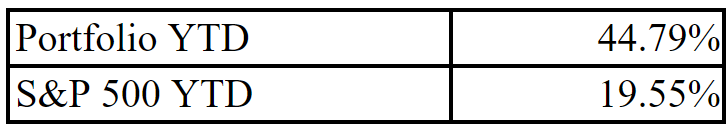

Globaltrans | 2.5x FCF, TTM ROIC of 46.8% but its Russian...

Globaltrans is a quality company trading at crazy low valuation but is it for a good reason?

Hello! 👋

I’m Kyler, and welcome to Busy Investor Stock Reports

Globaltrans is a standout opportunity, trading at just 2.5x FCF with an ROIC above 40%. Even better, it's in the stable rail logistics industry.

The only real issue…. it’s in Russia. (And it’s not currently listed but will be if shareholders give approval on the Sept 30th shareholders meeting.)

In this article I will breakdown Globaltrans as a company and potential investment.

If you like this type of content subscribe to get these posts right in your inbox.

Company: Globaltrans Investment PLC

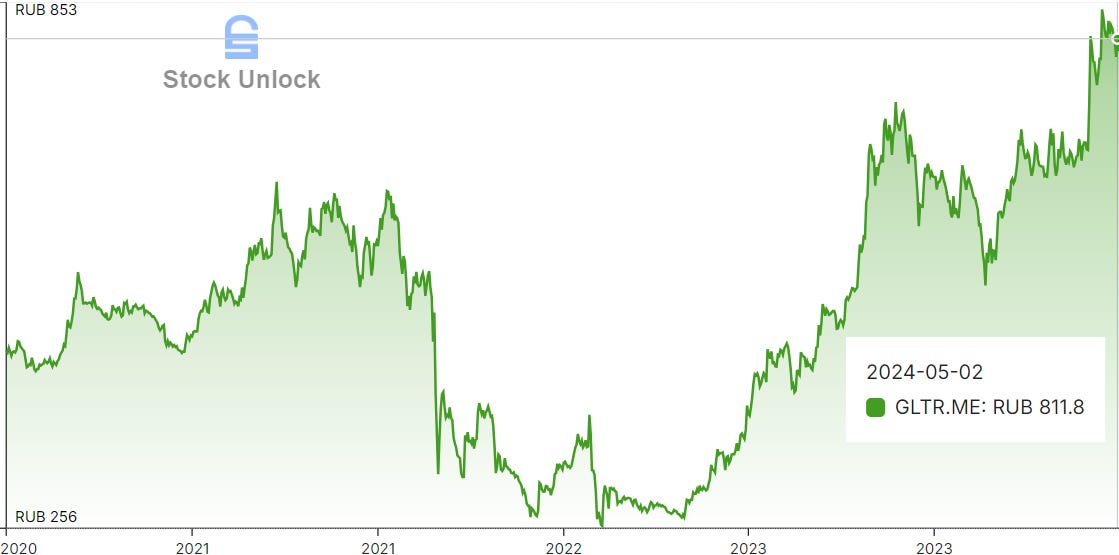

Ticker: GLTR.ME

Market Cap: $1.04 Billion (95.3 Billion RUB)

Industry: Logistics

Price to FCF: 2.5x

TTM ROIC: 46.8%

Summary of the Business

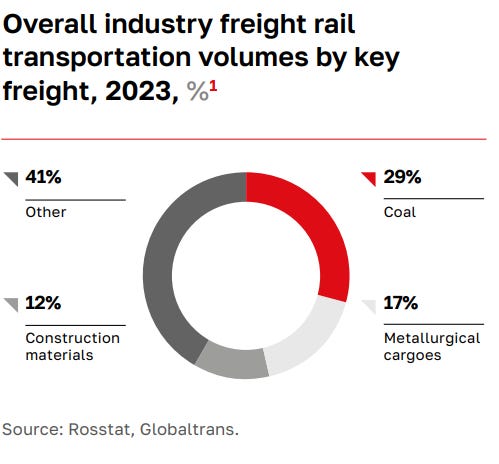

Globaltrans is a Russian rail logistics company with 6.4% market share. They own over 65,000 railcars to transport goods all over the country. Note they do not own the rail, just the railcars.

Industry Forecast

The Russian, rail industry operates differently than the US. The main difference is how the rail is operated and owned. In Russia all the rails are owned by Russian Railways which is controlled by the government. This setup means Russia has complete control over the industry, which it uses to set tariffs for the use of the rail system.

With that said, according to forecasts, the total volume of goods shipped will likely grow at a sluggish pace of around 2% per year. This is more than reasonable growth.

Not great, but fortunes can still be made in slow-growth industries.

Company Challenges

Before investing, it is important to not only understand the good but also the bad. These are the biggest challenges I see for Globaltrans.

Tariff Burden

Russian Railways has typically raised the tariff’s by about 10% per year. More recently though in 2022 they increased 18.6%, 2023 by 9%, 2024 by 10.75% and are expected to increase 5.2% in 2025.

This is an obvious, unavoidable expense for Globaltrans. It will rise each year and hurt profits.

Ruble Devaluation

Since 2008, RUB to USD has decreased from about 0.035 to 0.011. Or over a 70% loss in value compared to USD.

As a US investor, I care how their earnings translate into USD. Currency devaluation is another headwind.

Geopolitical Issues

I know it is hard to believe but the US and Russia don’t generally get along. Currently many brokerages don’t allow investment into stocks denominated in rubles at all. Which I believe was a key reason why they delisted from the exchanges they were on to seek other options.

Another scenario is more sanctions due to geopolitical tensions. That could cause their economy to weaken, consumer demand to fall, and in turn demand for freight to drop.

Addressing the Issues

The company's issues are real and tough. But, let's focus on their performance amid them and their potential future.

Tariff Burden

Despite the rising tariffs, their operating cash flow rose from 5.29 billion RUB in 2008 to 52 billion RUB in 2023 A growth rate of about 16.5%. When adjusted for Russian inflation of 7.18% over the last 15 years, real growth was 9.32% per year.

Impressive, given that industry volumes grew little since 2008. Only about 2%-3% per year. This shows the company is gaining market share. Its railcar fleet has grown 140% since 2008 to over 65,000 cars.

Ruble Devaluation

This issue is a little harder to solve. From a USD perspective, operating cash flow has grown from $180 million in 2008 to $572 million in 2023. A less impressive growth rate of about 8% or a real growth rate of about 5.38% when adjusted for inflation.

The key here is to understand USD has been a historically strong trend. I expect this trend to reverse as the US takes on more debt, lowers interest rates, and as other countries strengthen. This is important. If the USD weakens by 10% against the RUB, the company has 10% more profits, in USD, by doing nothing.

Overall I don’t expect the RUB to gain against USD. More so that they will weaken together so the impact will be far lower than in the past.

Geopolitical Issues

Russia has faced so many sanctions. I doubt the US can hurt its economy with more. So this is not a huge concern for me.

Moving to restrictions of US citizens investing in any Russia companies. This certainly makes it difficult. I am optimistic though. Either the AIX listing or future listings will help the company gain traction.

Financial Health

Margins

Globaltrans averaged a 29.1% FCF margin over the last 3 years vs comparable companies who average 22.37%.

This tells me that the companies' focus on high-margin shipments is working.

Returns On and Use of Capital

Globaltrans averaged ROIC of 35.1% over the last 3 years vs comparable companies which average 13.72%.

Total invested capital has remained flat for the last about 4 years. This is because they have paid down debt and kept a lot of cash. This offsets book value growth.

The company plans to start deploying their cash in the coming years, and their track record shows this often leads to significant profits.

Leverage

Globaltrans looks fantastic from this perspective with net debt of -24.3 billion RUB or -$267 million.

A good business should have a very modest amount of leverage employed as during a downturn high leverage can pose a great risk to a company going under or being forced to take on more debt and issue shares.

Leadership Impact

Shareholder Dynamics

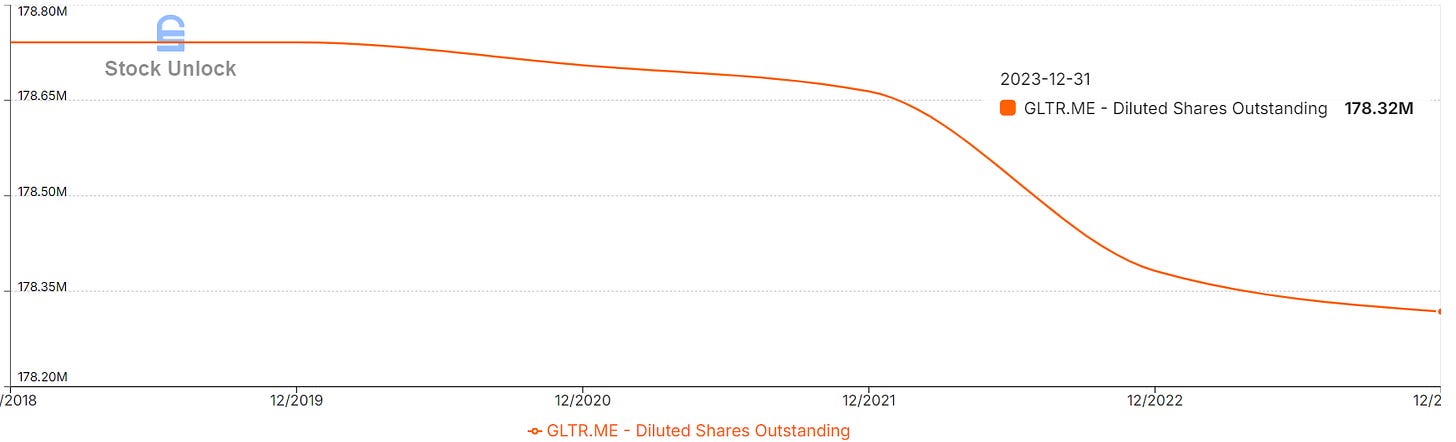

Total shares outstanding over the last 6 years has decreased just slightly by 0.25%.

Leadership Candor

Leadership at this company does good job laying out what they expect the future to look like. They give a lot of information in annual reports so you get a clear picture of how the market has evolved.

Valuation

Valuing Globaltrans is a bit more complex than usual, but let’s break down my assumptions. First, I’m assuming the RUB to USD exchange rate remains stable. This simplifies the analysis and seems likely given the USD’s recent weakening.

Next, I expect Globaltrans to continue gaining market share, with revenue growing at 8% annually. This would lead to the following projected revenue for 2033.

2033 Revenue: 209 billion RUB ($2.3 billion)

I’m assuming Globaltrans will achieve a free cash flow margin of 24% in 2033. I believe the current level is unsustainably high and as the company grows they will not have as high margin business to take on. This would get you the following FCF in 2033.

2033 FCF: 50.25 billion RUB ($552 million)

On this FCF what is an appropriate multiple? They currently trade at about 2.5X FCF. I believe fair value for the company sits at about 12x which is a 8.3% yield on your money. I believe that multiple takes into account risks while also accounting for the companies quality. This would mean the following share price and market cap in 2033.

Share Price: 4,632 RUB

Market Cap: 603 billion RUB ($6.63 Billion)

This implies a 530% upside from May 2024 levels or a 22.7% CAGR over the next 9 years. A very solid return for a long time frame.

Keep in mind what this assumes.

Russia’s Global Relations Improve

The Russian Economy Grows

RUB to USD Exchange Remains Flat

Globaltrans Take Market Share

Conclusion

Researching this company was fascinating, and I believe the risk-reward ratio at current prices is favorable. However, that doesn’t mean the risks aren’t real. There’s always a chance my assumptions won’t play out as expected, leading to lower returns.

That said, I’m confident the intrinsic value of the business will grow rapidly. The company’s fundamentals point to a strong economic moat, with high capital costs serving as a significant barrier to entry. Moreover, Globaltrans is well-managed, with excellent ROIC and strong margins.

While I think my growth assumptions are reasonable, other factors like improved relations and reduced currency weakness are much harder to predict. So be cautious and do your own work here to have confidence before you invest.

What do you think of the company?

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

Check out some of my other articles!

I like your post! Yes, Globaltrans is way too cheap. But as a western investor it's almost impossible to buy the shares at the MOEX. Maybe soon at the Astana International Exchange (AIX) in Kazakhstan. Do you own the GDRs?

I linked to your post my weekly Monday emerging markets links roundup: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-september-30-2024

Intriguing stock but I was confused about the listing/ticker/trading status e.g.:

GLTR.IL: https://finance.yahoo.com/quote/GLTR.IL/

GLTVF: https://finance.yahoo.com/quote/GLTVF/ / https://www.google.com/finance/quote/GLTVF:OTCMKTS

Globaltrans Invt 144A: https://www.google.com/finance/quote/38KH:LON