Tencent ($TCEHY) | China's Largest Economic Moat

Tencent is a massive company but are they a buy?

Hello! 👋

I’m Kyler and welcome to Busy Investor Stock Reports

Today, I’m breaking down Tencent, China’s largest public company. I will lay out the bull and bear case to give you a clear picture of the company. When you have the right context, you can make better decisions and make more money.

If you like this content subscribe to get these posts right in your inbox.

Company: Tencent

Ticker: $TCEHY

Market Cap: $447 Billion

Industry: Social Media, Music, Cloud, Gaming, Finance

Inside the Business

Tencent Operating Segments

Value-Added Services (49%): Social networks like WeChat and QQ, gaming operations, and other digital content like Tencent Music.

Online Advertising (16.6%)

FinTech and Business Services (33.4%): Tech solutions, like WeChat Pay, wealth management tools, and cloud services.

When you understand a business and its industry you can confidently hold through issues, downturns, and sentiment changes. All of which will wipe you out if your thesis is based on hopes and guesses.

Bull Case

Wide Economic Moat

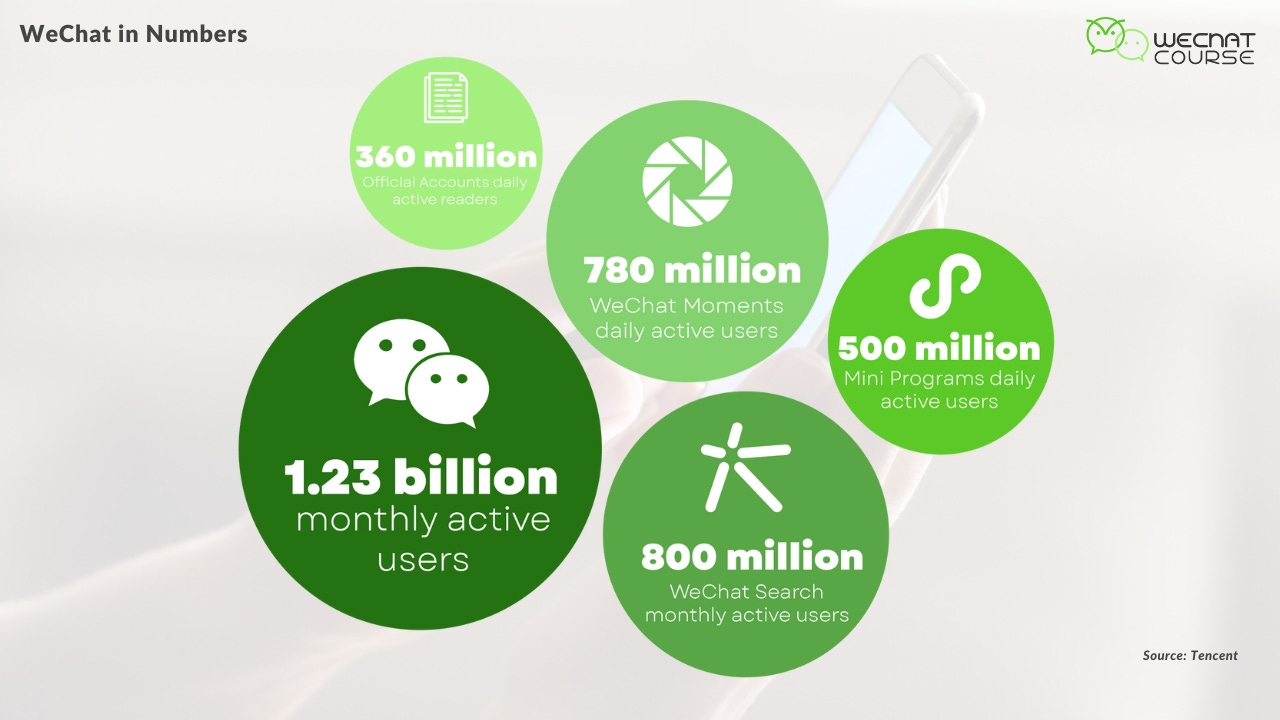

Tencent’s WeChat dominates with over 1.2 billion users. 800 million of which are in China. Its vast reach offers unmatched potential for advertising and data collection, with no serious rivals in sight. Regulatory increases could widen Tencent’s moat by raising entry barriers for smaller competitors.

Continue Growth Prospects

Tencent still has growth ahead. China's online advertising market is expected to grow 6.8%1, gaming by 8.11%2, the fintech sector at 15.67%3, and cloud at 20.75%4 annually based on forecasts.

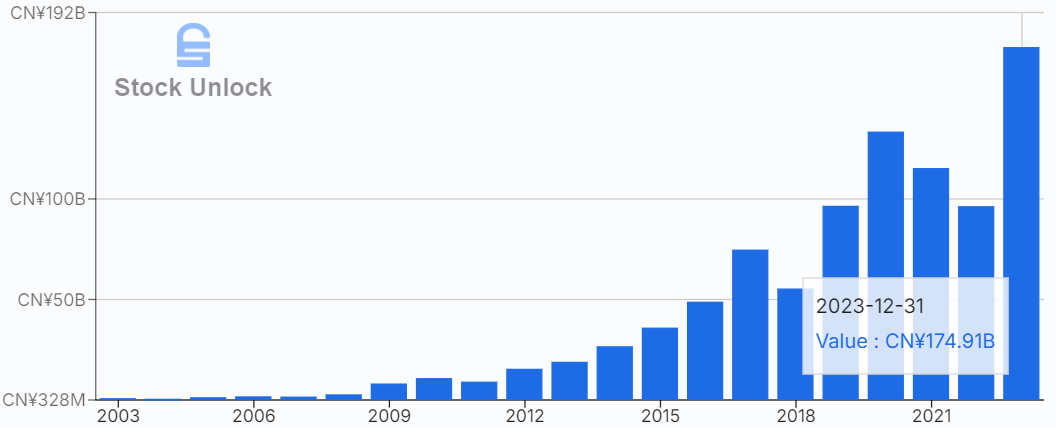

Their historical growth has been rather impressive as well. In 2003 Tencent generated about 300 million Yuan. In 2023 that number ballooned to 175 billion Yuan.

Bear Case

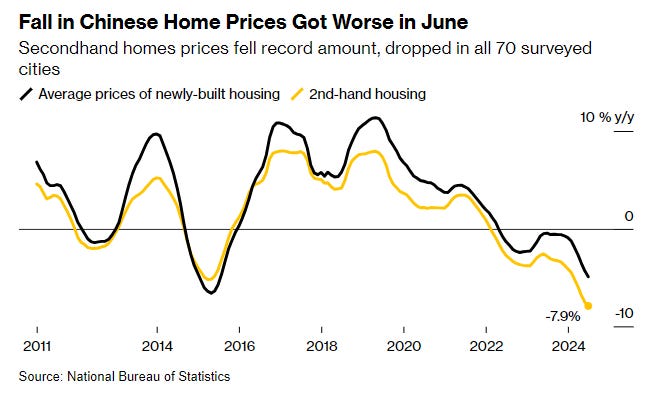

Poor Economy

China's economic struggles could slow Tencent's growth. Particularly dragged down from a weak housing market.

End of Innovation

Tencent has benefited from the wave of digitization. There is no promise they will continue to innovate successfully.

Restrictive Regulations

In the past China has instituted policies that directly impacted Tencent’s ability to grow and monetize. They could pass further similar regulations.

Cutting Through the Noise

Tencent’s economic moat, combined with industry tailwinds, makes a strong case for the company. Their firm hold is unlikely to waver, especially with the CCP's preference for control. Which they get more of if WeChat remains dominant. This moat almost guarantees cash flow for shareholders.

While increased regulations are the largest short-term risk, they could also widen Tencent’s economic moat. In the end, the bull case is compelling—but the numbers need to back it up.

Financial Health

Lets look at two important metrics. Capital allocation and leverage. This will tell us in a nutshell how competent management is, if the company is likely to grow, and if they have any debt issues.

Capital Allocation

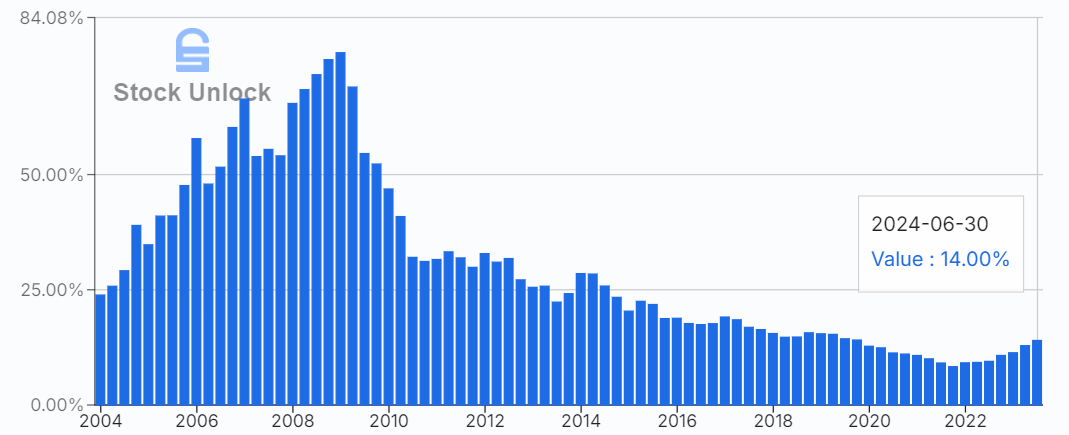

Over the past 20 years, Tencent has averaged almost a 30% ROIC. For every dollar of invested capital they generate 30 cents of operating income. A phenomenal return. Especially when you consider the amount of invested capital has increased from $45 million in 2004 to $120.2 billion!

Over the past 5 years though, that ROIC has decreased to an average of 11.87%. Notably, it has risen in the TTM to 14%. Neither is phenomenal, but both are still good.

As a company grows it is normal for investments to yield less because they have a far larger amount they need invested. So it is not unexpected for ROIC to decline. The key points are. First they are getting a higher return than their cost of capital. Then second they are growing the amount of capital invested at a fast pace.

Leverage

Tencent looks great by this metric. They have negative net debt. This means their cash and equivalents are more than their total debt. They could pay everything they owe right now with $600 million left over.

Valuation

Now that it is clear Tencent is a quality company, what are they worth?

To get to this figure I will project revenue growth over the next 5 year of 9%. I arrived at that number based on a conservative combined estimate from the sectors they operate in. Assuming that growth Tencent would produce the following 2030 revenue.

2030 Revenue: $136.2 billion

On this figure, what cash will they generate? Over the past 5 years they have averaged a FCF margin of 28.2%. I suspect that since regulations and restrictions have been in place long enough to adjust to, this will go up. I will assume a 30% margin, which comes to the following cash generated.

2030 FCF: $40.9 billion

On this FCF what is a reasonable multiple? A 20x FCF is very reasonable considering that it is a 5% FCF yield. This is a company with a very wide moat, and it has reasonable growth prospects. Assuming that multiple means following share price and market cap.

Share Price: $88

Market Cap: $818 billion

This implies an 80% upside from current levels or about a 12.5% CAGR. That is over the next 5 years based on about a $47.5 share price.

Conclusion

I do really like Tencent as a company. They have a massive economic moat and growth prospects.

Despite all the good they offer I will be passing on them. They simply don’t offer enough of a return to merit a position. Especially when you consider my largest position in China, Alibaba. They have much better growth prospects and trade at an even cheaper valuation.

Check out my thesis for the company below.

https://www.statista.com/outlook/dmo/digital-advertising/china

https://www.statista.com/outlook/dmo/digital-media/video-games/china

https://www.mordorintelligence.com/industry-reports/china-fintech-market

https://www.statista.com/outlook/tmo/public-cloud/china

Great way of showing the true value of Tencent.