Visa ($V) | Solid Growth, Stupid Buybacks

Visa processed $15 trillion dollars in 2023 but are they a good investment right now? Read the article to find out.

Visa is a massive company processing $15 trillion in transaction in 2023 but are they a good investment? The investment world loves Visa and it certainly has a bright future but what kind of returns should you expect to get over the next 10 years? I will explore these questions in the article below.

Welcome to the Busy Investor Stock Reports where I share my investment analysis to save you time, make you money. Consider hitting that subscribe button to get these articles directly in your inbox.

Snapshot Summary

This section is designed to get you all the important information from the article in a quick snapshot.

Visa is a massive payment processor raking in cash each time you use one of their cards and still has room to grow. That growth will continue as they take some market share globally and ride the tailwind of increasing spending.

My biggest gripe with the company is their incredibly inefficient use of capital. They use almost all their cash to buy back stock instead of retaining earnings to reinvest in the business at historically 35%+ rates of return.

When valuing the company I expect the following:

Revenue growth of 8% per year for the next 10 years.

A 57.2% FCF margin the totaling $43.13 billion in cash generated in 2034.

Share buybacks at 1.5% and 10% dividend growth per year.

On those assumptions and a price to free cash flow of 24x Visa would return about 8.6% per year from the current level of about $270 per share. For me Visa is a pass unless it were to fall significantly.

Roadmap for the Article

Lay out how the company operates and how the industry is likely to evolve.

Review the financial health of the company along with its use of capital.

Reviewing management, their share buybacks, incentives, and candor.

Detail of the companies strengths, weaknesses and my valuation.

Inside the Business and Industry

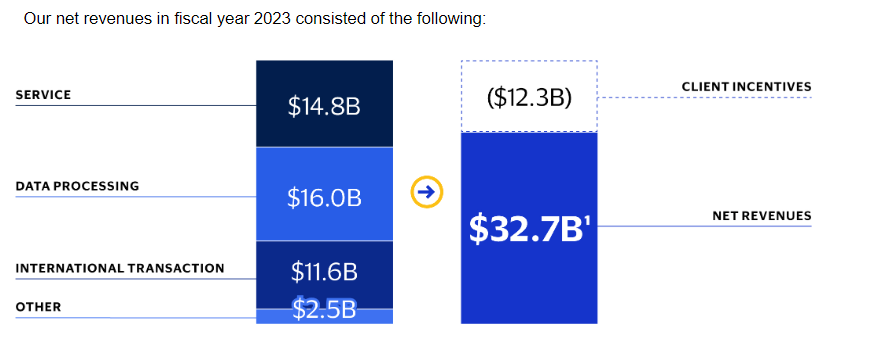

Visa is a huge payment processor globally and in 2023 they generated $32.7 billion in revenue by taking a small fee every time you use their card. A pretty good business model since most people tap their car more than once per day.

To attract even more merchants and partnerships Visa also has a robust incentive plan.

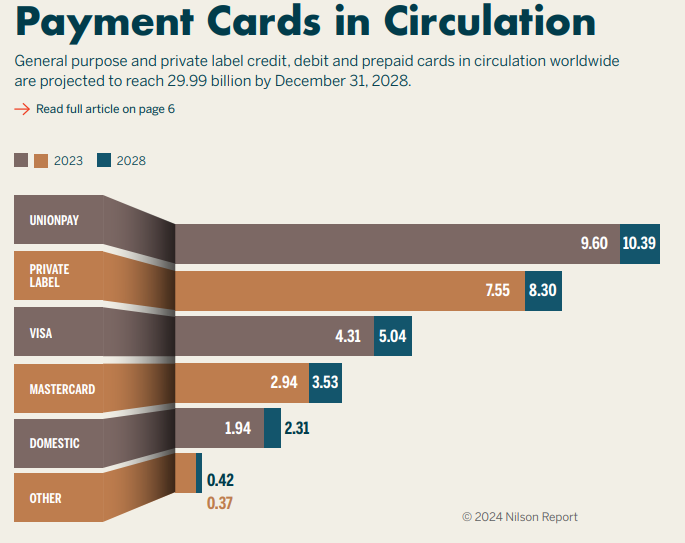

Visa has a very meaningful market share in the payment processing industry. In the US they dominant the debit and credit card industry with a 61.1% market share which is up from about 53% in 2007. Worldwide Visa also holds a strong position where they have about 16.14% of cards in circulation worldwide. And according to the Nilson Report that share will grow to 16.8% by 2028.

Visa operates at a global scale so their growth will likely be driven by very large fundamental trends. Their industry will benefit from the transition to card payments away from cash and increasing consumption.

The transition to card payments is still an ongoing process around the world and along with increasing consumption included this comes to a respectable growth rate. According to the average of 8 forecasts of growth for credit cards or cards and payment volumes, the global industry will grow about 8.95% per year.

When you understand a business and its industry you can confidently hold through issues, downturns, and sentiment changes. All of which will wipe you out if your thesis is based on hopes and guesses. 2020 was a perfect example of that even for this industry. It was the only year in the last 20 that Visa’s revenue went down. The lesson, only invest in what you understand.

Financial Health

Margins

The value of the all businesses comes down to how much cash it can generate so a higher FCF margin than competitors indicates a high quality company.

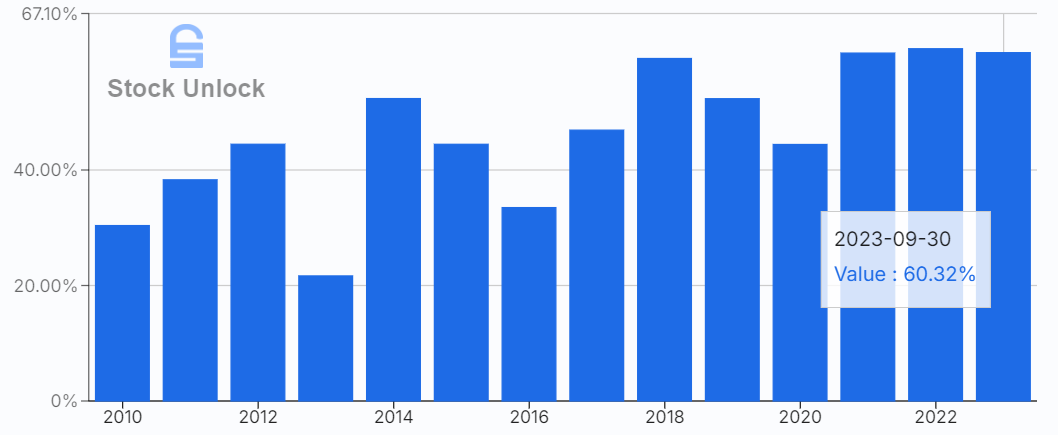

Over the last 20 year Visa’s competitors1 averaged a median FCF margin of 28.37% while Visa had a median of 44.2%. Their only competitor with a higher average is Discovery which tells me Visa operates more efficiently than most and has a better product.

Returns On and Use of Capital

Visa has a fantastic historical return on equity with the median over the past 5 years at 37.38%. This tells me the management knows how to use invested capital very efficiently to generate profits for the company.

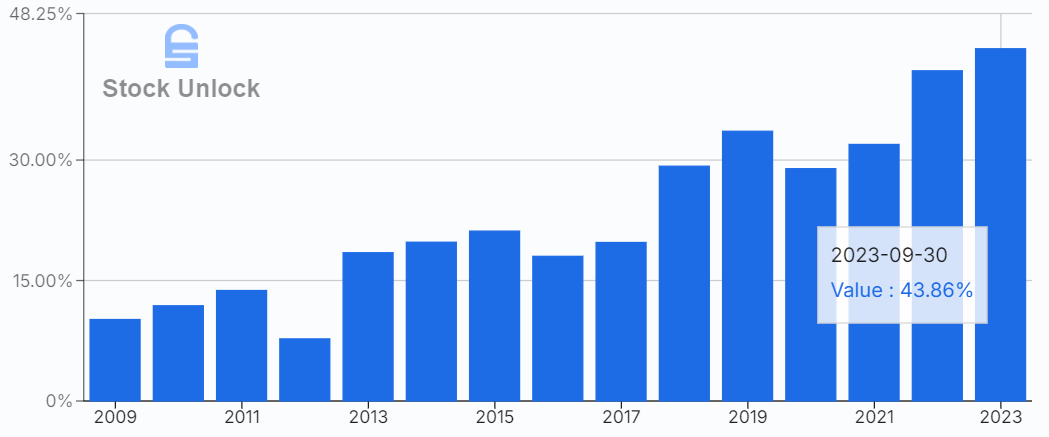

Over those same 5 years Visa’s book value has only grown at 2.9% annually, mostly because virtually all of their free cash flow has been used for share repurchases and dividends—a strategy I believe is a serious mistake. The management has consistently proven their ability to generate high returns on retained earnings, yet they continue to divert almost all free cash flow away from retention. According to Warren Buffett, retaining earnings makes sense if a company can grow its book value faster than the S&P 500 and consistently trades at a premium to book value. In the trailing twelve months, had Visa retained all of its free cash flow, their book value could have grown by 48.6%; instead, it increased by less than 2%. During this time they also traded at almost 14x book value. This suggests that their capital isn’t being utilized as effectively as it could be. Rather than compounding $19 billion at over 30%, they chose to repurchase shares—overall a terrible trade.

The only reason I can see whey they wouldn’t retain the capital is they do not see any good ways to deploy capital. That may be true in the US but is certainly not in emerging countries where their market share is far lower. They could look to make strategic acquisitions, increase R&D spending, or market more aggressively in low penetration markets.

I will admit though the company still continues to generate cash and grow although at a slower rate than I think they could. Ideally I would like to see Visa retaining somewhere around 50% of their FCF and paying the rest as a dividend unless their stock traded down to around 17x FCF, where I think buybacks would make a lot more sense.

Leverage

Visa holds $16.6 billion in cash reserves, $20 billion in total debt, and generated nearly $19 billion in free cash flow over the past year, meaning they could easily pay off all their debt at any time.

As you could guess as well this is a very capital light business with maintenance CAPEX, based off depreciation and amortization, sitting around $1 billion during the TTM.

A good business should have a very modest amount of leverage employed as during a downturn high leverage can pose a great risk to a company going under or being forced to take on more debt and issue shares. Both would destroy shareholder value.

Leadership Integrity & Impact

Shareholder Dynamics

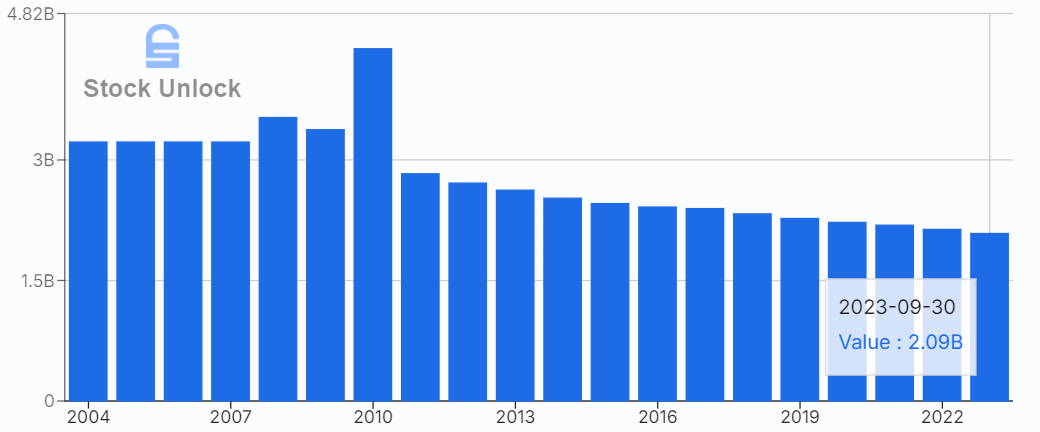

Over the last 20 years Visa’s outstanding shares have decreased at a rate of 2.7% per year but as discussed previously this is not an effective use of their capital. Especially when compared with retaining and reinvesting into the business. Certainly better than a company that continues to dilute shareholders though.

Incentive Alignment

At Visa management compensation plans are tied to the EPS and total return against the S&P 500. I thinks this helps tie in why they continue to buyback shares and issue dividends. Right now the market places a high value on both buy backs and dividends. This means management can boost the share price while also reducing share count so EPS would rise even if incomes were flat.

I believe the market would view Visa less favorably if they stopped buying back shares, leading to a drop in stock prices—and consequently, a decline in management's compensation, which they clearly want to avoid. In the long run this plan hurts business performance and is very short term minded. Charlie Munger said, “Show me the incentives, and I'll show you the outcome.” Visa is just another example if this playing out.

Leadership Candor

Leadership at Visa over the last decade has done an ok job communicating the reality of the business. They give high level views without fully diving into their reasoning behind their moves. It leaves a lot of important work to the investor which unfortunately is the normal so I put them as average.

Great management is clear and realistic in their communication. If they often promise the world and under deliver this is a huge red flag of poor management.

Strengths and Weaknesses

So far I have been pretty hard on Visa and their use of incoming capital. From a numbers standpoint I think share buybacks at current levels of almost 28x FCF is actually the worst way they could be using the money for the long term. Retaining to reinvest or make acquisition would be my preference here.

Think about it, if Visa could invest into the business at even a 20% rate of return, which is far below their historical returns, they could reignite high growth. Instead they chooses to payout all their cash in share buy backs which can only mean one of two things.

Management cares more about short term paychecks than the long term shareholder.

or

Visa has no current options for growth outside of the incentives they offer.

Neither look great for Visa’s long term outlook buts lets move onto the many positives for the company.

Visa still has massive market share in the US and a strong presence internationally. Both will make it hard for any competitors to disrupt their position. This is further entrenched when you consider the larger reach a payment processor has the wider and more sustainable their competitive advantage. This happens since no merchant would want to pay to host a processor few people use.

Visa also has a incredible FCF margins which insures they will be highly profitable as the continue to grow. If you compare this company to essentially any other they generate massive amounts of cash per dollar of revenue.

An overlooked reason I like Visa is it does not take a genius to run the company. Almost no matter who runs things Visa will do well so there is no form of key man risk I can see. This is great news because some day a dud will run the company and shareholders likely won’t need to worry about them destroying the competitive advantage.

Lastly the business also still has reasonable growth prospects into the future driven by global trends and helped along by their incentive plan. For all my ranting on how they are using their capital Visa will continue to find growth opportunities.

Valuation

Now lets move to valuing the company starting with expected revenue growth. Overall I expect Visa’s revenue to grow at about 8% per year for the next 10 years. This would give them the following revenue in 2034.

2034 Revenue: $75.4 Billion

On this revenue I expect they will continue their 5 year median FCF margin of 57.2%. This would get you the following FCF in 2034.

2034 FCF: $43.13 Billion

In the next 10 years, because share buy backs and dividends are so important for this company, I will assume dividends per share will increase at 10% per year and 1.5% of outstanding shares are repurchased each year. Now with those out of the way I think a reasonable price to FCF is 24x. This is far above the market average of about 17x because this is such a dominant company. With all the assumption above you would get the following share price and market cap in 2034.

Share Price: $602

Market Cap: $1.03 Trillion

This implies about a 115% upside from current levels of $276 per share by 2034 or about an 8.6% CAGR. Even with all of my issues with how the company uses their capital the still offer a reasonable return over the next 10 years. If they used their capital better could they grow faster? Certainly, but I don’t expect management to make those changes because it would likely hurt their pay.

As crazy as it may sound I would only be interested in buying the company at around $150 per share. Then the returns would sit closer to about 15% per year. To be clear I never expect Visa to drop to these levels because it is such a highly followed and quality company. If it ever did though I would consider adding it to my portfolio.

Enjoyed the article? Consider becoming a paid subscriber! By subscribing, you'll get access to my best ideas with the highest returns. Always over a 20% CAGR! Plus, with my Punch a Puppy Guarantee, if you wouldn’t punch a puppy to keep getting my articles, I’ll refund your subscription in full within the first month—no questions asked. There's zero risk and tremendous value. Check it out!

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

Competitors: DFS, AXP, MA, PYPL, FI and JKHY

On September 5, I reported that legendary billionaire investor Andreas Halvorsen sold his firm's $1.8 billion Visa stake. I also noted that Nancy Pelosi sold between $500,000 and $1 million in Visa stock.

https://ffus.substack.com/p/contrarian-move-andreas-halvorsens

$250 is possible. I picked some up recently at $258. If it gets back there again then I’m buying more.