Costco ($COST) | Deals Are Cheap, The Stock Isn’t

This is a full analysis of the highest quality wholesale chain out there, Costco. Is it a buy at these levels?

Costco is an incredibly business with over a 92% membership renewal rate in the US and Canada—now that’s customer loyalty! They operate with unmatched efficiency and still have growth prospects around the world. Unfortunately they’re priced for perfection and then some, with a forward P/E of 53. So, let’s explore what Costco is really worth and if they make a good investment. My thesis for the company over the next 10 years1 is simple:

Modest Growth

Continued High-Quality Operations

Inside the Business: Company & Industry Dynamics

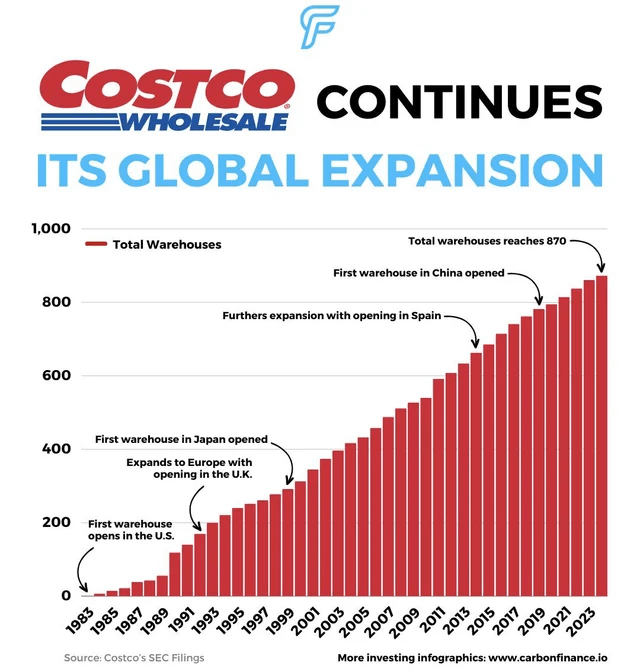

Most of you are likely familiar with Costco, the wholesale grocery store that’s become a household name. Since its founding in 1983, Costco has grown at a pace that far outstrips the rest of the wholesale grocery market. A key reason for this success lies in their innovative approach: turning the warehouses where most chains store goods into their actual retail locations. This model not only allows Costco to operate more efficiently but also enables them to pass those savings on to customers, fostering fierce loyalty.

With 861 warehouses worldwide as of 2023, Costco's strategy has clearly paid off. If they remain committed to offering the best deals possible, I’m confident they’ll continue to capture more market share.

Drivers of Growth

Costco has several advantages over its competitors, but I’ll focus on the two biggest drivers for their continued growth.

Store Count Growth

Same-Store Sales Growth

Let’s start with store count growth. Over the last nine years, Costco has been on a steady expansion spree, adding an average of 22 stores per year. In 2023, each new store raked in an impressive $150 million in sales during its first year. According to their latest earnings call, they plan to open 25-30 more warehouses annually for the foreseeable future. I’ll assume the lower end of that range—25 new warehouses per year—since market saturation will eventually slow their pace.

Now, to give you a sense of scale, adding 25 new stores would bring in an extra $3.75 billion in revenue based on 2023’s numbers. And here’s the kicker: first-year sales are likely to grow by around 6% per year, so the value of new stores will grow each year.

Next, let’s dive into same-store sales growth. Historically, stores that have been open for at least a year have seen revenue growth of about 6% annually. This isn’t just a lucky streak; Costco offers something special that keeps customers coming back for more. And those loyal customers? They’re practically walking billboards for the brand, spreading the word wherever they go.

So, let’s break down the expected revenue growth:

25 new stores each year generating $150 million in their first year, with those first-year sales growing 6% annually.

Same-store sales growing by 6% per year after the first year.

Membership revenue expected to grow slightly faster than store sales, at 7%.

Taking all of this into account, we’re looking at a projected revenue for Costco in 2033 of $498 billion.

Continued High Quality Operation

When it comes to quality, whether qualitative or quantitative, Costco stands out as one of the highest-quality operations in the industry. Let’s dive into two key comparisons:

ROIC vs. Competitors

Customer Ratings vs. Competitors

Over the past 10 years, Costco has maintained a median ROIC of 26%, with the only competitor ahead of them being BJ’s Wholesale at 27.7%. However, in the last five years, Costco has come out ahead, with a median ROIC of 36.1% compared to the next highest from BJ’s at 30.8%.

Costco’s ability to deploy capital with increasingly higher returns is a hallmark of its operational excellence. This efficiency means that, over time, Costco can achieve the same level of growth with less capital—an ideal scenario, provided growth opportunities remain.

Now, let’s look at the qualitative side: How do Costco’s customers feel about their experience? We can gauge this by comparing Net Promoter Scores (NPS), a metric that measures customer loyalty by asking how likely they are to recommend the company or its products. Customers are categorized as promoters (9 or 10) or detractors (0–6) based on their responses. A score above 70 is considered excellent, while a score of 0 or above indicates more promoters than detractors.

Costco currently boasts an NPS of 79—an outstanding number that reflects how much customers love their experience. For comparison, Target scores a 39, BJ’s a -25, Walmart a 32, and Sam’s Club a 53. Costco clearly leads in this category, underscoring the loyalty of its customer base. This strong loyalty suggests significant growth potential, as the larger Costco gets, the more natural advertisers it gains through its members.

Strategic Edge & Valuation Insights

It should be clear by now that I like this company. Costco operates as the low-cost supplier in the ultimate commodity industry. They continue to increase returns on the capital they deploy and still have solid expansion prospects. Plus, their shoppers absolutely love them. This gives Costco significant leverage over suppliers, securing better deals because brands know the incredible distribution they’re getting. All this to say, Costco certainly has an economic moat—a large one at that.

Now, let’s get to the question you’ve been waiting for: What is Costco worth?

Starting with my estimated 2033 revenue of $498 billion, I’ll then estimate their FCF margin. Over the last 10 years, Costco’s median FCF margin was 2.2%, and over the last three years, it’s been 2.7%. Through automation and general optimization, Costco will gradually increase this margin—but not dramatically. Their best value proposition is low prices, so they’ll keep pressuring their margins to offer the best deals. On this basis, I’ll assume a 3.4% FCF margin, leading to the following 2033 FCF:

2033 FCF: $16.93 billion

Assuming a 24x FCF multiple on that amount—significantly above the market average of 16x-17x due to Costco’s high quality—you’d arrive at the following valuation in 2033:

Share Price: $916.52

Market Cap: $406.32 billion

Now, here’s where it gets interesting. Costco currently has a market cap of $389 billion. Based on my assumptions, even if Costco doubles its revenue over the next 10 years to half a trillion dollars, you’d see essentially NO GAINS—around 4.4% total. Not great. This is why you need to pay attention to both the price and quality of a company. You can pay too much for a good thing, and Costco is a perfect example in my opinion.

That said, I’m keeping a close eye on Costco. At its current levels, it would need to drop by more than 50% before I’d even think about jumping in. To be clear, I’m not predicting a drop; more likely, the stock might trade sideways for a while. With a current FCF yield of just 1.9%, it’ll take time for the fundamentals to align with the high price. I’ve set an alert at $350 a share, but I honestly don’t expect it to hit that mark. For now, I’m comfortable passing on Costco. What about you?

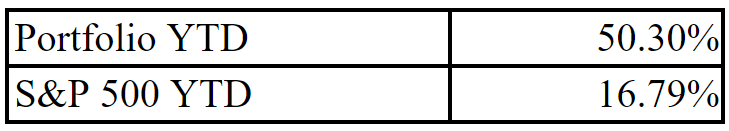

Don’t let short-term noise distract you from long-term gains. My focus on high-quality companies has delivered market-beating returns this year—and it can do the same for you. Subscribe now for insights straight to your inbox. Thanks for your support!

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

Check out some of my other articles!

Starting from the end of the last full year 2023.