Big Drops and Big Opportunities | QXO, ATKR, DG, SSL

An update on one of my current holdings, three stocks I am researching, and how I find new ideas. QXO, Atkore, Dollar General, and Sasol

One stock I own. Three stocks I’m researching. One key investing question. Every week (starting now!), I break down my portfolio, explore new ideas, and answer what’s on your mind. Let’s dive in!

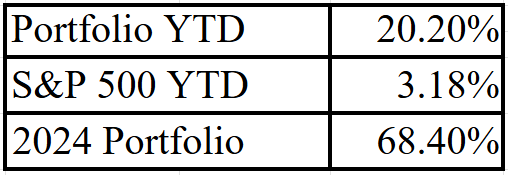

Portfolio Spotlight

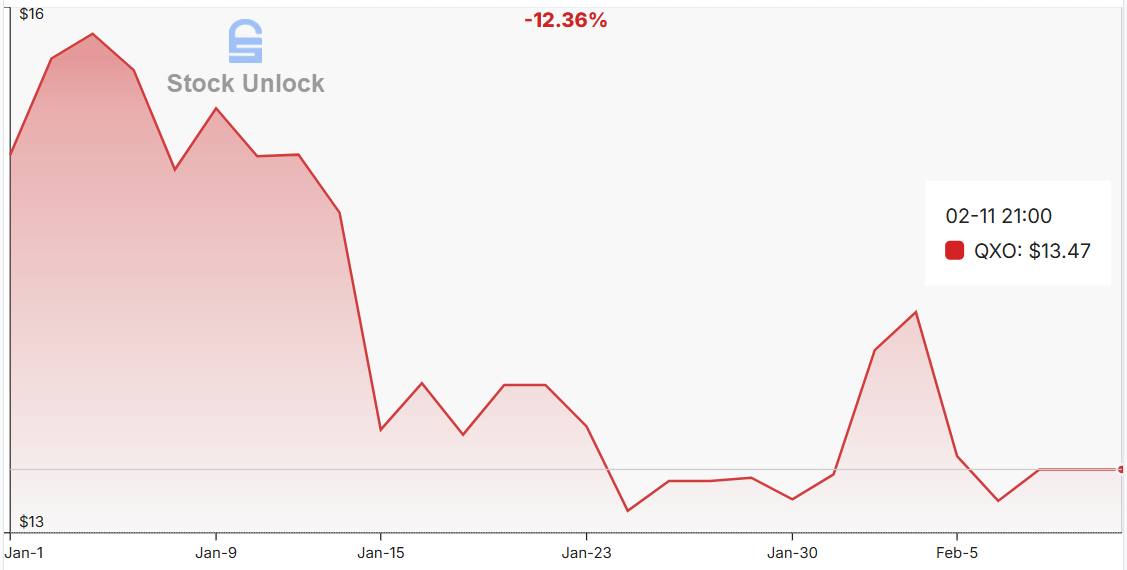

QXO (Write Up Here)

There is a lot of news around QXO and their bid for Beacon Roofing so lets cut through the noise.

First lets address what QXO’s mission is as a company.

QXO's Mission

Goal: Become a tech-forward leader in the $800 billion building products distribution industry.

Growth Plan: Focus on acquisitions and organic growth to reach tens of billions in annual revenue.

These are great goals but the kicker is who runs the company to get them there.

Brad Jacobs

Role: Founder, Chairman, and CEO of QXO, Inc.

Track Record: Built multiple billion-dollar companies, including:

XPO Logistics: Transportation and logistics leader.

GXO Logistics and RXO: Spin-offs from XPO.

United Rentals: World’s largest equipment rental company.

United Waste Systems: Sold for $2.5 billion in 1997.

Expertise: Completed ~500 M&A transactions, known as a "roll-up artist" for consolidating industries.

So with all that laid out what has been happening with QXO over the past few months?

Proposed Acquisition of Beacon Roofing

Target:

Beacon Roofing Supply – A major distributor of roofing materials and building products.

Initial Offer (Nov 2024):

Valuation: $6.2 billion

Response: Rejected by Beacon as "undervalued."

Hostile Takeover Attempt (Jan 2025):

Offer: $124.25 per share (~$11 billion)

Strategy: Directly approached Beacon’s shareholders.

Beacon’s Resistance Tactics:

Delayed Financial Projections: Pushed 2028 forecasts to March 2025, hindering QXO’s ability to justify its bid.

Restrictive Negotiation Terms: Imposed strict preconditions, including a long-term standstill agreement to block direct shareholder engagement.

Seeking Alternatives: Explored rival bids from strategic buyers and private equity firms.

QXO’s Countermoves:

Accused Beacon of Stalling: Argued the delays and conditions were meant to frustrate negotiations.

Appealed to Shareholders: Highlighted the 37% premium and lack of financing or regulatory hurdles.

Board Takeover Threat: Warned it may nominate directors to Beacon’s Board if the bid remains blocked.

Current Status & Outlook:

Beacon continues to resist.

QXO remains committed and could escalate with a proxy fight or higher bid.

Potential counteroffers from Lowe’s or other buyers add uncertainty.

This is a messy situation and not the normal tactic that Brad Jacobs takes. Normally acquisitions he makes are with the full cooperation of the current management and board. While the situation is not ideal there is a reason why I still hold the position.

At the most basic level I hold this position because I believe Brad Jacobs can recreate the success he has had before. His track record speaks for itself and as of now I don’t have any reason to doubt things will be different. It really is that simple.

On My Radar

Atkore- (Write up Here)

I covered this company in 2024 and since then things have not been pretty. In their recent earnings call they lowered estimates and called for headwinds to continue longer than originally thought. This led to another 20% drop. Now down a total of 63% since their all time high made less than a year ago.

Why is this company interesting?

The first thing that caught my eye is their significant drop from all time highs in such a short time. The markets often overshoot on both the up and downside creating opportunities for investors who are willing to do the work to find them.

The other reason I like them is from a fundamental operating perspective. They have an impressive average return on capital employed (ROCE) of 27.8% and return on invested capital (ROIC) of 28.3% since 2016.

And finally they trade at just 2.8x their peak TTM FCF which was made in the past couple years. Since I know they are a high quality leader in a growing industry they will get back to that level again. The question is when.

What is my research now focused on if I covered them once before?

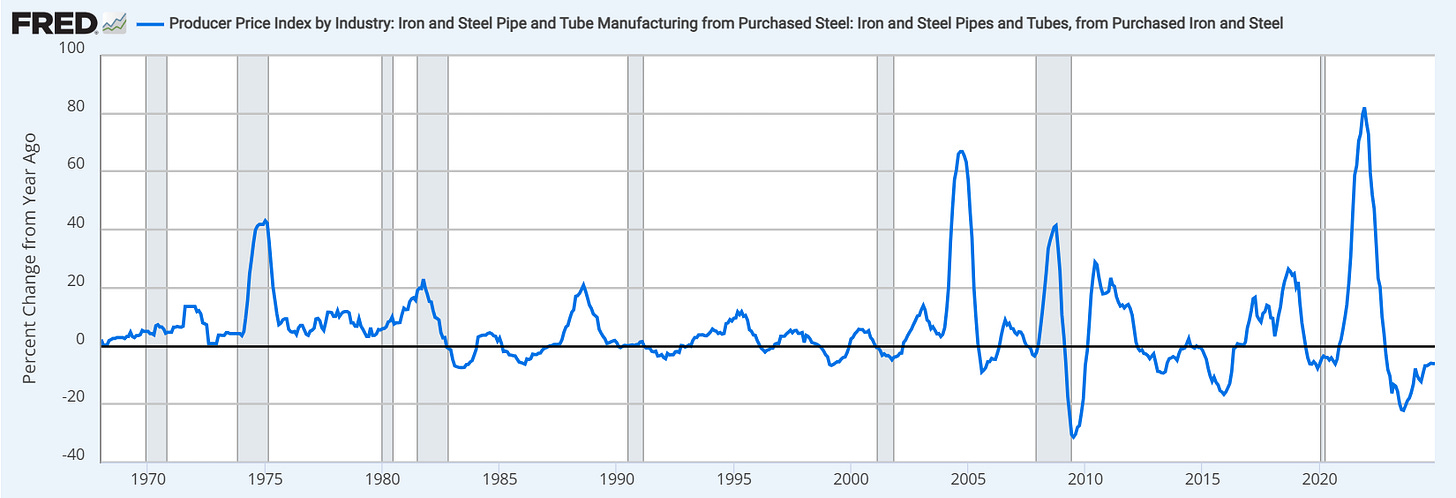

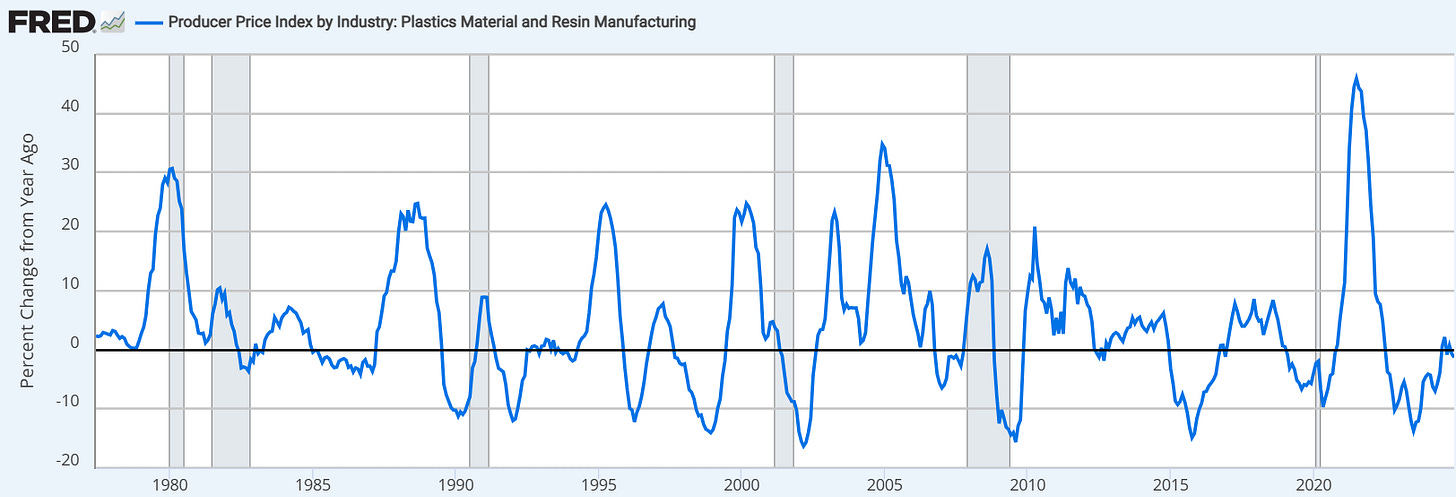

The biggest reason behind their decline is the average selling price of their products which has been declining for 7 straight quarters. Largely due to decelerating growth and increased competition from imported goods.1

PVC from Columbia, Dominican Republic, and China. Along with steel pipe from Canada and Mexico have been imported in larger quantities than before. By the law of basic supply and demand this pushes prices down.

So my focus has been in researching the fundamental turnaround in prices of these two materials so far. Do they have normal cyclical patterns? How will tariffs affect them? Etc.2

So far it does seem for steel conduit specifically they have already seen the steepest of the YoY declines in prices and could be following similar cyclical patterns seen in 2008 and 2016.3

When I look at PVC through resin prices it looks like the cycle has also already seen its worst with prices basically flat year over year but turning back down. Historically after prices feel to a 10% or more YoY decline they turn back positive aggressively. A good sign for PVC prices and Atkore.4

The one piece I feel most confident in is the increase in infrastructure spend. The mag 7 are spending hundreds of billions on data centers, cloud infrastructure, and AI. All of these require massive amounts of pipe, cable trays, and other things Atkore makes.

Likely the growth from last year will not be huge but there will still be some growth and Atkore will certainly benefit. All of this is shaping up to create a very compelling case for Atkore right now while it is beat down.

Dollar General

Just like Atkore, Dollar General has really been beaten down. Currently they are down almost 72% since their all time highs in 2022.

Why is this company interesting?

You might be seeing a theme here I often look for companies down significantly from all time highs. That was what first caught my eye and to cement that their average ROCE is 22.2% and ROIC 17.3% since 1990. Though more recently their returns have been declining some. To be expected though when you face competition from all sides.

From a valuation perspective they company generated $2.8B in FCF during 2021 and since then their revenue is up more than 15%. They currently trade at 5.8x that 2021 FCF high. Another situation where if they turn things around it is severely undervalued.

What am I researching?

My goal with Dollar General is to understand why they will bounce back. Why won’t their competition out compete them? Why won’t it be a long slog of low returns going forward as the norm?

This one I have a lot more research to do and this won’t be my only focus but for now is the only important thing to focus on. Retail is hard, and harder when you compete on the basis of low prices so I really need to understand why the business will turn around.

These are the current steps they are working on according to management.

Inventory Management: Dollar General plans to reduce their product range by 1,000 items and cut overall inventory by 5.5% per store.

Supply Chain Improvements: They're aiming for "on time and in full" deliveries, and closing 12 temporary warehouses to streamline operations.

Theft Prevention: The company is reducing self-checkout kiosks in 12,000 stores (about 60% of all locations) to help prevent theft.

Store Efficiency: While specific plans aren't detailed, they're focusing on making day-to-day store operations run more smoothly.

Employee Investment: Dollar General made a significant investment in store labor in 2023 to improve execution in key areas.

Sasol

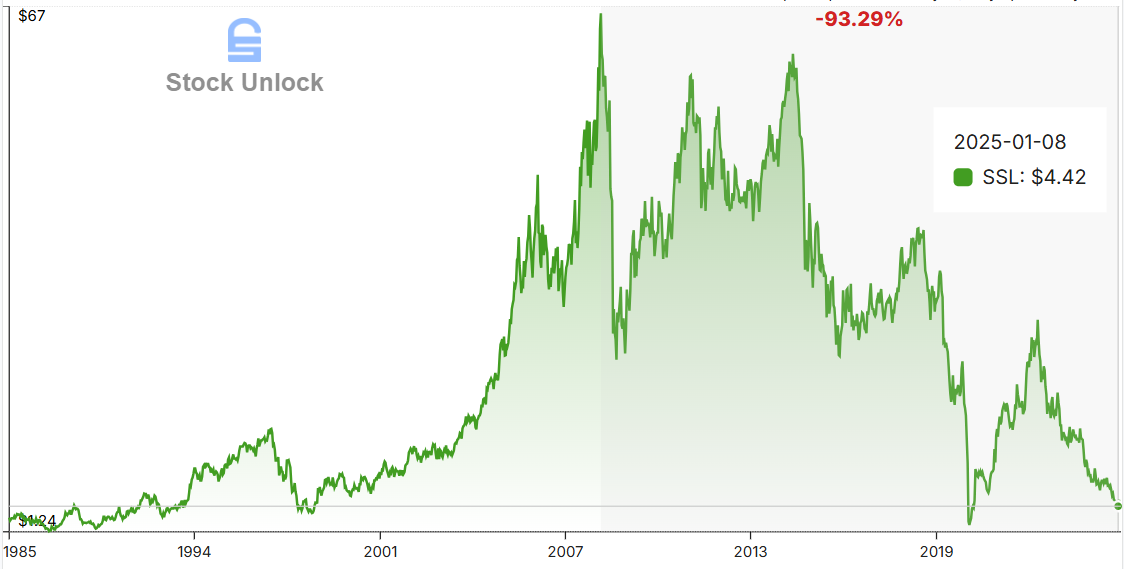

Now this company is in a far more complex situation than the others but I felt is still worth some work being down 93% from all time highs.

Why is this company interesting?

Staying very on brand I found this company when going through those down big from highs. Based on their price chart you would probably never guess that since 2001. After converting to USD based on exchange rates during that given year. Their revenues are up from about $4B to now $15B. Yet their stock price is actually down during that time.

You might also think they are earning poor returns on capital but you would be wrong. Since 2001 they averaged an 18.7% ROCE and a 14% ROIC. They also haven’t diluted shareholders either with share count up just 1% in over 20 years.

Looking at their valuation they trade at just 0.32x sales and 2.8x their peak FCF made in the past few years. Their FCF generation is volatile and often negative but just like any cyclical company if you can catch them at a trough huge returns can be made.

On a lot of fronts this company is very interesting.

What am I researching?

Sasol is a complex company operating in coal mining, natural gas, oil, gas stations, and chemical industries in South Africa. Just by nature of their complex operations in a foreign country I need to get a clear understanding of how their future will evolve and where the growth is.

I also need to determine if they have any solvency issues. On their balance sheet they have ZAR 131.1B in long term debt and ZAR 48.9B in cash on their balance sheet. This tells me their ability to pay down debt is going to rely on their cash flows which is currently in a downtrend and just turned negative. Not a great sign so I will need to find out if there is a catalyst for a turnaround.

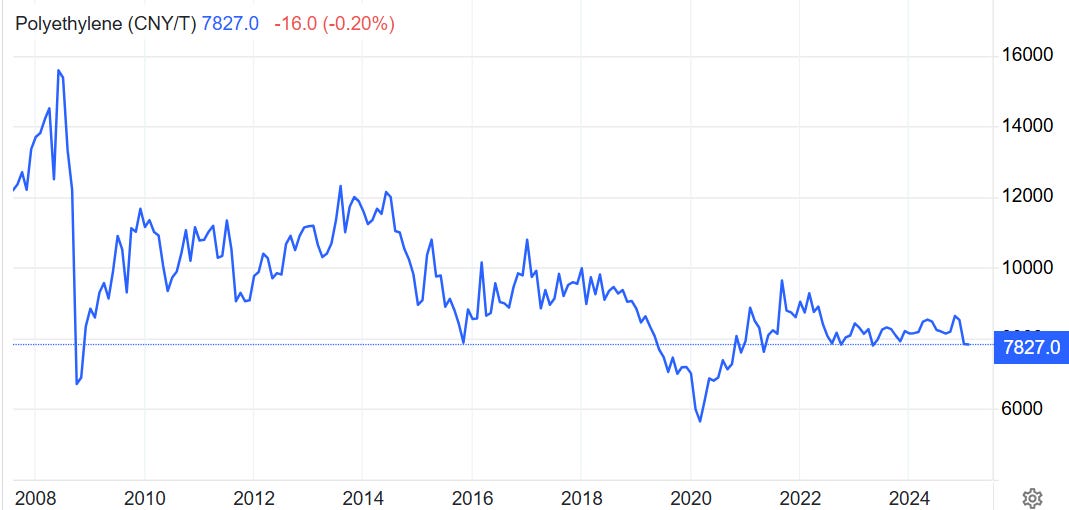

This catalyst will likely come from an increase in the prices of the commodities they sell like oil, ethane, and polyethylene.

Predicting commodity prices is certainly very difficult but it is promising for a turnaround when you see ethane and polyethylene at very suppressed levels.

Investor Inbox

What investing question do you have? Each week I will pick one question to answer in this section. Since this is the first week I have chosen a common topic to address.

What do I look for in a stock when searching for new ideas?

ROIC and/or ROCE above 12% on average or trending in that direction.

Low share dilution; typically below 3% but I can make acceptations if they are done for good acquisitions.

Significant drawdown in price. The further the better!

These are the first things I look at when searching for ideas. And if they pass these quick tests then I add them to a list of companies I want to start running through my filters. Obviously there is a lot more I look at but if they meet these requirements then there is a solid base to work from.

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, and past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

See you in the next edition!

https://fred.stlouisfed.org/series/WPU10260314 (I didn’t include copper as it has trended up helping revenue and margins but it is another import commodity to pay attention to for Atkore.)