Boeing ($BA) | The Company that can't be Killed

This is an analysis of Boeing, the company with one of the best MOATS in the world.

Welcome back to Busy Investor Stock Reports

Investors often miss long-term gains by focusing on short-term noise. My strategy of targeting high-quality companies has led to market-beating returns this year, and it can help you do the same. So hit that subscribe button to get the content right in your inbox, your support is appreciated!

Check out some of my other articles!

📈Warner Brothers Discovery ($WBD) | Too cheap to ignore?

📈Atkore ($ATKR) | A Construction Supply Company with Fantastic Capital Allocation

📈Alibaba ($BABA) | The Obvious Multi-Bagger No One Wants to Touch

Got any companies you would like me to look into? Leave a comment below!

Company: Boeing

Ticker: BA 0.00%↑

Website: https://www.boeing.com/

Current Stock Price: $168.50

52-Week High: $267.54

52-Week Low: $159.70

Market Cap: $103.82 Billion

Competitors: Airbus

Understanding the Company

Boeing is a global leader in manufacturing commercial jetliners and defense systems, operating through three key segments: Commercial Airplanes (BCA), Defense, Space & Security (BDS), and Global Services (BGS).

BCA: Develops, produces, and markets commercial jet aircraft.

BDS: Focuses on research, development, and production of manned and unmanned military aircraft, weapons systems, and surveillance technologies.

BGS: Delivers services to both commercial and defense customers worldwide.

Boeing's most significant strength is its formidable moat—it's one of only two companies globally in this space, with extreme barriers to entry for any new competitor.

Understanding the Industry

Forecasting this industry is relatively straightforward. The two main players have enough commercial plane orders to keep them busy for the next decade, and other revenue streams are likely to see modest growth. Profitability will be largely dependent on the delivery of these planes efficiently and in high quantities.

BCA: The commercial airplane industry won't experience steady growth but rather a ramp back to normal levels, which I'll discuss in more detail during my valuation.

BDS: U.S. military spending, projected to grow at around 3.5% annually, serves as a solid benchmark for the entire industry’s growth.

BGS: Over the past eight years, Boeing's services segment has grown at approximately 4.5% per year, a reliable indicator of industry-wide growth.

Financial Fundamentals

Margins

Boeing’s historical median free cash flow (FCF) margin is 6.86%, compared to Airbus’s at 4.22%. While this might seem like a small difference, it means Boeing is 50% more profitable.

Returns

Boeing’s historical median return on invested capital (ROIC) is 32.9%, significantly higher than Airbus’s 15%. This shows Boeing generates 50% more profit with half the capital.

Leverage

Boeing currently holds about $16 billion in cash against $52.3 billion in long-term debt. With peak FCF just under $14 billion, returning to those levels would make this a manageable debt load.

Management’s Integrity

Shares Outstanding

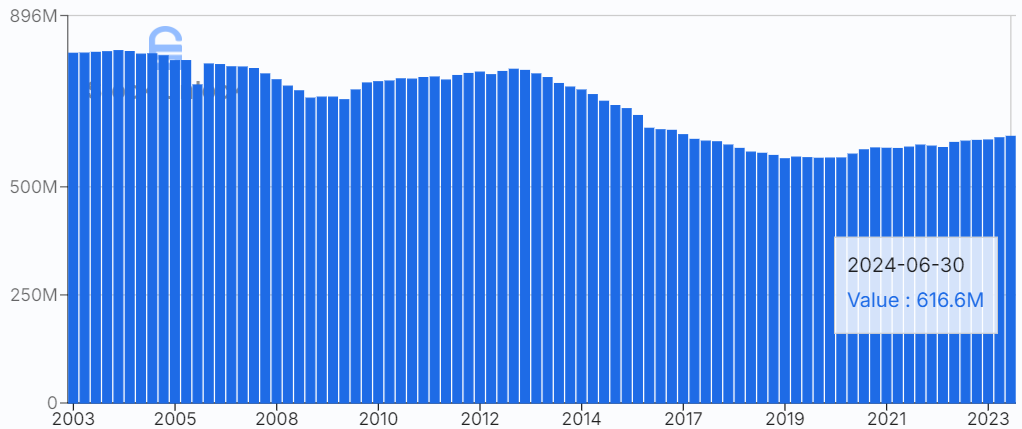

Boeing has effectively reduced its share count over time, averaging a 1.4% decrease annually.

Incentives

Management is currently in transition, but past compensation plans have been poorly handled. Despite ongoing major issues, executive pay continued to rise. This will need to be addressed in the future.

Performance

Past management's missteps—shrinking margins, declining plane quality, and rising executive pay—are classic examples of how to damage a company. Fortunately for us, Boeing is essentially unkillable.

Company Concerns or Issues

Terrible Leadership

Current management is steering the company poorly, resulting in a series of negative product headlines. This bad press is well-deserved, as the planes being delivered continue to fall short of quality standards.

The problems began with two tragic crashes at the end of 2018 and the start of 2019, claiming over 300 lives. Since then, revenue and margins have significantly dropped, as management has struggled to improve plane quality while maintaining delivery speed.

Declining Profitability

Profitability has taken a severe hit as a result of the poor management. Boeing's FCF margin peaked at 13.9% in 2018, but in 2019, 2020, and 2021, it turned negative—an unsustainable situation for any company.

Addressing the Concerns or Issues

Terrible Leadership

Their current CEO is stepping down this year, with Robert Ortberg set to take over. Ortberg is a multi-decade aerospace veteran, an engineer, and an outsider to Boeing. I believe this change will be positive for the company, as he can bring a fresh perspective, improve company culture, and focus on delivering higher-quality planes—both crucial for regaining market confidence.

In the big picture, Boeing operates in a duopoly with Airbus and would almost certainly be bailed out by the government if necessary. The company is so essential to numerous organizations and the U.S. government that its survival is virtually guaranteed.

It's also important to note that Airbus, Boeing’s only competitor capable of taking business from them, is already producing planes as fast as it can and has a backlog of over 8,600 orders. According to Jonathan Berger, managing director at Alton Aviation Consultancy, Airbus’s ability to capitalize on Boeing’s troubles is “very limited.”

Declining Profitability

Since experiencing three years of negative FCF, Boeing saw positive FCF in 2022 and 2023, marking a significant turnaround. Although recent quarters have turned negative again due to ongoing quality issues, I expect a return to positive cash flow as total deliveries increase.

However, this recovery may face challenges with Boeing's acquisition of Spirit AeroSystems. Integrating Spirit into their supply chain will likely cause short-term friction but, if managed effectively, should enhance profitability in the long run through greater vertical integration.

My Thoughts

Boeing might seem complex at first glance, but the analysis is straightforward due to their formidable moat. As one of only two major global providers of commercial planes, Boeing has a backlog of over 6,250 planes. Given their record annual delivery of around 800 planes, this backlog represents at least eight years of revenue, even without new orders—which I am confident they will continue to secure.

The company is already in the early stages of a turnaround. While it will take time, I am very optimistic that a full recovery will occur.

Valuation

I’ve previously outlined the expected revenue growth for the military and services segments and will apply those growth rates to Boeing for the next five years. This suggests 2029 revenue projections as follows:

BDS Revenue: $30.65 billion

BGS Revenue: $24.9 billion

Regarding commercial aircraft deliveries, Boeing reached a peak in 2018 with $60.7 billion in revenue from this segment, averaging about $75 million per plane. In 2023, they generated $33.9 billion from aircraft deliveries, averaging $64.2 million per plane.

As new management works to turn the business around, I project Boeing will deliver 750 planes at $70 million each by 2029. This would result in:

2029 Aircraft Deliveries Revenue: $52.5 billion

Total Revenue: $108 billion

Assuming improved margins due to increased deliveries, better cost management from engineering improvements, and reduced manufacturing friction from the integration of Spirit AeroSystems, I estimate a 12% FCF margin. This would yield:

2029 Free Cash Flow: $12.96 billion

With Boeing's substantial moat, a 20x FCF multiple seems reasonable, leading to:

Share Price: $420.70

Market Cap: $259.2 billion

This share price implies a 130% return, or an 18% CAGR. For a company of Boeing’s quality, this represents a phenomenal return with almost 100% certainty.

Assumptions

The key assumptions for this scenario include:

Management improves operating efficiency.

The industry remains a duopoly.

It’s crucial to conduct your own research. Relying solely on headlines may leave you anxious and prone to selling at the wrong times.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.