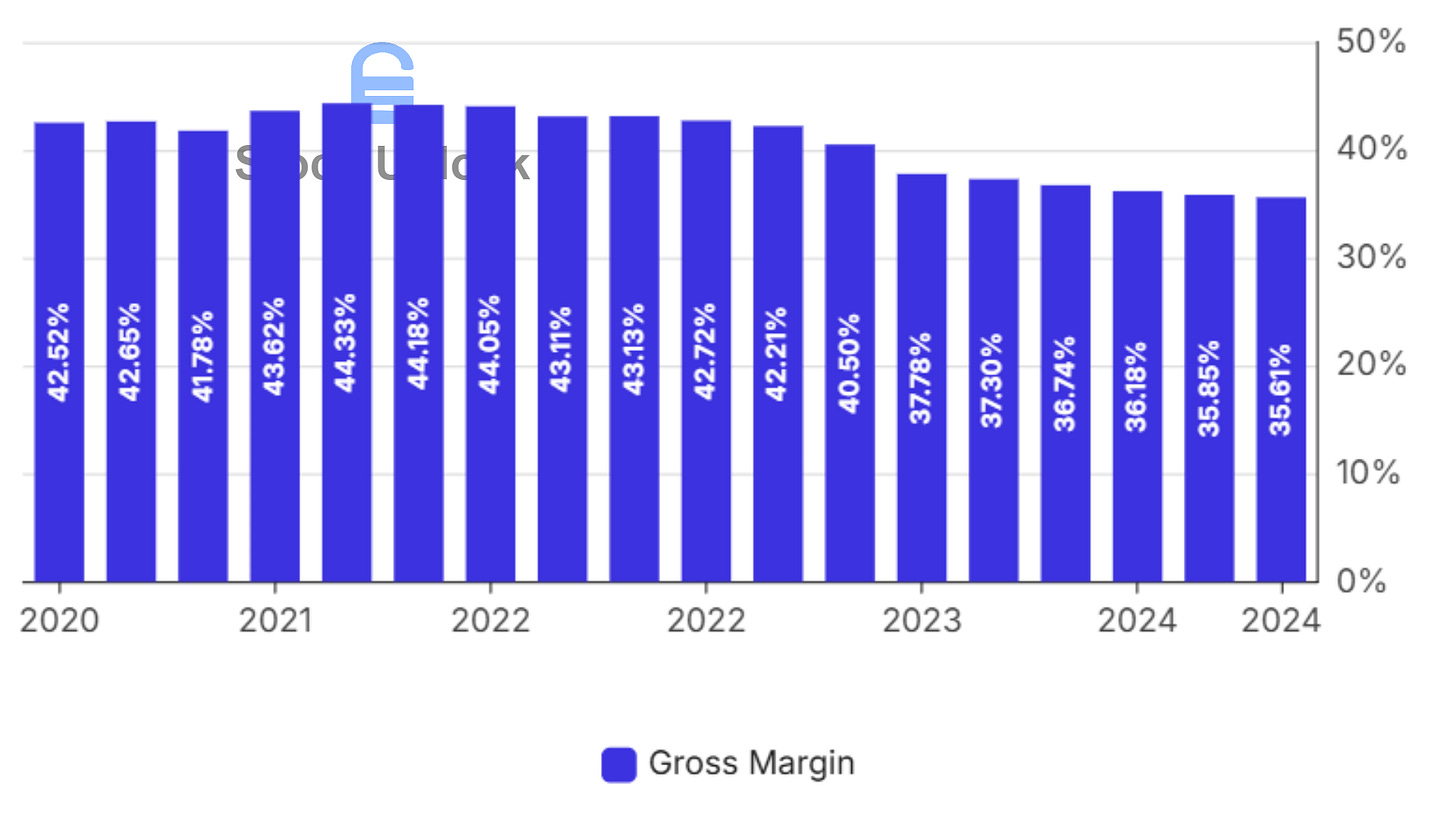

Gross margins have fallen meaningfully since 2020.

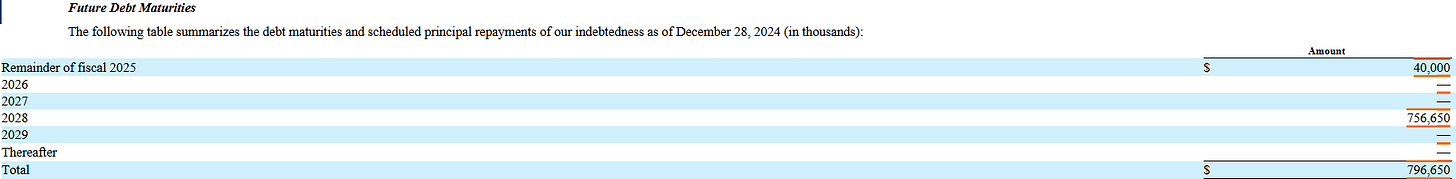

Debt has piled up with $756M coming due in 2028.

What am I researching?

Given that the company's future depends on generating sufficient cash to service their debt over the next 3 years, I'm focusing my research on two areas.

Management's cost reduction strategy.

Their plan to transition toward higher-margin services.

For 2025 management expects flat revenue but slightly improved gross margins as they optimize inventory and costs. They state their “#1 capital allocation priority remains reducing overall debt and lowering our leverage profile.”

My perspective is margins have likely bottomed but I need more evidence they can turn back up meaningfully. My last question after understanding their plan is critical. Even if margins improve can they generate enough cash to pay down debt or be in a good position to refinance?

What questions would you ask?

Investor Inbox

Do you ever read an investment article and have questions about a term, idea, or company? Feel free to ask below and each week I will pick one question to answer in this section.

How I think about returns on and cost of capital.

This concept is very important but often overcomplicated. What you are looking for is a company that earns more with the money they have than it costs them.

For debt this means if their interest rate is 7% then they should earn, in profit, more than that on their invested capital to make it worth it.

Think of it like this. Say you took out a loan at 5% interest and invested it in a bond that pays you 4%. Dumb right? But what if the bond pays you 10%? Then it is a smart trade because it costs you 5% to make 10%. Over time your money will compound.

The cost of equity is a little harder to grasp but to make it simple I assume the cost of equity is 9%.

This is because the company can pay what they earn back to me and I can get an average 9% return investing myself. They need to be able to beat that hidden cost or in comparison they are losing money. Think of it like opportunity cost.

So when you are researching a company you need to clearly define if they are earning over their cost of capital. If they are, great. If not then the business is slowly eating itself.

Portfolio Spotlight

GXO Logistics ($GXO)

Resources:

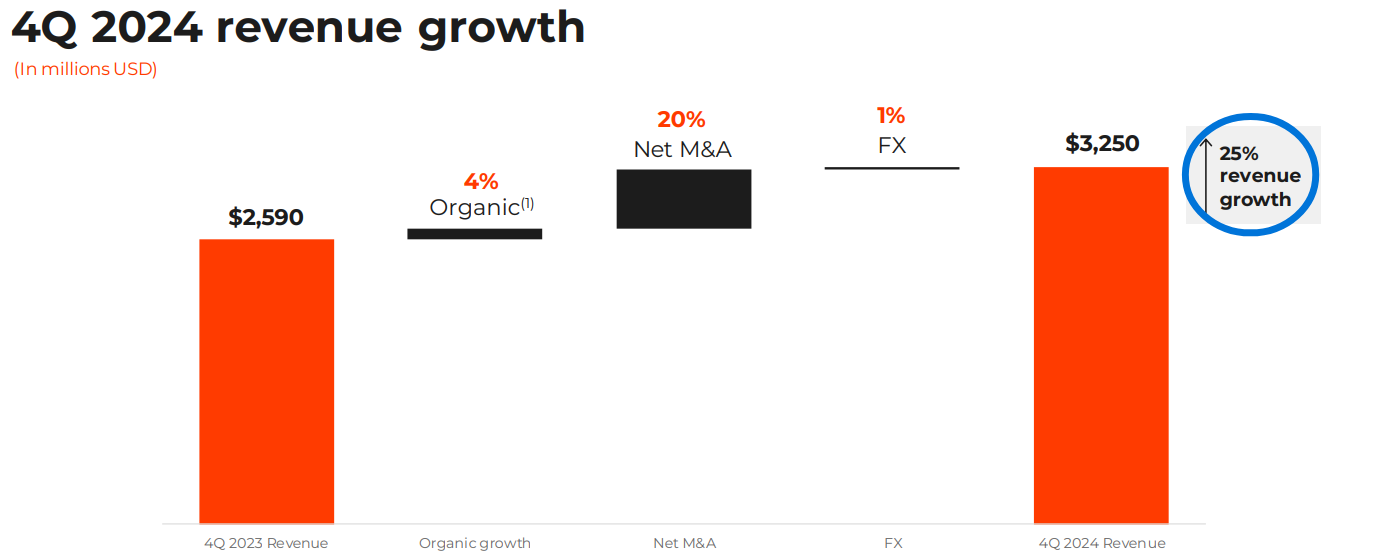

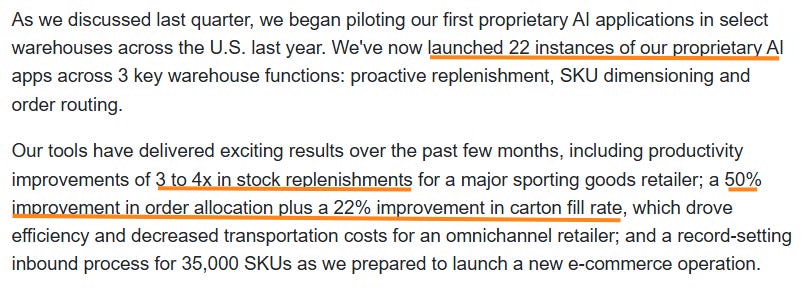

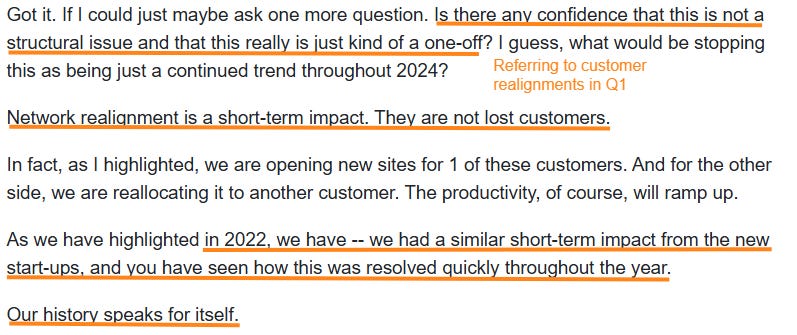

The initial reaction off earnings was negative with a 15% drop. I believe this is for a few reasons.

The company is still searching for a new CEO.

The Competition and Markets Authority (CMA) is still reviewing the acquisition and does have the authority to block the deal. Though according to management is is very unlikely that would happen it still weighs on the company.

Some “customer capacity realignment” affected Q1. “We have worked with a few of our large customers to realign their footprints to fit their future needs.”

These are short term issues for the company that will push out the timeline of their growth by a little bit. But likely an overreaction that is backed up by the 8.5% bounce back the day after. To be clear I am not saying these are a non-issue. Just short term ones.

Lets look past the negatives investors saw to some of the good things the company is doing.

GXO is performing very well and will have some very strong growth in coming quarters. Customer realignments and maybe slightly slower than expected organic growth could push my timeline out but not by a lot.

I took advantage of the dip and bought more shares in the low 30’s.

What questions do you have on the company and their recent earnings?

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, and past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

See you in the next edition!

Atkore management has shown that they don't understand the cycle well. That's why i sold. Very little credibility left in management.

Are they in direct servicing of Pools?

If so, how about their workforce, considering the rapid and fundamental chamge we see (Chris Homan, if you ask for clarification)