📈Atkore ($ATKR) | A Construction Supply Company with Fantastic Capital Allocation

This article is an analysis of Atkore as a company and potential investment.

Hey All!👋

Welcome back to 📗Value Investing Blueprint📗

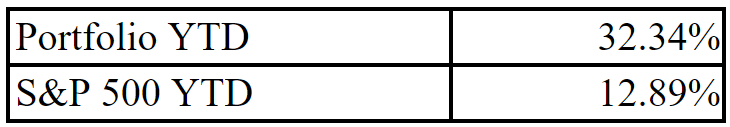

Investors often miss long-term gains by focusing on short-term noise. My strategy of targeting high-quality companies has led to market-beating returns this year, and it can help you do the same.

Check out some other articles!

📈International General Insurance | A High-Quality Insurance Company

📈Intel | The Semiconductor Company Everyone Hates (Except the Government)

📈Alibaba | The Obvious Multi-Bagger No One Wants to Touch

While researching undervalued companies, I stumbled upon Atkore—and what I found was impressive. This company is a master at acquiring businesses, deploying capital with precision, and keeping a tight control over debt. In this article, I’ll break down the full business analysis and explore its investment potential. Stick around to see why this overlooked opportunity might be a strong addition to your portfolio!

Understanding the Company

Before investing in any company, it's crucial to understand what they do and how their business economics might evolve in the future. If you can't confidently grasp this, then the company likely falls outside your circle of competence.

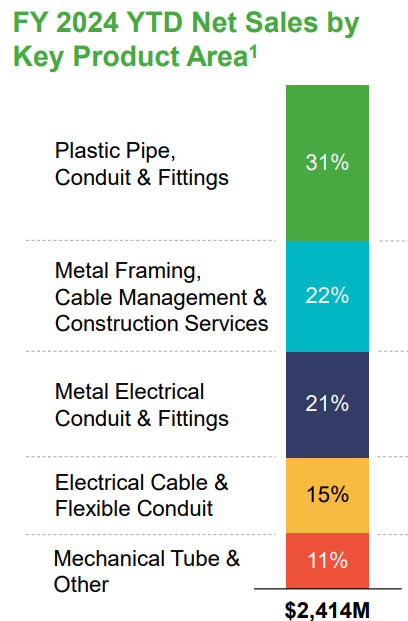

Atkore has two segments:

Electrical

Safety and Infrastructure

Their electrical segment manufactures electrical power systems, including conduit, cable and installation accessories, and serves contractors in partnership with the electrical wholesale channel.

The safety and infrastructure segment designs and manufactures solutions, including metal framing, mechanical pipe, perimeter security and cable management for the protection of infrastructure.

Understanding the Industry

Once you understand what the company does, the next step is to gauge how the industry is likely to perform or evolve in the coming years. If the industry outlook isn't favorable or at least stable, it can be incredibly challenging for any company to thrive against that underlying current

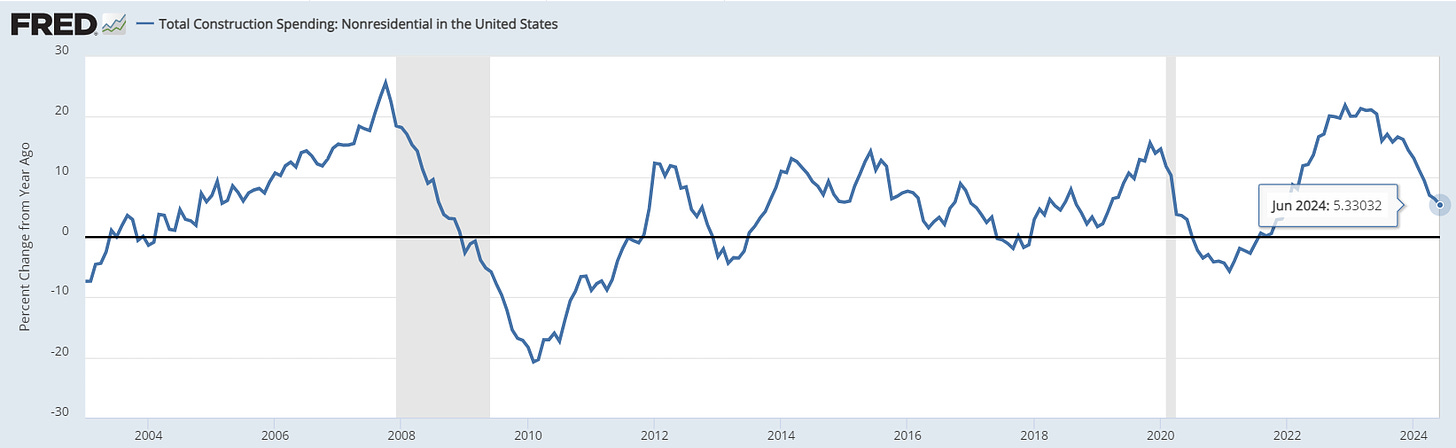

The electrical construction supply industry is highly commoditized, with products primarily differentiated by price. In such an environment, understanding demand is key. For Atkore, I’ll be looking at total construction spending in the U.S. as a primary indicator of where demand for their products might be headed. This metric is crucial because it reflects the broader trends in the construction industry, which directly impact Atkore's sales and growth potential.

Over the past 20 years, the electrical construction supply industry has shown a highly cyclical nature, with pronounced downturns during recessions. However, in the last decade, the industry grew at an average rate of 7.2% per year, reaching its most recent peak in late 2022—a peak that coincided with Atkore’s highest revenue.

Since that peak in 2022, growth has been slowing and is expected to continue decelerating for the next couple years, according to forecasts. To be conservative, my base case assumes that nominal spending in 2025 will be up just 3% from 2023 levels, followed by a steady 3% annual growth through 2029. This projection would bring total construction spending to approximately $1.33 trillion by the end of 2029.

Financial Fundamentals

Revenue and Margin

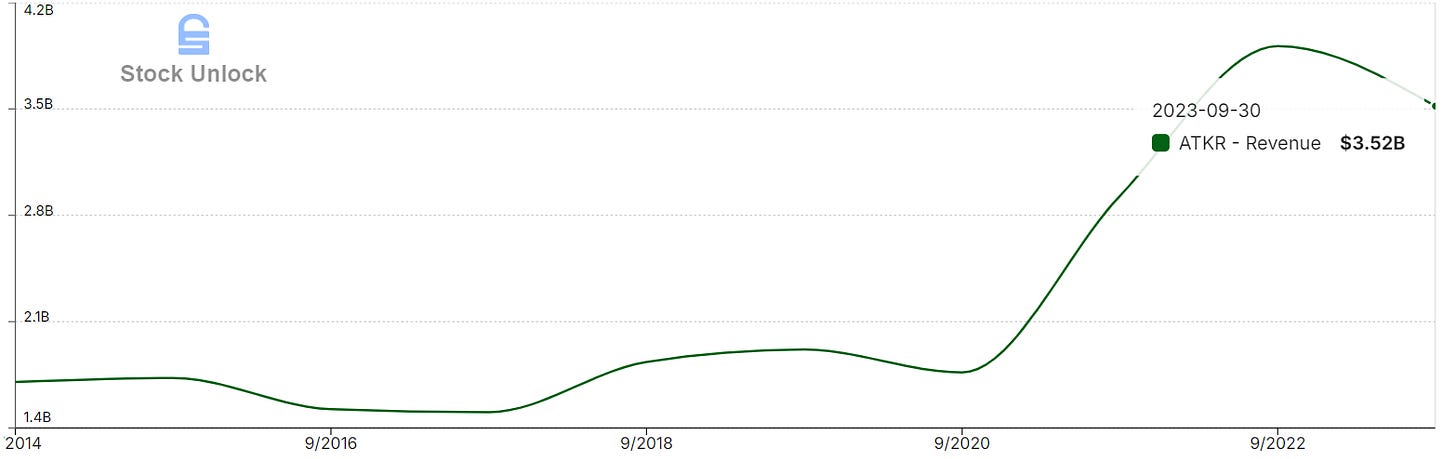

Over the past 10 years, Atkore’s revenues have grown at an impressive rate of around 9% per year, slightly outpacing the industry’s average annual spending growth of 7.2%. This outperformance suggests that Atkore has been able to capture a larger share of the market, likely due to strategic acquisitions, operational efficiency, and effective capital deployment.

Over the last 10 years, Atkore has maintained a median free cash flow (FCF) margin of 10.4%, slightly above the industry average of 9.26%. This positions Atkore right around the market average in terms of FCF margin, indicating that while the company is competitive, it hasn’t significantly outperformed in this area. However, maintaining a solid margin above its peers suggests a strong ability to generate cash, even in a commoditized industry.

Returns

Over the last 10 years, Atkore has achieved a median return on invested capital (ROIC) of approximately 19.5%, significantly higher than the industry average of 10.7%. Additionally, Atkore has boasted a median return on equity (ROE) of 51.7%, with its book value—the 'E' in ROE—growing at an impressive compound annual growth rate (CAGR) of 30%. These figures highlight Atkore’s exceptional capital efficiency and strong performance in generating returns for shareholders.

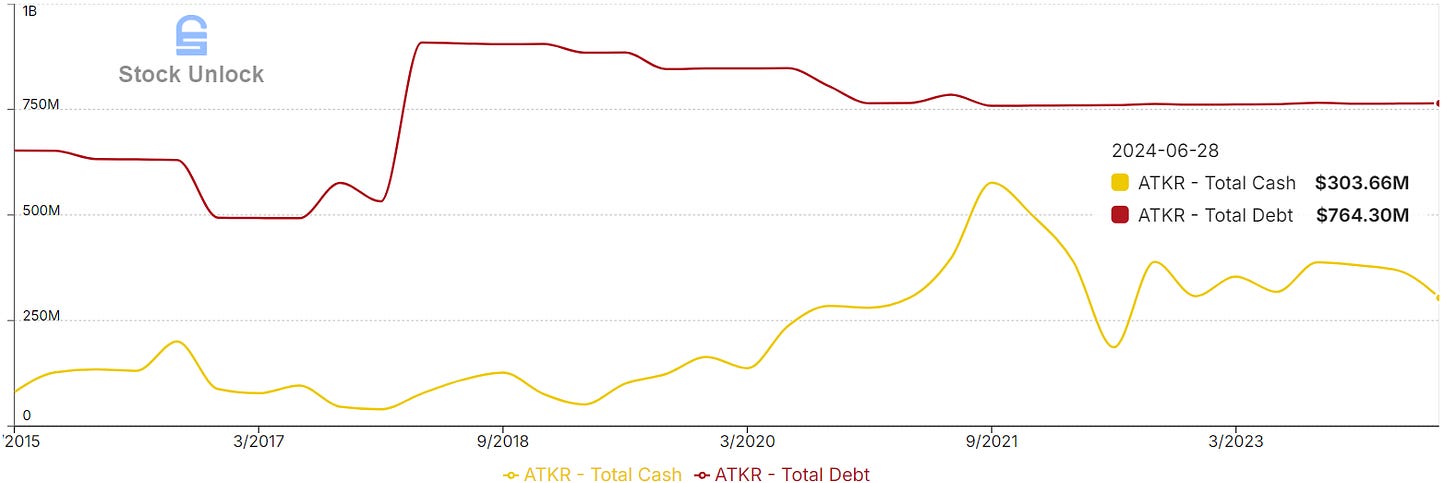

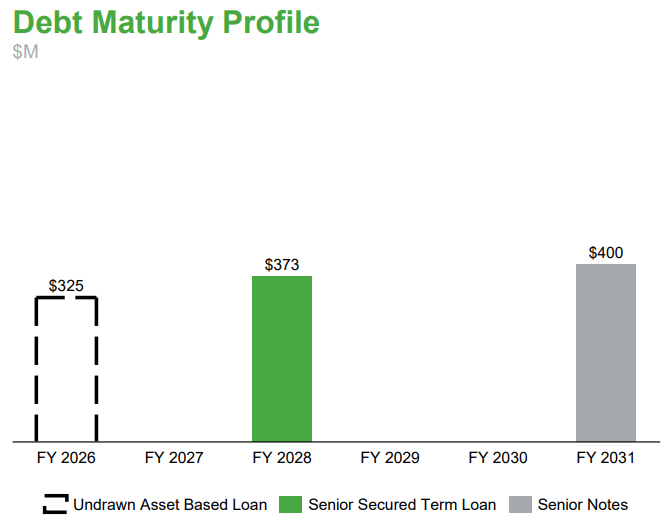

Leverage

Atkore maintains a prudent leverage strategy, holding approximately $300 million in cash and reducing its debt from $764 million since 2018. As of Q1 2024, the company generated around $430 million in free cash flow (FCF on a trailing twelve-month basis). The remaining debt has long maturity dates extending to 2028 and 2031, providing the company with ample time to manage and service its obligations effectively.

As of Q1 2024, the best proxy for maintenance capital expenditures (CapEx) is 18% of operating cash flow, which is derived from depreciation and amortization. This indicates that Atkore’s business is neither highly capital intensive nor particularly CapEx light, striking a balance that allows for sustainable operations without excessive capital outlay.

Management’s Integrity

Shares Outstanding

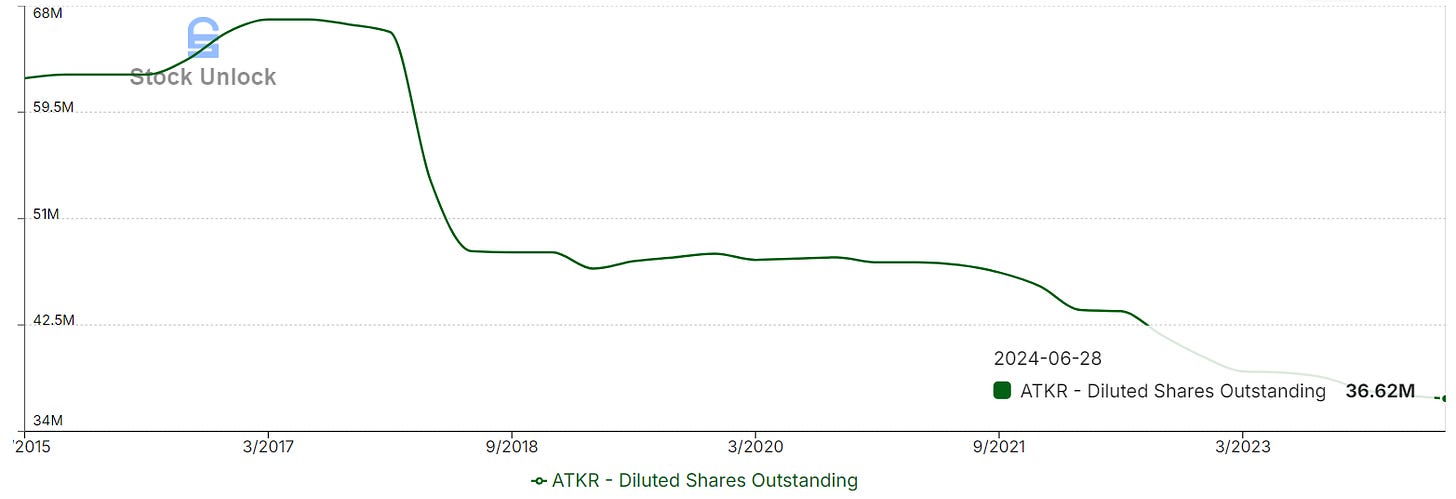

Since the end of 2017, Atkore’s management has consistently bought back shares, reducing the number of shares outstanding by an average of nearly 6% per year. While this indicates a commitment to returning value to shareholders, it’s also important to consider whether there were potentially better uses for this capital. It appears however, in Atkore’s case, management used capital for share buybacks after using other high return options.

Stock-based compensation (SBC) has generally remained relatively low, standing at about 4.7% of free cash flow (FCF) as of Q2 2023. While this is higher than I would prefer, it is still lower compared to many other corporations. Monitoring SBC levels is important, as it impacts shareholder value and reflects the company’s approach to incentivizing its employees.

Incentives

Atkore’s management compensation is not tied to any specific metric but is instead linked to the overall performance of the company. This approach aligns management’s interests with the long-term success of Atkore, encouraging a focus on broad strategic goals rather than individual performance metrics.

Performance

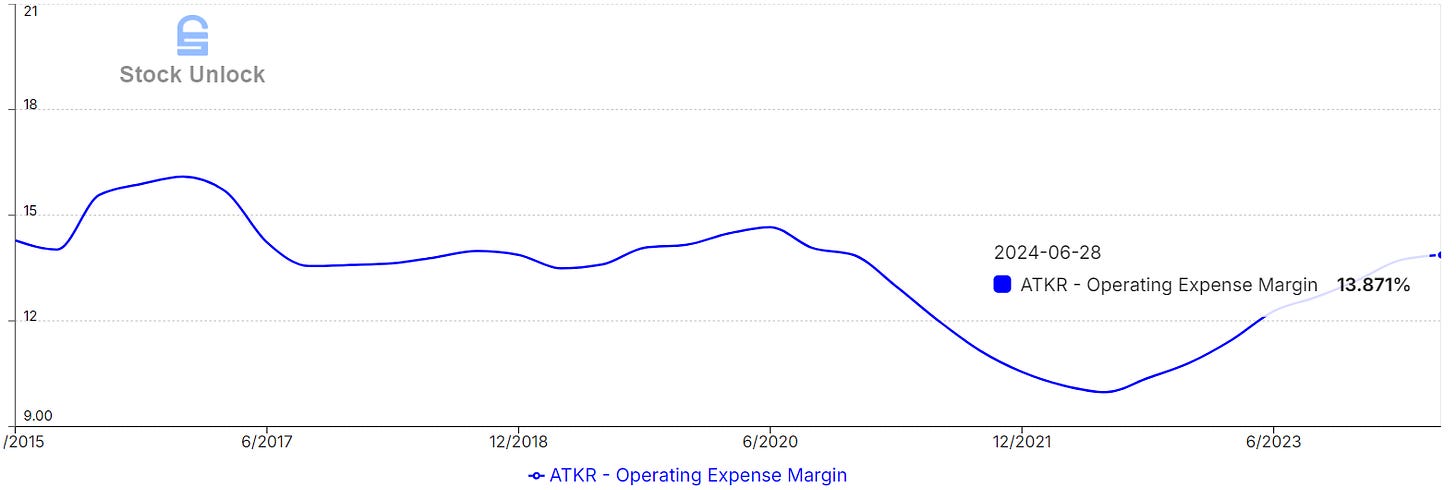

Atkore has excelled at managing expenses, though it may not be their top priority. Since 2016, their operating expense margin has decreased slightly from about 15% to 13.9%. This reduction highlights the company’s ability to control costs effectively while still pursuing growth. Notably, since becoming a public company in 2016, Atkore has completed 17 acquisitions. Despite this aggressive expansion, the number of shares outstanding has decreased, debt levels have remained stable, and operating expenses have fallen, showcasing strong financial discipline.

Candor

Atkore’s management seems to excel at providing a realistic outlook and consistently exceeding expectations. This is a strong indicator of effective leadership, as many companies tend to present overly optimistic projections and frequently underdeliver. Atkore’s ability to surpass forecasts suggests a high level of transparency and competence in their management team.

Company Concerns or Issues

Atkore’s operations are strong, and the recent decline in revenue and free cash flow (FCF) is not attributed to mismanagement. Instead, it reflects an industry-wide slowdown and a drop in prices due to reduced construction spending, as detailed in the industry outlook.

In their Q3 2024 earnings report, Atkore reported flat year-over-year volume of products sold, with the decline entirely due to lower average selling prices. This price drop is a result of basic supply and demand dynamics: increased supply, which surged when prices were high, has now led to a glut as demand has weakened, pushing prices down. This more pronounced downturn than anticipated prompted Atkore to lower its guidance, contributing to the continued decline in the stock.

Addressing the Concerns or Issues

The issue with soft prices is clearly a temporary one. As highlighted in the industry outlook, the electrical construction supply industry is highly cyclical, with typical slowdowns following rapid increases in spending, such as those seen in 2023. This pattern is a normal aspect of a healthy economy.

This situation illustrates a common market behavior: investors often drive up stock prices when conditions appear favorable, forgetting that peaks are usually followed by inevitable slowdowns. The current price weakness is part of this cyclical pattern and should be viewed in that context.

My Thoughts

After a thorough review, I am quite impressed with Atkore’s overall quality. While their free cash flow (FCF) margins are close to the market average at 10.4%, their capital allocation is exceptional, and they stand out in almost every other aspect.

Atkore holds a #1 or #2 market share position in each of their product categories, which is a significant advantage in an industry where products are primarily differentiated by price. This strong market position allows them to achieve better economies of scale and offer products at lower costs. While this represents a competitive edge, it’s not quite an economic moat.

The most compelling aspect of Atkore is their ability to grow revenue through acquisitions without increasing debt, diluting shares, or compromising their cost structure. This approach not only reflects their strategic acumen but also positions them well for continued market share gains and revenue growth in the future.

Valuation

To value Atkore, I’ll start by accounting for the current soft prices, projecting a 5% revenue decline from 2023 levels. Despite this initial dip, I anticipate that Atkore will outperform industry growth. I expect their revenue to increase at an annual rate of about 7% through 2029. This forecast considers several factors: organic volume growth, price increases per unit, and potential revenue boosts from acquisitions. I also anticipate that demand will improve as construction activity picks up with declining interest rates. With these assumptions, the projected revenue for Atkore in 2029 will be as follows:

2029 Revenue: $4.33 Billion

Based on the projected revenue, I will assume free cash flow (FCF) margins of approximately 15%, reflecting an improved price per unit environment. This assumption takes into account a more favorable market condition. Applying this margin to the projected revenue will yield the following FCF estimates:

2029 Free Cash Flow: $650 Million

Using the projected free cash flow, I will apply a 12x FCF multiple to estimate the valuation. Additionally, I’ll assume that the total number of shares outstanding will decrease by 15% by 2029, which is more conservative compared to their average annual buyback rate of about 5%. With these assumptions, we can estimate the following share price and market capitalization.

Share Price: $258.20

Market Cap: $7.8 Billion

This implies an approximate 170% return from current levels over the next five years, translating to a 22% compound annual growth rate (CAGR). While this represents a strong return, it doesn’t quite surpass the returns offered by my current investments. Nevertheless, Atkore is a company I will monitor closely, particularly to see if it declines further during the current slowdown, which could present a more attractive entry point.

Assumptions

For this valuation to be realized, several key assumptions must hold:

The non-residential construction industry experiences modest growth through 2029.

A higher per-unit price environment materializes in the next few years, leading to improved margins.

Atkore maintains its previous growth strategy and continues expanding at a similar rate.

These conditions are crucial for achieving the projected valuation. How reasonable do they seem to you?

If you enjoyed the article, consider becoming a paid subscriber! You can cancel anytime in the first MONTH and you will get my famous Punch a Puppy Guarantee! If you wouldn’t punch a puppy to keep getting my articles I will refund your subscription in full no questions asked so go check it out. There is absolutely zero risk and incredible content to take your investing game to the next level.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.