📈IHS Holdings ($IHS) | The Giant Hiding in Plain Sight

Detailed analysis of the largest cell tower operator in Africa. IHS Holdings $IHS

Hey All!👋

Welcome back to 📗Value Investing Blueprint📗

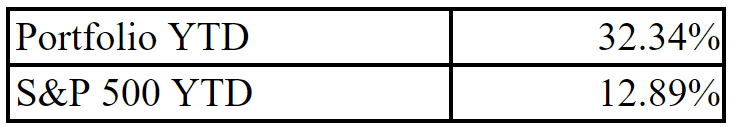

Investors often miss long-term gains by focusing on short-term noise. My strategy of targeting high-quality companies has led to market-beating returns this year, and it can help you do the same.

Check out some other articles!

📈Atkore ($ATKR) | A Construction Supply Company with Fantastic Capital Allocation

📈Intel | The Semiconductor Company Everyone Hates (Except the Government)

📈International General Insurance | A High-Quality Insurance Company

IHS Holdings is an often-overlooked company in Africa. I am going to analyze this giant hiding in plain sight and why it has great potential to make many people a whole lot of money.

Summary of Business

Before investing in any company, it's crucial to understand what they do and how their business economics might evolve in the future. If you can't confidently grasp this, then the company likely falls outside your circle of competence.

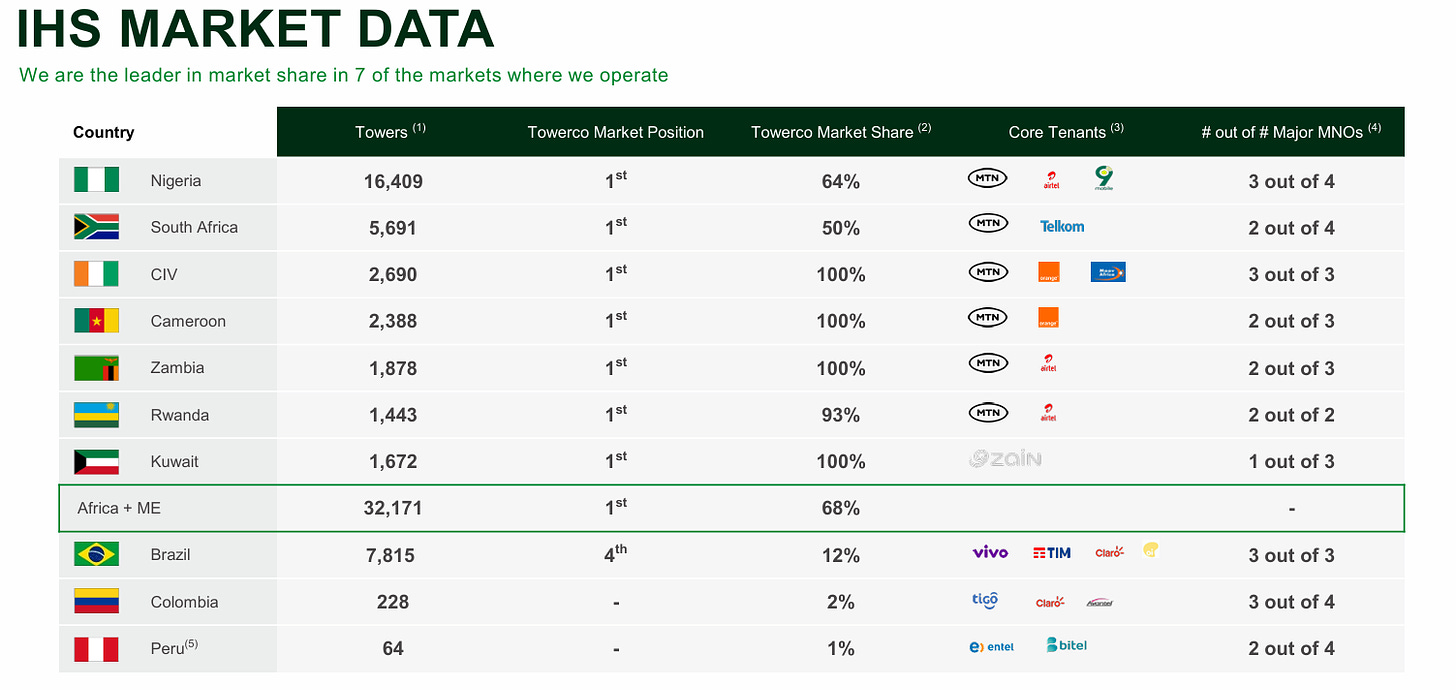

IHS provides mobile telecommunications infrastructure services. They own or operate approximately 40,000 towers across 11 markets, including Brazil, Cameroon, Colombia, Côte d’Ivoire, Egypt, Kuwait, Nigeria, Peru, Rwanda, South Africa and Zambia.

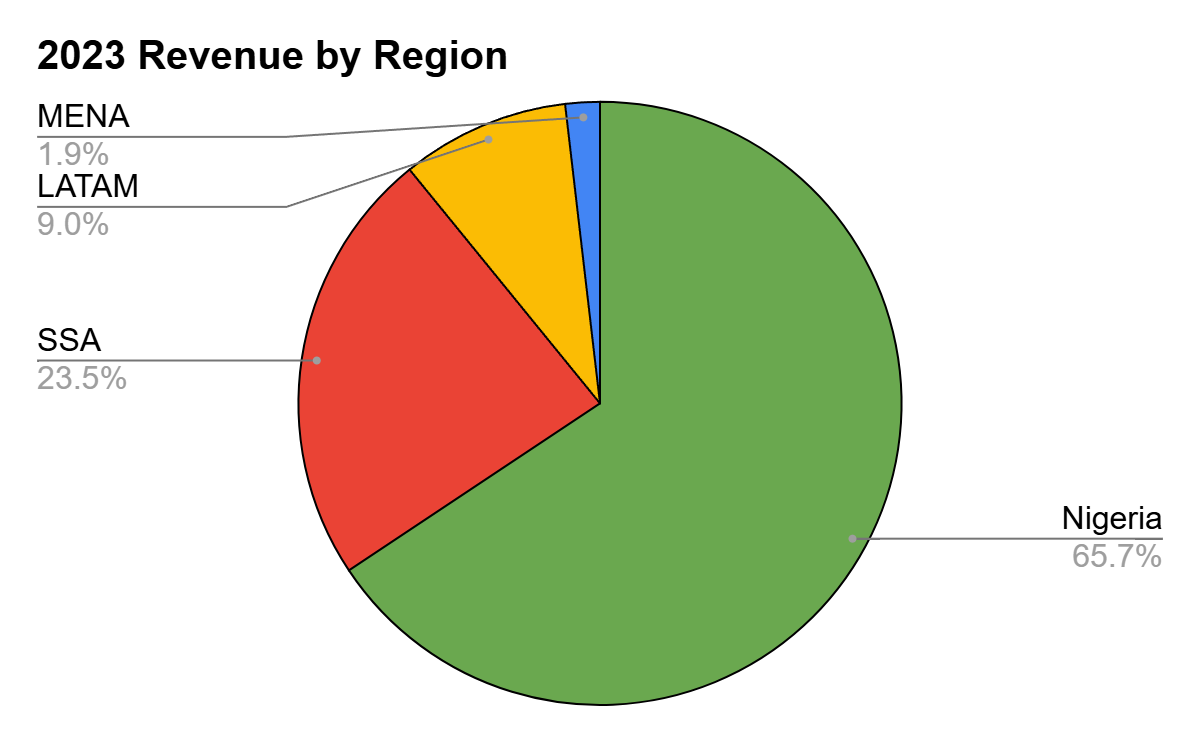

Four operating segments:

Nigeria

SSA, which comprises operations in Cameroon, Côte d’Ivoire, Rwanda, South Africa and Zambia

LATAM, which comprises operations in Brazil, Colombia and Peru

MENA, which comprises operations in Kuwait and Egypt. Although full operations in Egypt have not commenced, the business has incurred some startup costs.

IHS holdings has over 93% market share in 5 countries and is the #1 largest provider in 7. Between those 7 countries the total population comes to about 372 million people.

Industry Forecast

Once you understand what the company does, the next step is to gauge how the industry is likely to perform or evolve in the coming years. If the industry outlook isn't favorable or at least stable, it can be incredibly challenging for any company to thrive against that underlying current.

I am incredibly confident people will continue to use phones more and more in developing countries across the world. They will also want better and faster connectivity with more complete coverage, so I expect this industry to outperform GDP although not particularly stellar growth. Somewhere in the 4%-7% range.

Company Concerns or Issues

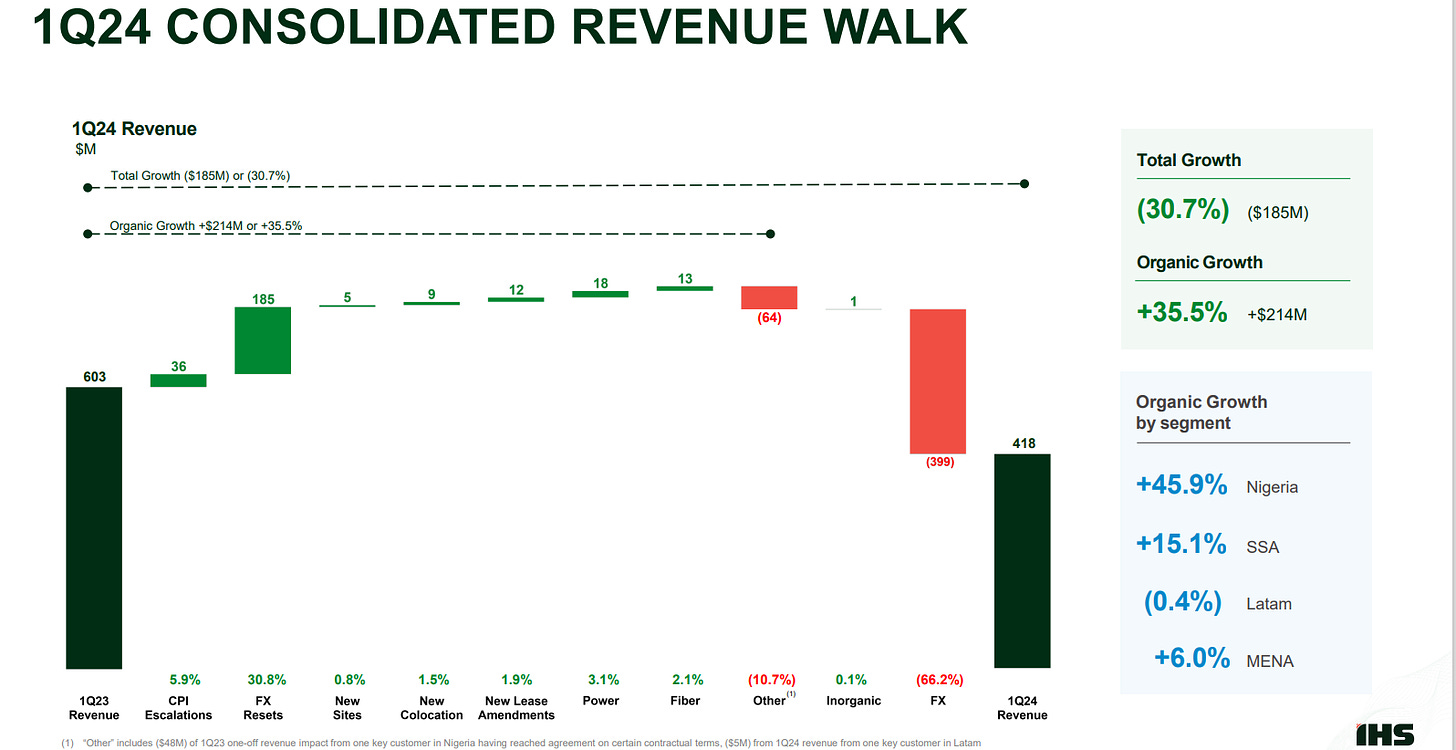

The main driver of the pessimism was a significant devaluation of the Naira which made up a large portion of the revenues for IHS. This devaluation has caused revenues to be down significantly in USD figures.

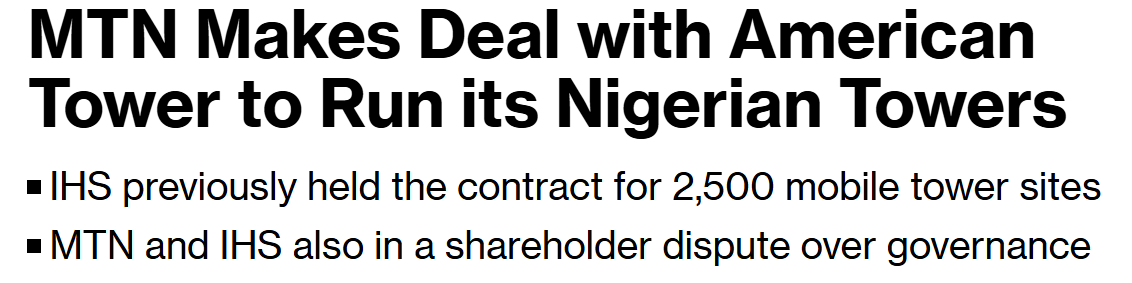

Another concern for IHS is that other companies will come in and take market share from them.

Address Potential Issues

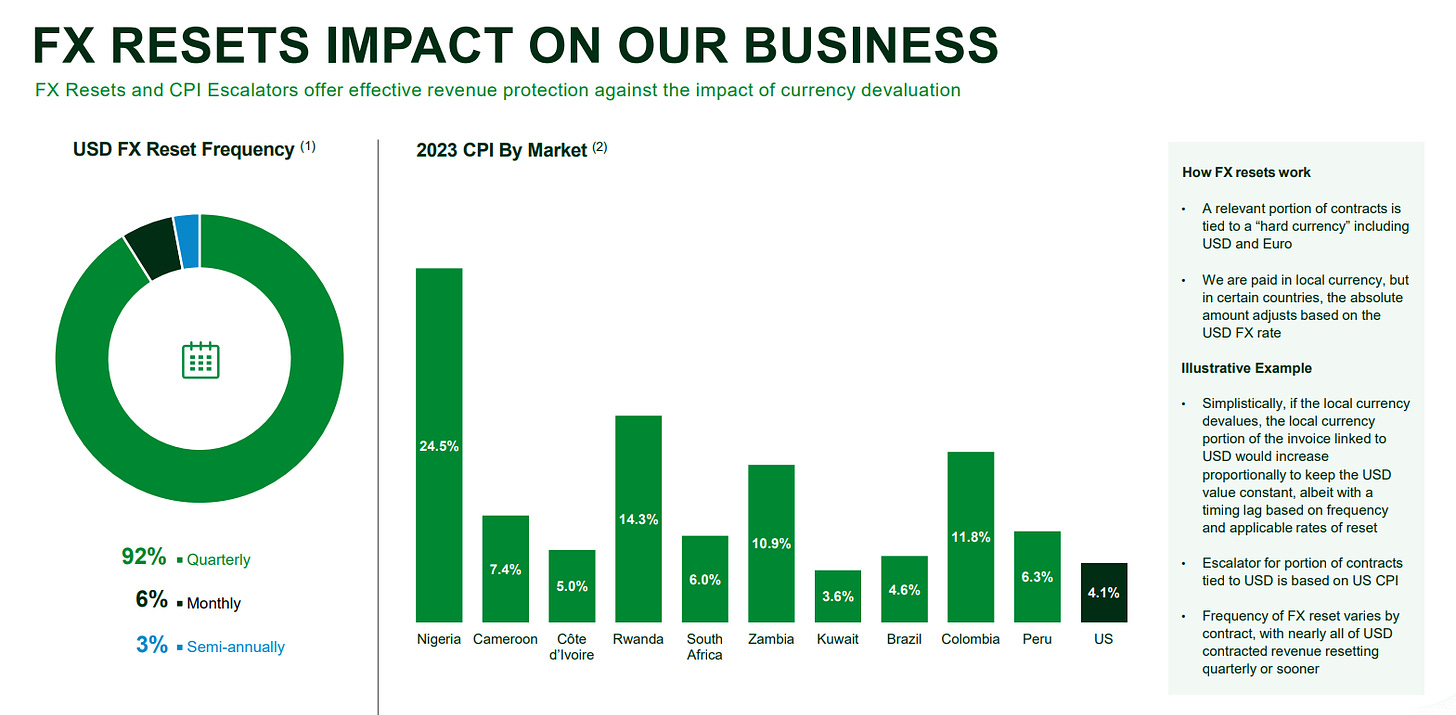

The issues around the Naira are difficult to address directly however IHS has about 97% of its contracts reset to market rates quarterly meaning all it will take is a stabilization of the currency for them to see a full rebound and a return to growth in USD earnings.

Regarding the potential issue of losing market share to other competitors when you dig under the surface you realize the largest shareholder of IHS is the same MTN cell provider that gave some business away. They own just over 25% of the company. So, they have a vested interest in IHS success.

It also seems to me the play for MTN to give American Tower Business was to show IHS they were serious about the requested changes they wanted and once IHS got that, they quickly acted to adjust their policies. Which seem to have gotten the approval of MTN back as they signed a decade long deal renewing contracts with over 30% of IHS’s total towers and adding almost 10% more total towers on 7/2/24.

Overall, these are real problems that could cause issues, but I think it is a very reasonable assumption that Nigeria over the coming years can stabilize their currency and IHS will continue to have phenomenal market share.

The CEO of IHS is constructive about their future as well.

“We are making great commercial progress, as highlighted by the renewals and extensions with both MTN and Airtel this year,” Darwish says.

“With MTN Rwanda MLA (master lease agreement) just signed, we have now completed all contract renewals and extensions with MTN outside Nigeria covering the five countries of Cameroon, Cote d’Ivoire, Zambia, Rwanda and South Africa – a total of over 12 200 tenancies renewed or extended into the next decade.

“The renewals with our largest client, in addition to the signing of a new 3 950 tenant multi-year rollout agreement with Airtel in Nigeria announced earlier this year, are a testament to the criticality of our digital infrastructure to the industry and reaffirms our leading position on the continent.”

Business Fundamentals

Revenue and Margins

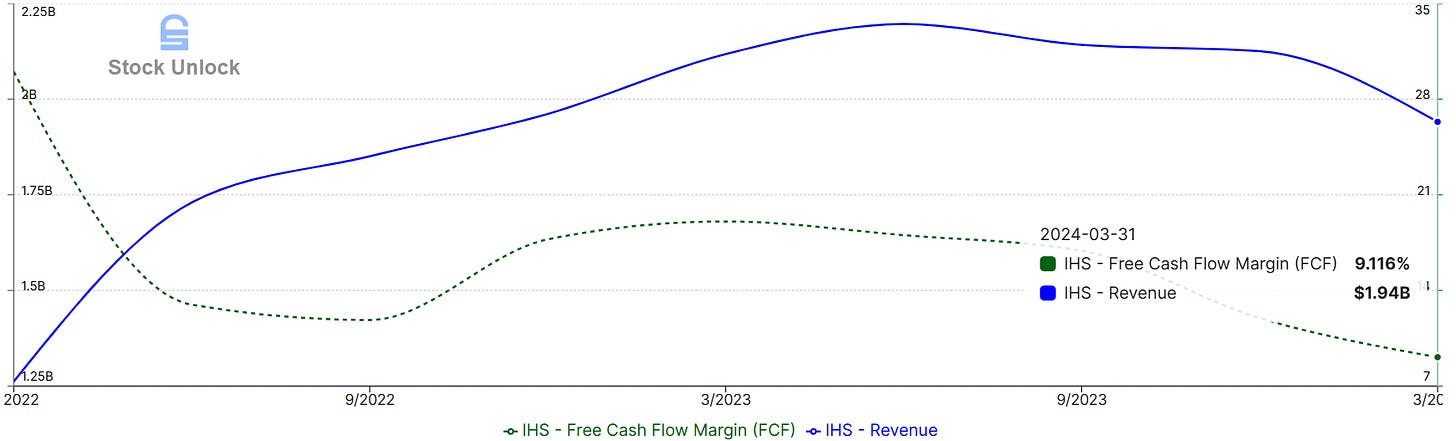

IHS has overall solid growth in their revenue with a 24% CAGR over the past couple years but recently both revenue and FCF margin have dipped which is evidence of the currency devaluation.

Solvency

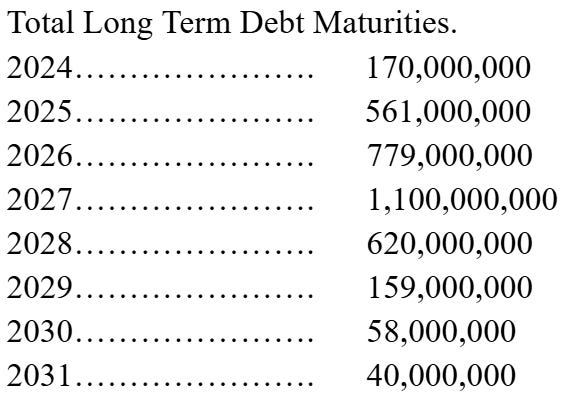

IHS currently has total available liquidity of $693 Million between cash and available loans to draw from. It is also important to note that the management is exploring the sale of non-core assets to raise $1 Billion over the next 12 months to invest where they see better returns and lower debt.

Debt could become a concern for IHS if the Naira continues to devalue by a large percentage in the short term but if they are able to raise the $1 billion as planned or the currency stabilizes somewhat, I suspect they will have no issues.

Management

IHS currently has a historical median ROIC of 11.43% while their competitors during that same time averaged ROIC of 7.26%. I think there are two reasons why IHS is outperforming in their ability to allocate capital.

They countries they operate in have more attractive growth opportunities than most.

Their management can identify those opportunities competently.

During earnings calls and in reports the management of this company has done a great job of clearly describing where the company stands and how the devaluation of the Naira is affecting them. They are also communicating well with shareholders like MTN but, it did take MTN giving away 2,500 towers of business to American Tower, so I suspect there is more work to be done. Overall, it seems the management in place is able to operate things effectively here though I would not describe them as outstanding.

Summary

Their revenue breakdown from their most recent Q1 earnings tells the story of the last couple years. 35% organic revenue growth which includes CPI escalations and FX resets to catch up to past devaluations but after you take into account the most recent Naira devaluation that switches to a 30% loss YoY. They have just been playing catch up.

Had the devaluation not happened and the revenue grew 35.5%, this would mean IHS would have generated about $305 million1 of free cash flow in a single quarter for an entire company with a market cap currently just under $1 billion. Keep in mind this company often has contracts with cell companies that are a decade long meaning they are incredibly stable which means the only ingredient missing here is that stabilization of the Naira.

Valuation

Fair Value:14x P/FCF, 0% Outstanding Stock Growth

2029 FCF: $1.1 Billion

2029 Share Price: $46.20

Full Value 17x P/FCF, 0% Outstanding Stock Growth

2029 FCF: $1.25 Billion

2029 Share Price: $63.90

From the current levels of about $3 per share the full value suggests a 2,000% return which comes out to a mind boggling 84% CAGR! This is by far the best expected return of any position in my portfolio and why I have been adding aggressively to it. It is not without its risks though and you have to make some important assumptions for this to happen.

Assumptions

IHS can maintain and grow good relationships with customers.

IHS will pay down debt.

The Naira stabilizes.

If you enjoyed the article, consider becoming a paid subscriber! You can cancel anytime in the first MONTH and you will get my famous Punch a Puppy Guarantee! If you wouldn’t punch a puppy to keep getting my articles I will refund your subscription in full no questions asked so go check it out. There is absolutely zero risk and incredible content to take your investing game to the next level.

Disclaimer

This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.

Assuming 25% of what would be FCF goes to taxes. (37.5% FCF Margin

Kyler. I saw $IHS ROE is negative. Like they are losing equity. Is that something to worry about?