📈Warner Brothers Discovery ($WBD) | Too cheap to ignore?

This article is a full analysis of the messy media conglomerate as a business and potential for investment.

Welcome back to Busy Investor Stock Reports

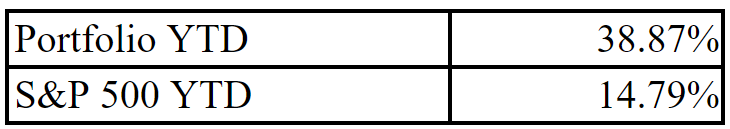

Investors often miss long-term gains by focusing on short-term noise. My strategy of targeting high-quality companies has led to market-beating returns this year, and it can help you do the same. So hit that subscribe button to get the content right in your inbox, your support is appreciated!

Check out some of my other articles!

📈IHS Holdings ($IHS) | The Giant Hiding in Plain Sight

📈Atkore ($ATKR) | A Construction Supply Company with Fantastic Capital Allocation

📈International General Insurance ($IGIC) | A High-Quality Insurance Company

Company: Warner Brothers Discovery

Ticker: $WBD

Website: https://ir.wbd.com/investor-relations/default.aspx

Current Stock Price: $7.05

52-Week High: $13.81

52-Week Low: $6.64

Market Cap: $17.31 Billion

Competitors: Netflix, Disney, and Paramount

Here is a quick outline of what I will cover today.

Start with an overview of the company and its industry to see if it’s within my circle of competence and identify any potential industry tailwinds.

Analyze the financial fundamentals and management's performance to gauge the company’s quality within its industry.

Address any current or potential issues, distinguishing between permanent impairments and short-term challenges.

Calculate the valuation and outline key assumptions to determine if the stock is attractively priced and has the potential for the projected return.

Understanding the Company

Before investing in any company, it's crucial to understand what they do and how their business economics might evolve in the future. If you can't confidently grasp this, then the company likely falls outside your circle of competence.

Warner Brothers Discovery is an interesting case with a mix of strengths and challenges. The concerns surrounding their situation have pushed the stock down over 70% from its 2022 peak.

As a major media conglomerate, Warner Brothers Discovery owns some iconic brands in entertainment, including Warner Bros. Pictures Group, Warner Bros. Television Group, DC, HBO, HBO Max, Discovery Channel, discovery+, and CNN.

They break the company into the following segments which I note what percentage of 2023 revenue each segment makes up.

Studios (28%): The production and release of feature films along with related consumer products, themed experience licensing, and interactive gaming.

Networks (49%): Primarily consists of our domestic and international television networks.

DTC (23%): Consists of our premium pay-TV and streaming services.

Understanding the Industry

Once you understand what the company does, the next step is to gauge how the industry is likely to perform or evolve in the coming years. If the industry outlook isn't favorable or at least stable, it can be incredibly challenging for any company to thrive against that underlying current.

Warner Brothers Discovery operates in a rapidly evolving industry, with streaming taking center stage. To understand their potential, it’s crucial to break down each segment individually.

Studios: Growth in this segment is likely to be modest. While many people now wait for movies to hit streaming platforms, theaters aren’t going anywhere. The cinematic experience still holds a unique appeal, as recent blockbusters like Deadpool and Wolverine and Inside Out 2 have shown. If you create something people want, they will show up. I’m estimating around 3% annual growth over the next five years.

Networks: This segment is almost certainly in decline. Traditional television is a slowly dying business, and I’m confident in forecasting a 2% annual decline over the next five years. There’s a chance it could do better, but I’m sticking with a conservative estimate.

DTC (Direct-to-Consumer): This segment looks much more promising. The average of five forecasts points to strong growth just above 20%. To stay conservative, though, I’m estimating 12% annual growth.

Financial Fundamentals

Margins

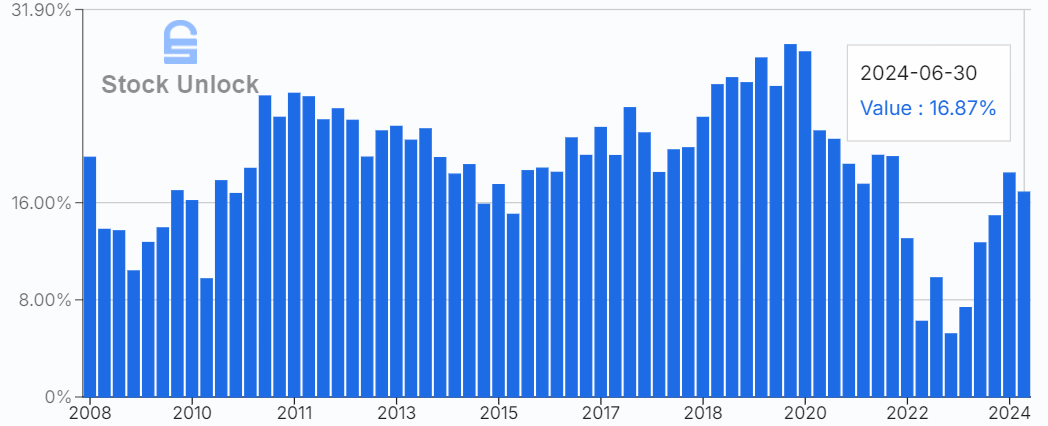

Over the past 15 years, Warner Brothers has maintained a median free cash flow (FCF) margin of 20%, significantly higher their competitors median of 3.4%. However, it’s important to note that in recent years, Netflix has become substantially more profitable, surpassing Warner Brothers. Disney also seems poised for a turnaround.

Returns

Warner Brothers has posted a median return on invested capital (ROIC) of 11.2% over the last 15 years, slightly below the industry median of 11.4%. On the return on equity (ROE) side, Warner Brothers’ median stands at 11.7%, compared to an industry average of 13.5%. It’s worth mentioning that these competitor averages are weighed down by Paramount, which has historically struggled with effective capital deployment.

Leverage

Warner Brothers has a quick ratio of 0.55, with about $3.6 billion in cash, $6.2 billion in receivables, and $17.8 billion in current liabilities. In the trailing twelve months (TTM), they generated approximately $6.75 billion in FCF. This tight situation suggests that covering their liabilities in the coming year will be challenging with what they have on hand and what they’re likely to generate.

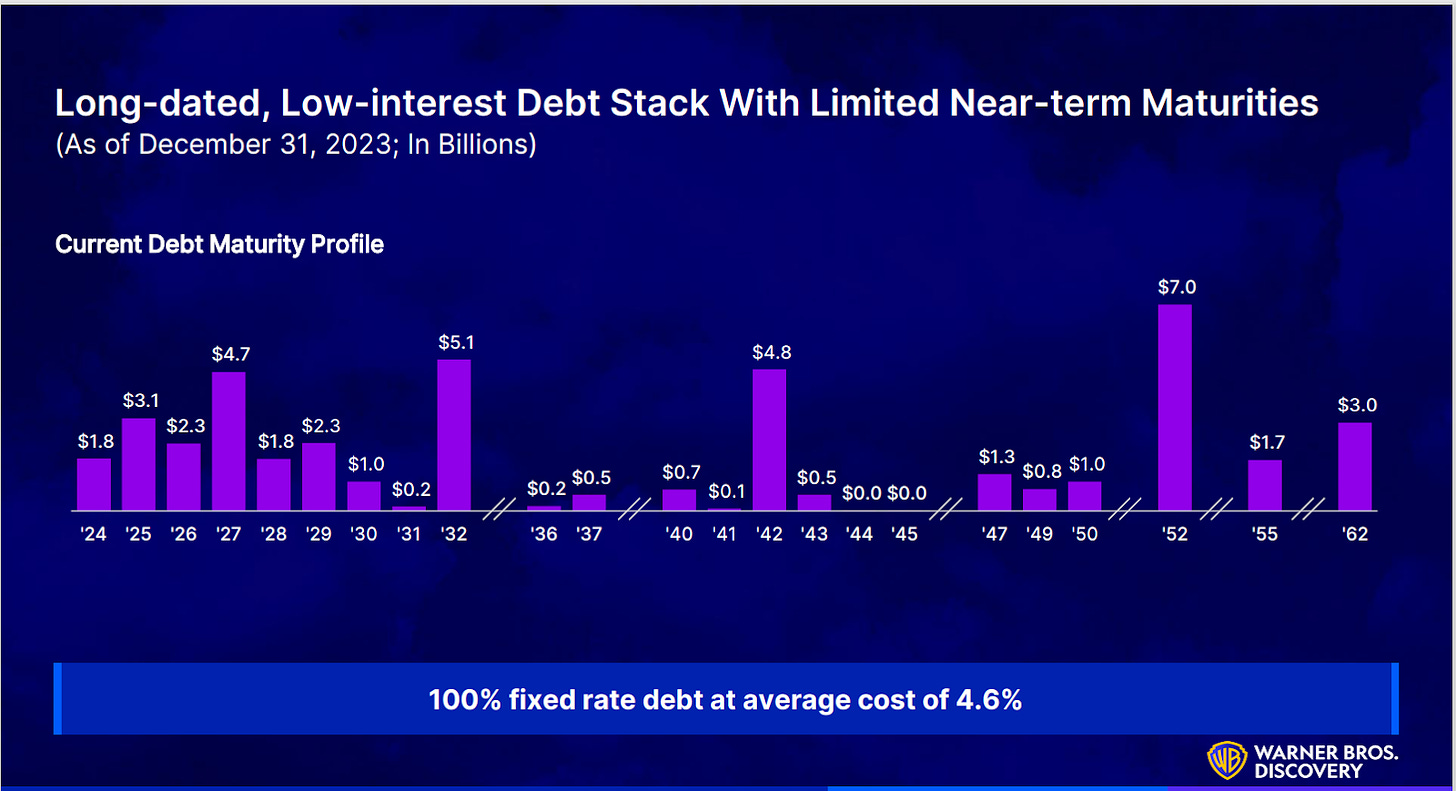

Long-term, Warner Brothers has $41 billion in debt, with maturities extending until 2062. This results in a debt-to-FCF ratio of about 6.1, meaning they would need roughly six years of FCF to pay off all their debt based on current figures.

Management’s Integrity

Shares Outstanding

Evaluating management's effectiveness in handling share issuance is a bit tricky here due to the 2022 merger with Warner Media, which resulted in a significant increase in the share count. Since then, the share count has risen by about 1% over the past year and a half.

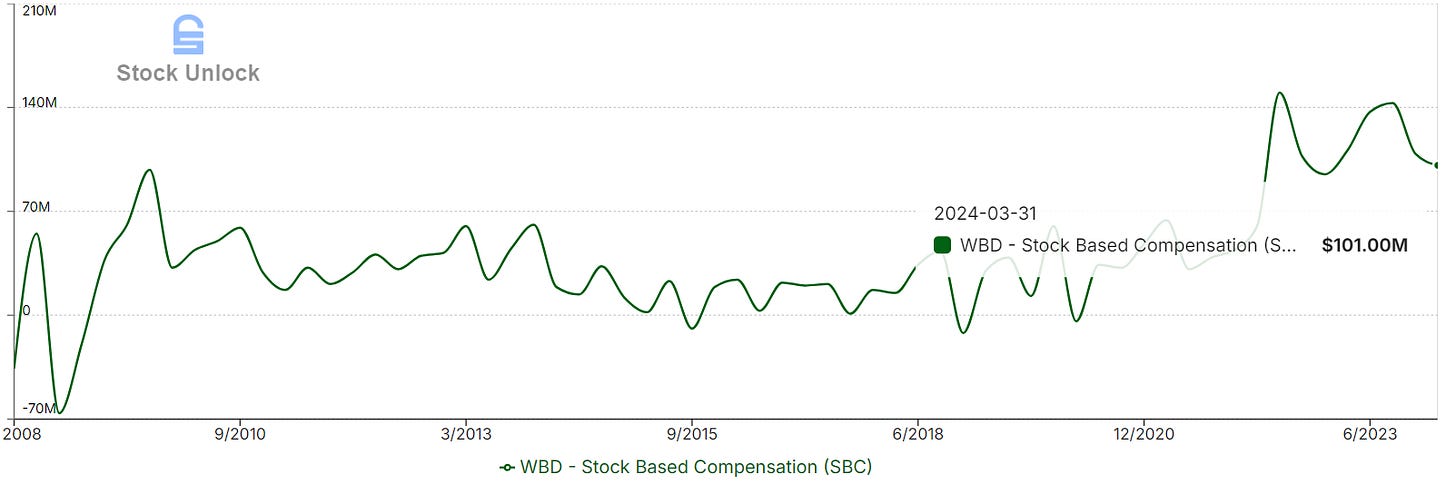

Recently, the company has been issuing more stock as compensation, at a rate of over $100 million per quarter. If left unchecked, this could increase the share count by around 2.5% per year. However, they are also buying back some shares simultaneously, which helps to offset this dilution. While not an ideal situation, it appears manageable for now and I hope that this trend will decrease in the future.

Incentives

At Warner Brothers Discovery, management’s compensation is tied to cash flow—a focus I believe is ideal for the company. This emphasis has led to a significant increase in David Zaslav’s compensation, but given the company’s needs, I see this as a positive development. As Charlie Munger’s saying goes, “you show me the incentive, and I will show you the outcome.”

Performance

Under David Zaslav’s leadership, Warner Brothers has maintained a constant focus on cost-cutting and efficiency—crucial elements for building a strong, long-term company. Could this approach continue under different leadership? I believe it could, though David seems particularly adept at running a high cash-flow media company ruthlessly cutting ventures he sees as unprofitable.

Candor

From what I’ve observed, management tends to paint a more optimistic picture than reality, which isn’t ideal. This means I’ll need to take their statements with a grain of salt, often leaning toward more conservative estimates.

Company Concerns or Issues

Debt

As mentioned earlier, Warner Brothers is operating within very tight margins to pay back their debt without issuing shares or depleting their cash reserves. If the company encounters difficulties in generating cash flow, they may be forced to issue more shares or seek refinancing at potentially higher rates.

NBA Contract Drama

Warner Brothers had a long-term contract to broadcast a portion of NBA games, set to expire in 2025. However, during the bidding process for the next deal, Warner was not selected to continue broadcasting the games. While the exact revenue from this deal is unclear, it likely contributed at least some meaningful amount to the company.

Adding to the complexity, Warner Brothers is now suing the NBA for not selecting their bid, alleging that the league breached its contract by declining their offer and signing with Amazon instead.

Growing Max

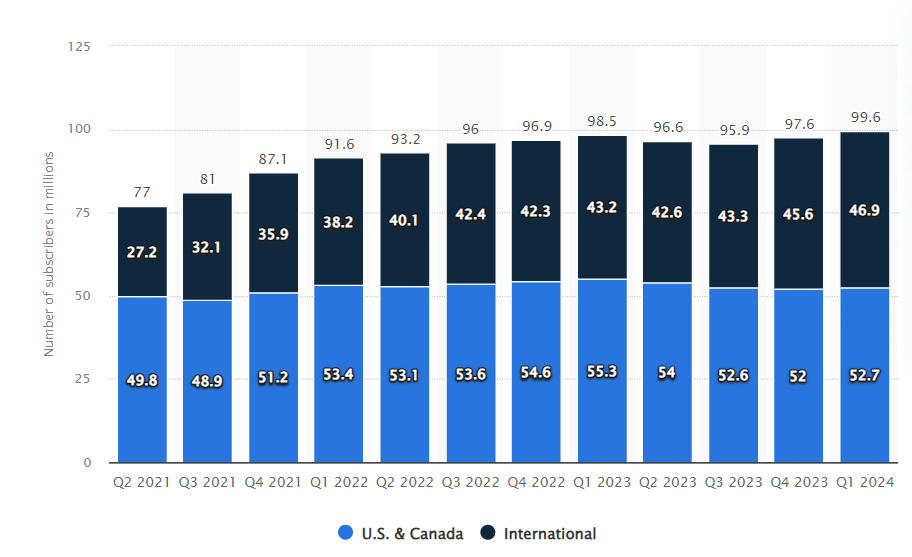

The most recent earnings call underscores a key issue: Max has struggled with user growth in the U.S., while maintaining strength internationally. From Q2 2023 to Q2 2024, U.S. subscribers decreased from 54 million to 52.4 million. The success of their streaming service is crucial for the company's growth. If Max fails to meet expectations, Warner Brothers could face serious challenges in generating cash, especially with tough competition from Netflix and Disney.

Addressing the Concerns or Issues

Debt

Debt is undeniably a concern for Warner Brothers. However, refinancing might be a viable option, especially with interest rates potentially decreasing over the next couple of quarters. The main risk would arise if the company struggles to generate sufficient cash flow and is forced into issuing shares or taking on higher than necessary interest rate loans.

This concern isn't unfounded and resurfaced in full force in their latest earnings. In that most recent quarter, Warner Brothers generated about $1 billion in free cash flow (FCF), down from $1.7 billion in the same quarter of 2023. This decline is partly due to the favorable impact of last year’s writer strikes, which reduced employee compensation and boosted margins.

As the year progresses, we’ll see how things unfold. In my view, the company has the right CEO and incentives in place to navigate these challenges effectively.

NBA Contract Drama

In my opinion, this issue is both less critical than headlines suggest and difficult to fully quantify in terms of revenue impact. Given the uncertainty, I'll leave it as is since there’s no way to precisely predict the extent of the potential declines.

Growing Max

The critical issue for Warner Brothers is the future of their streaming service, MAX. The company faces significant challenges in growing MAX profitably in the U.S., but their international performance has been exceptional. In the last quarter alone, international subscribers surged from 46.9 million to 50.8 million, offsetting the decline in U.S. subscribers.

This subscriber growth is expected to continue as MAX expands into new countries outside the U.S. Alongside this expansion, increasing the average revenue per user (ARPU) will be crucial for sustained success.

They have done well at increasing ARPU, and I expect this positive trend to continue in the short term. However, I have concerns about their long-term growth based on the metrics discussed.

Warner Brothers faces intense competition from Netflix and Disney, both of which offer better capital returns, greater brand recognition, and are likely to catch up in FCF margins. While WBD could still establish itself as a strong contender in the streaming space, they have significant work ahead to prove they deserve a top spot at the table.

My Thoughts

Warner Brothers is a fascinating company, and you might wonder why I’m focusing on a company facing challenges against giants like Disney and Netflix. The answer lies in how incredibly cheap the company is right now.

With a market cap of $16.5 billion and $6.16 billion in free cash flow (FCF) generated in 2023, WBD is trading at just 2.7 times last year’s FCF. This valuation suggests the company is exceptionally undervalued, especially if it can grow its FCF over the long term.

However, this bargain price comes with significant risks. The issues with debt and the NBA are not necessarily the main threats; rather, the real challenge lies in Warner Brothers' ability to execute and secure a strong position in the streaming industry through MAX.

Despite these concerns, the company has outperformed expectations in cash generation, which suggests they may perform better than anticipated in the future, thanks to their strong leadership and incentives.

Nevertheless, it’s important to note that Warner Brothers faces serious concerns that cast doubt on its future. The lack of a competitive moat and potential absence of a clear competitive advantage are significant hurdles. However, if they manage to overcome these challenges, the potential rewards could be substantial, which is why it’s worth paying attention to.

Valuation

Based on my industry growth assumptions, here’s the projected performance for Warner Brothers over the next five years:

Studios: I’m assuming a 2% annual growth rate.

Networks: I’m assuming a 5% annual decline.

DTC (Direct-to-Consumer): I’m assuming an 8% annual growth rate.

With these assumptions, 2029 revenue is projected to reach:

Revenue: $44.82 billion

For free cash flow (FCF), I’ll estimate a slightly better-than-median historical margin of 21%. This increase reflects anticipated cost reductions and the completion of MAX’s rollout to new countries, which incurs some additional costs. Based on this margin, 2029 FCF would be:

Free Cash Flow: $9.41 billion

A reasonable multiple for this FCF would be 10x, implying a 10% FCF yield on your investment. With this multiple and assuming no additional share growth, the projected share price and market cap would be:

Share Price: $38.38

Market Cap: $94.1 billion

This suggests a potential return of about 470% over the next five years, or approximately a 36.5% compound annual growth rate (CAGR). While this represents a significant potential return, it’s crucial to evaluate how certain you are of achieving it.

Assumptions

To achieve the projected outcomes, several key assumptions must hold true:

Warner Brothers must attract and retain subscribers to their MAX platform.

They need to continue paying down debt without issuing shares or refinancing at significantly higher rates.

The company must continue to release profitable films.

They need to achieve growth while maintaining strong free cash flow (FCF) margins.

I have more uncertainty about their future than I would prefer, which is why I sold my small position a few months ago to invest in more stable opportunities. Conduct your own research. Warner Brothers is a complex situation, and having the confidence to withstand negative press and potentially volatile stock prices will be crucial.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.