📈Intel ($INTC) | The Semiconductor Company Everyone Hates (Except the Government)

Full analysis of Intel as a company and potential investment.

Intel has been crushed, down nearly 70% from its 2020 peak, following another missed earnings report on 8/1/24. As one of the most criticized semiconductor companies in the U.S., this article will analyze Intel’s business and investment potential.

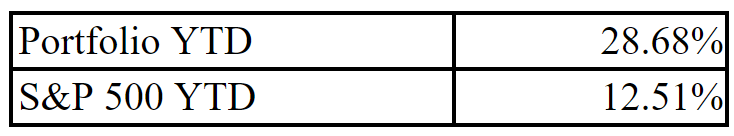

If you like this type of content hit subscribe to get these in your inbox every time I send an article. It is this work I am giving away that has allowed me to out perform the market by a significant margin this year.

Summary of Business

Intel designs, manufactures, and sells computer products and technologies. The company’s portfolio includes microprocessors, chipsets, integrated circuits, and other semiconductor components. Intel also develops software, services, and solutions aimed at enhancing computing performance and enabling advancements in fields like artificial intelligence, autonomous driving, and data centers.

Client Computing Group

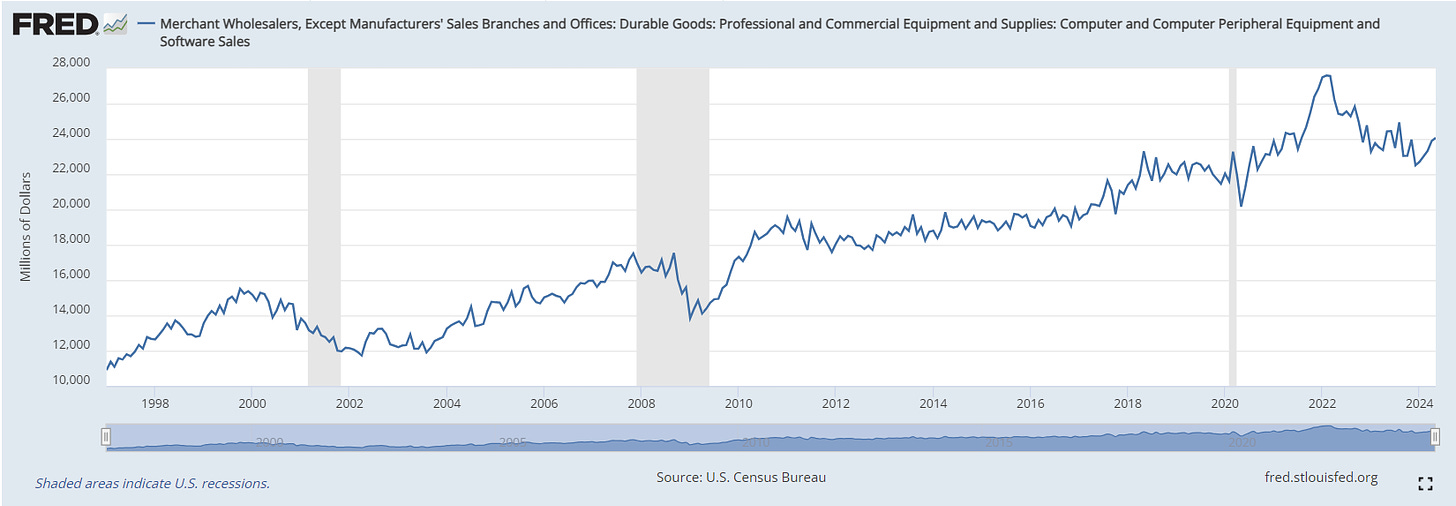

Intel’s Client Computing Group, which focuses on personal computers, has been a significant source of investor pessimism. However, the division seems poised for a turnaround, driven by the cyclical nature of the PC and equipment market. Additionally, increased AI usage and the growing penetration of devices in education are expected to benefit this division.

Data Center and AI

Intel’s Data Center and AI division provides the software and hardware that businesses need to harness their data for better decision-making. Despite its potential, this division has underperformed expectations.

Network and Edge

Intel’s Network and Edge division focuses on optimizing business networks for improved communication and operational efficiency. This division develops solutions that enhance network performance, security, and scalability, enabling businesses to handle increasing data demands and edge computing requirements.

Mobileye

Intel’s Mobileye division specializes in developing autonomous driving systems. This division focuses on advanced driver-assistance systems (ADAS), sensor technologies, and software algorithms to enhance vehicle safety and enable self-driving capabilities.

Foundry Services

Intel’s Foundry Services division manufactures computer chips for other companies lacking in-house capabilities.

The U.S. government has provided Intel with $8.5 billion and promised an additional $11 billion in loans to develop its foundry business, aiming for domestic self-sufficiency in semiconductor production. Currently, the industry is dominated by Taiwan Semiconductor Manufacturing Company (TSMC), which holds approximately 60% market share. Intel has expressed its ambition to become the second-largest player in foundry services by 2030.

Industry Forecast

While a detailed industry forecast for Intel could be extensive, I prefer to keep things simple. An investment should be appealing based on basic fundamentals alone, or it's not worth pursuing. With that in mind, I will only forecast growth for Intel’s Foundry Services and Client Computing divisions, as I believe these will be the most relevant over the next 5-10 years. For all other sectors, I will assume a conservative growth rate of 4%.

Client Computing is cyclical by nature, and we should be at or near a trough. Five separate industry forecasts predict an average growth of 6.4%, which I consider reasonable. I will assume a 6% growth rate.

Foundry growth should be robust as Intel, with government support, heavily invests in this business. The industry is projected to reach around $300 billion by 2034. I assume Intel will capture a 15% market share in 10 years, equating to approximately $45 billion in revenue. This implies an annual growth rate of about 10%.

Company Issues

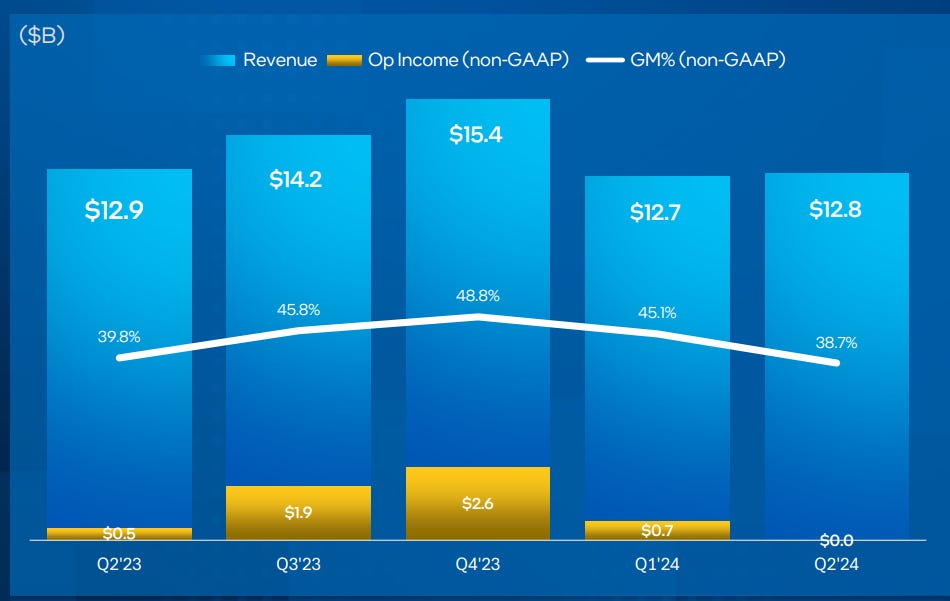

Intel has struggled in recent years due to a lack of innovation and a downturn in the PC market. In response, the company has undertaken restructuring and increased R&D efforts. However, these changes coincided with a decline in operating cash flow, leading to a more pronounced drop in margins and free cash flow (FCF).

Since peaking in 2021, key metrics for Intel have deteriorated significantly:

Revenue is down about 30%.

FCF has shifted from a positive $21 billion to a negative $14 billion, reflecting a -170% change.

Addressing the Issues

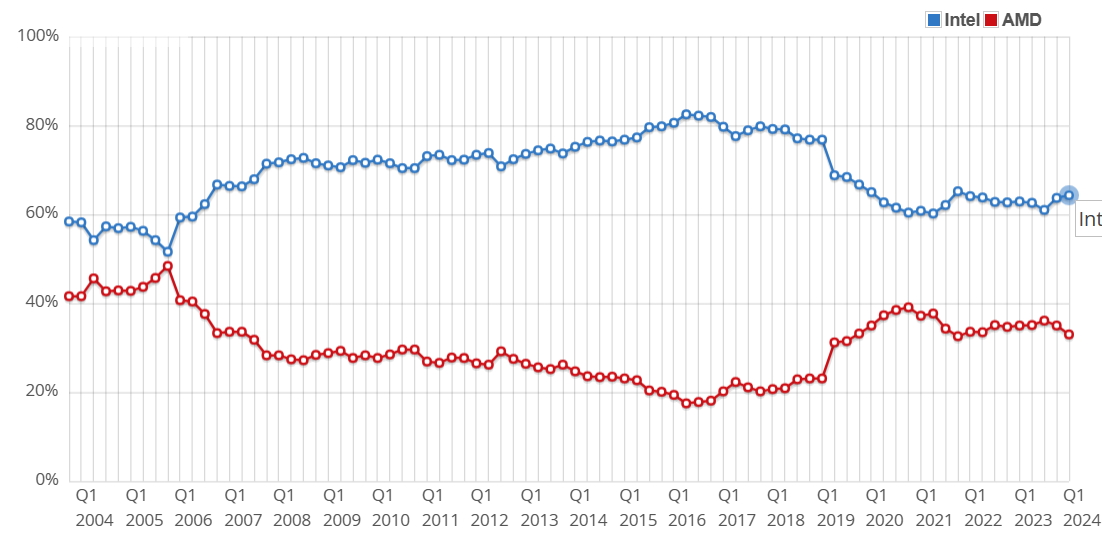

Intel’s issues are substantial and have significantly impacted their profitability. However, there are signs of improvement, including a potential inflection in revenue, market share, and management’s response that could lead to a turnaround.

Revenue hit a low of $11.7 billion in Q1 2023 but has consistently been above that level in the following quarters.

Their market share in CPUs has increased by about 4% from its recent low, indicating that their changes may be having a positive effect.

One of the most significant updates from the recent earnings call was Intel’s announcement of a $10 billion cost-cutting plan for 2025. This initiative is expected to greatly help profitability. However, it will be crucial to monitor whether productivity is maintained after the reduction in headcount.

With improvements in PC purchases, market share recovery, and cost reductions, Intel is well-positioned to get back on track, provided they successfully execute their new product initiatives and grow their foundry business. The success of these efforts falls on effective management. (Free Government money will help too.)

Management and Fundamentals

In 2021, Intel reappointed Patrick Gelsinger as CEO. Gelsinger previously served as Senior VP and GM of the processor business from 1979 to 2009, during which he played a key role in establishing Intel as a dominant player in the semiconductor industry. His extensive experience and deep understanding of Intel's operations and technology give me strong confidence that the company can effectively execute its strategies and navigate current challenges.

Respect for Shareholders

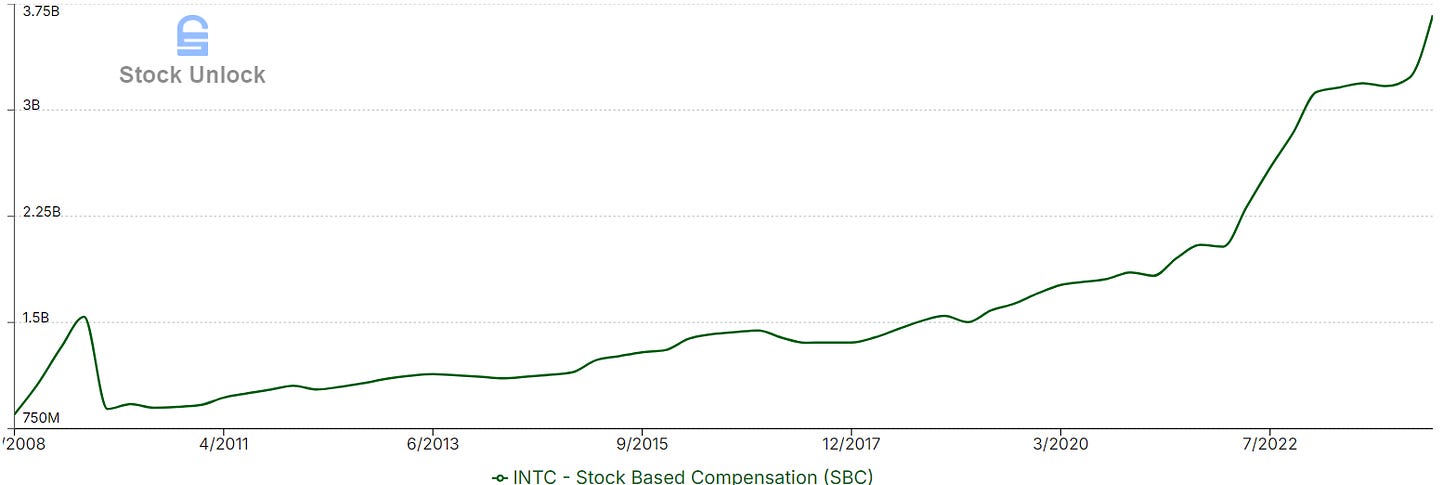

I pay close attention to how current management treats shareholders, particularly through stock-based compensation (SBC) and changes in share count. Since 2022, SBC has increased significantly, which raises concerns about potential dilution and the alignment of management's interests with those of shareholders.

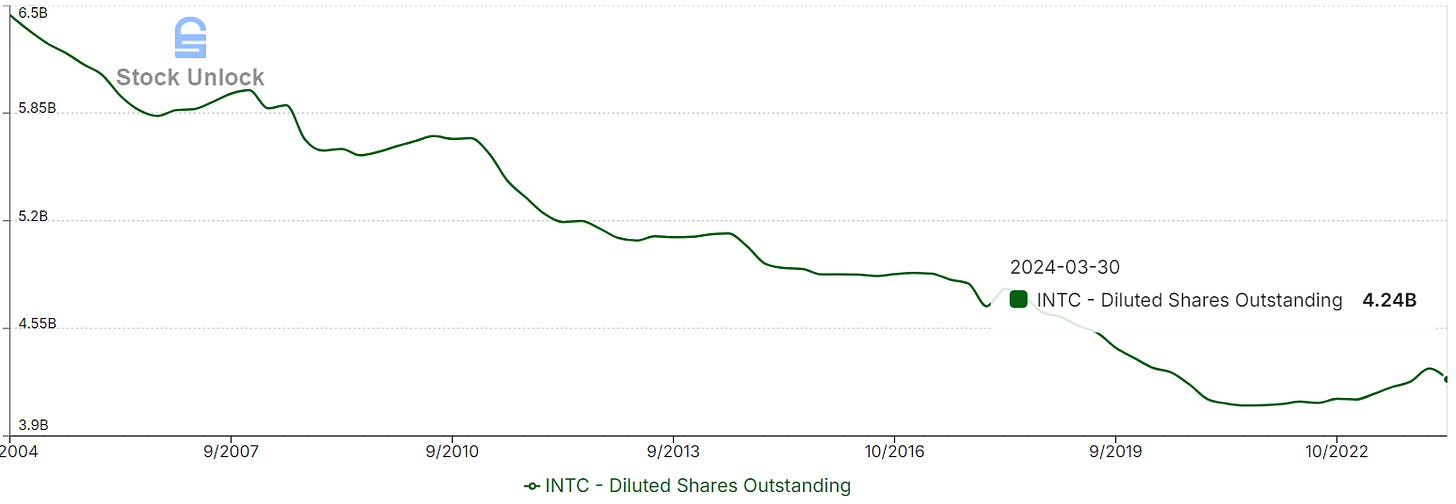

Over the long term, the story is different: the number of shares outstanding has declined significantly since the early 2000s. However, there has been an increase in share count since 2020.

I am somewhat disappointed that Intel continues to issue shares through SBC, as it dilutes current shareholders. However, the company does seem to buy back shares in amounts significantly greater than what is issued. Ideally, Intel would issue bonuses in cash rather than stock options, which would better protect shareholder interests.

Solvency

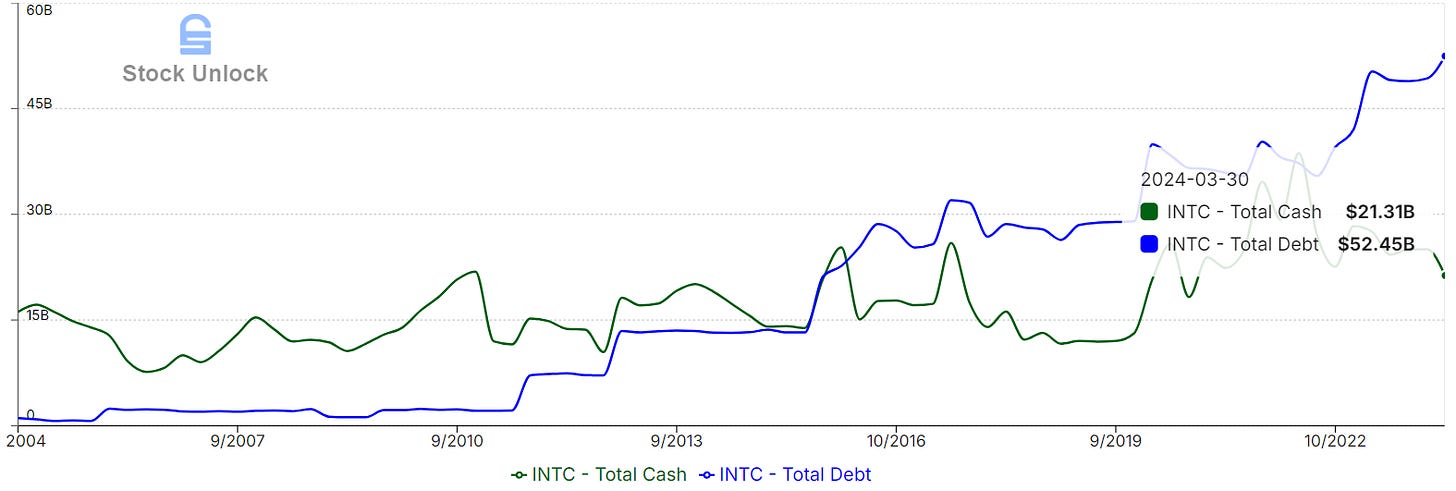

Intel currently maintains a strong balance sheet, though it appears to be deteriorating. Historically, the company held cash balances comparable to or greater than its total debt. Presently, Intel has approximately $52.5 billion in debt and a cash balance of around $21.5 billion. While the balance sheet remains robust, the growing gap between debt and cash is a concern.

Thoughts

Intel is in an interesting position, currently trading at a market cap of around $90 billion. This valuation is more intriguing when you realize Intel had peak free cash flow just under $22 billion and now has significant support from the U.S. government to bolster its competitiveness against Taiwan Semiconductor Manufacturing Company (TSMC). The company has also reintroduced Patrick Gelsinger, a former executive with a proven track record, to spearhead the turnaround. Gelsinger's initiatives, including major cost-cutting measures, are already showing promise.

However, Intel faces real challenges in catching up within a rapidly evolving industry. The other competitors are investing heavily in R&D just like Intel so catching up may be more complex than it appears. Despite these hurdles, the combination of government support, strategic leadership, and the ongoing PC replacement cycle provides a solid foundation for a potential recovery. While regaining its former dominance will be challenging, these factors suggest that a turnaround is within reach in my opinion.

Valuation

Based on my previous assumptions, projected revenues for Intel in 10 years are as follows:

Client Computing Group: $56.6 Billion

Foundries: $45 Billion

Others: $32.7 Billion

Total: $134.3 Billion

To estimate the free cash flow (FCF) margin, I considered Intel’s average FCF margin of approximately 20% (excluding recent years with negative margins) and Taiwan Semiconductor’s average of around 22%. I will use a conservative estimate of 21%, reflecting a shift toward TSMC's foundry margins.

Free Cash Flow: $28.2 Billion

Assuming a FCF multiple of 17x, the projected share price and market cap for Intel 10 years from now would be:

Share Price: $112.65

Market Cap: $479.4 Billion

If my assumptions hold true, Intel could deliver a return of just over 400% over the next 10 years. While the company faces significant challenges, its long-standing dominance and current positive tailwinds make it an intriguing investment opportunity.

Personally, I am closely watching Intel but am not investing at current levels. My decision is based on the fact that my existing investments offer similar or better returns and I have a higher level of confidence in predicting their future business performance.

If you enjoyed the article, consider becoming a paid subscriber! You can cancel anytime in the first MONTH and you will get my famous Punch a Puppy Guarantee! If you wouldn’t punch a puppy to keep getting my articles I will refund your subscription in full no questions asked so go check it out. There is absolutely zero risk and incredible content to take your investing game to the next level. Becoming a paid subscriber give you access to all articles I posted more than 3 weeks ago and in the future additional business analysis that I don’t send to free subscribers.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.

It always makes me laugh how the government is trying so hard for Intel to do well — giving them billions — but Intel just doesn’t want to succeed. Of course, there’s more to it, but it’s funny to think about. Great post Kyler!

It must take a lot to get you to invest. From the information you gathered, Im tempted to invest. Solid free cash flow, government assistance are good reasons to invest. It’s amazing that this company’s market share is a tenth of Berkshires. I’ll keep reading your articles Kyler. Ive never has urges to punch puppies and probably won’t considering im almost 50.