📈Alibaba ($BABA) | The Obvious Multi-Bagger No One Wants to Touch

Full analysis of Alibaba as a business and investment opportunity.

Hello!

I’m Kyler and welcome to Busy Investor Stock Reports

Imagine stumbling upon a gold bar that everyone’s ignoring—that's Alibaba. It’s cash-rich, poised for growth, and undervalued. In this article, I’ll explore Alibaba’s operations, tackle common concerns, and share my 5-year outlook on this hidden gem.

If you haven’t yet, subscribe to get access to this post, and all posts.

Summary of Businesses

Alibaba is a massive company with major brands in China and beyond. Before investing, you need to understand the business fully—imagine you’re buying the entire company.

Commerce and Wholesale (52% of Revenue)

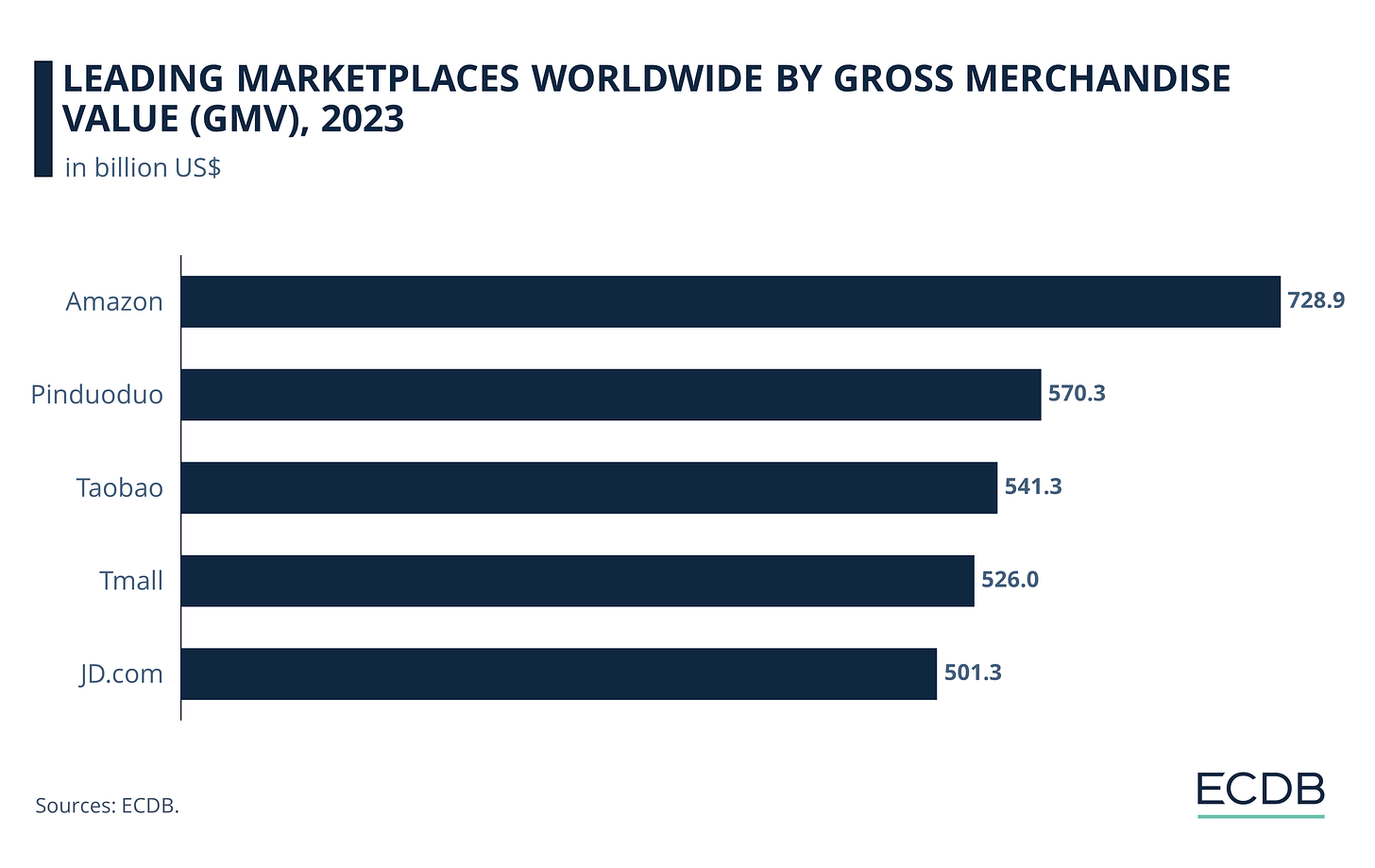

Through Taobao, Tmall, and Alibaba International Commerce—including AliExpress and Lazada—Alibaba provides a vast online marketplace for products both in China and globally. They handle general merchandise and groceries at a scale that surpasses even Amazon in terms of gross merchandise value (GMV), reflecting the total sales value of all merchandise sold.

Logistics and Supply Chain Management (8.3% of Revenue)

Alibaba provides global logistics and supply chain services through Cainiao. They offer full-scale solutions that are easy to use and adaptable across various industries.

Cloud (11.1% of Revenue)

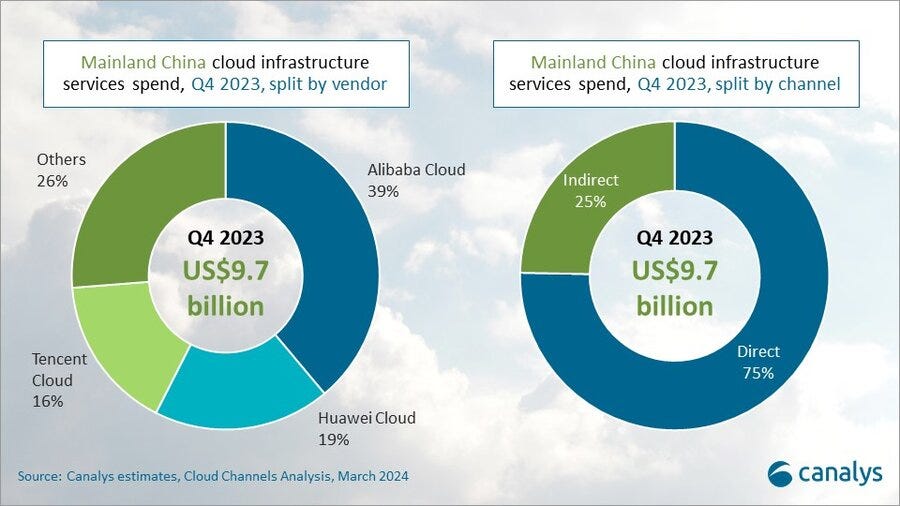

Alibaba Cloud offers a comprehensive suite of services, including servers, computing, storage, networking, security, databases, big data, and machine learning. With a 40% market share in China, Alibaba Cloud is the dominant player in the country's cloud industry.

Others (28.6% of Revenue)

Alibaba's revenue streams span across media (shows and movies), on-demand delivery (food and merchandise), healthcare services, and gaming.

Industry Forecasts

Forecasting Alibaba's growth is complex due to its diverse businesses. I'll simplify by focusing on three main segments: commerce and wholesale, cloud, and logistics, while grouping other areas together.

I’ll provide a rough estimate of the overall business value, acknowledging that precise predictions are challenging, so setting reasonable expectations and using conservative estimates is key.

Commerce and wholesale

This division has seen slow growth in China but rapid international expansion. For the 2024 fiscal year, Taobao and Tmall grew 5%, while Alibaba International Commerce grew 46%. Given the 11.6% average e-commerce growth forecast for China, I'll conservatively project 8% growth for both China and international commerce and wholesale revenues.

Cloud

Alibaba's cloud growth has slowed recently due to cutting unprofitable customers. However, growth is expected to improve once this cleanup is complete. For now, I’ll base my estimate on a 20.5% average growth forecast, but I’ll conservatively project 10% growth for Alibaba’s cloud business.

Logistics

Alibaba’s logistics growth has been robust, with a 28% increase in the 2024 fiscal year. The average global industry forecast is 19.9%. To be conservative, I’ll project a 12% growth rate for Alibaba’s logistics business.

Alibaba has strong growth potential, even with conservative estimates. For all other revenue streams, I’ll use a 5% growth rate, aligning with expected GDP growth.

Risks and Concerns

Alibaba’s stock is down about 70% from its peak, reflecting doubts about its future. Concerns include China’s housing sector struggles, US tariff disputes, and rising competition.

I’ll address these by focusing on what’s “knowable and important” following Warren Buffett and Charlie Munger’s advice.

Economic Collapse

Predicting an economic collapse is as uncertain as forecasting how shattered glass will fall—impossible to know. While it's a crucial issue, I'll provide a basic explanation despite the inherent limitations.

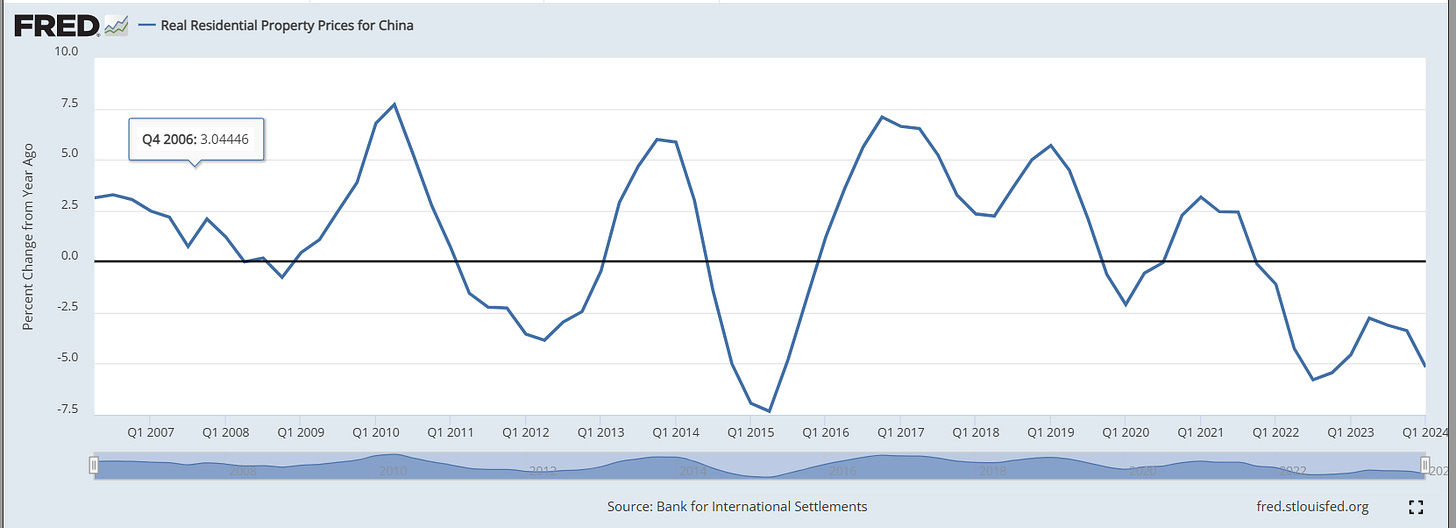

In 2015, real residential prices in China dropped about 7.5% YoY, slightly worse than the current decline. However, the cumulative drop from the peak is now greater. Back then, China lowered interest rates and eased home buying regulations, and they're doing the same now. These actions should boost buying activity and stabilize prices, similar to what happened in 2015.

Tariff Wars

Is predicting tariffs and trade restrictions knowable? No, it’s as complex as forecasting an economy, needing insight into US and China political moves. However, it's important. During Trump’s tenure, despite tariffs and trade restrictions, the Chinese stock market had an average return of 7%. This historical performance suggests how similar conditions might impact the market again.

Rising Competition

Is this knowable? Kind of. It’s more knowable than other concerns and crucial for Alibaba’s future. I’ll focus on Pinduoduo (PDD), a major competitor. PDD’s strategy of low prices and flashy promotions targets lower-quality goods, driving rapid but potentially unsustainable growth. Even if PDD's growth proves sustainable, it deals in lower-quality products, whereas Alibaba is known for higher-quality offerings.

Demographic Thesis

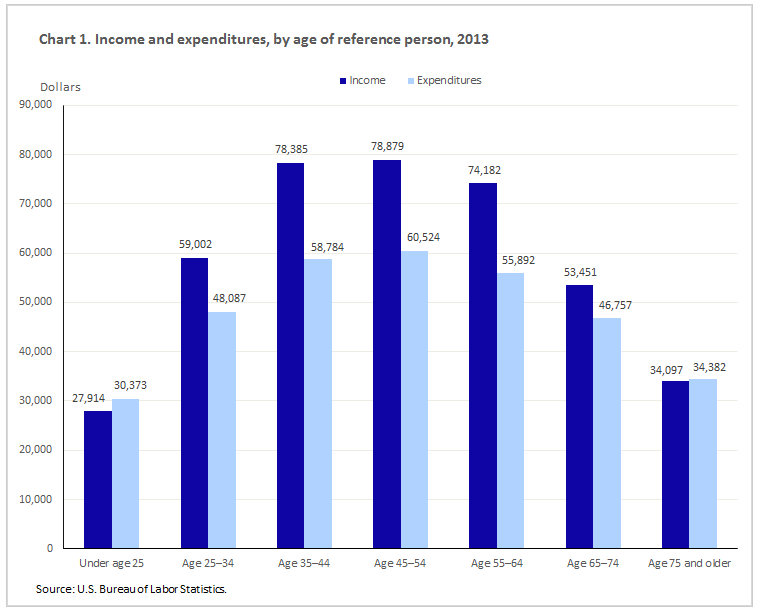

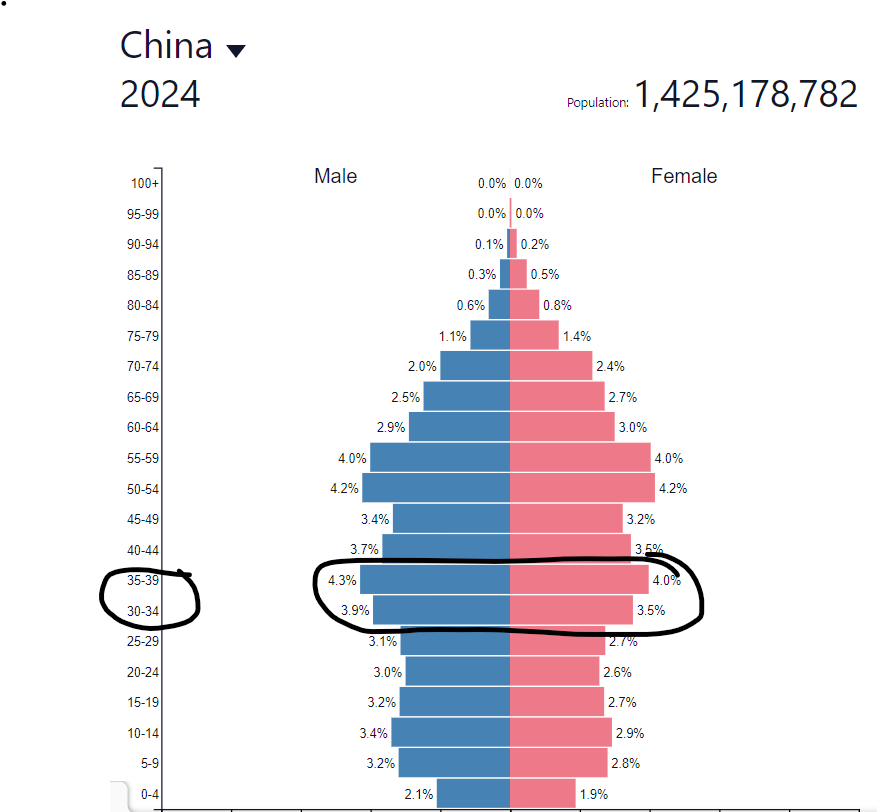

Underlying my entire thesis for Alibaba is a crucial factor: demographics. People drive consumption, so more consumers typically lead to increased sales. Peak consumption usually occurs in the 35-44 age range.

China has a significant portion of its population entering the 35-44 age range, a peak period for consumption. As these individuals form families and buy homes, they will drive increased spending on essential items. A major retailer like Alibaba stands to benefit greatly from this demographic shift.

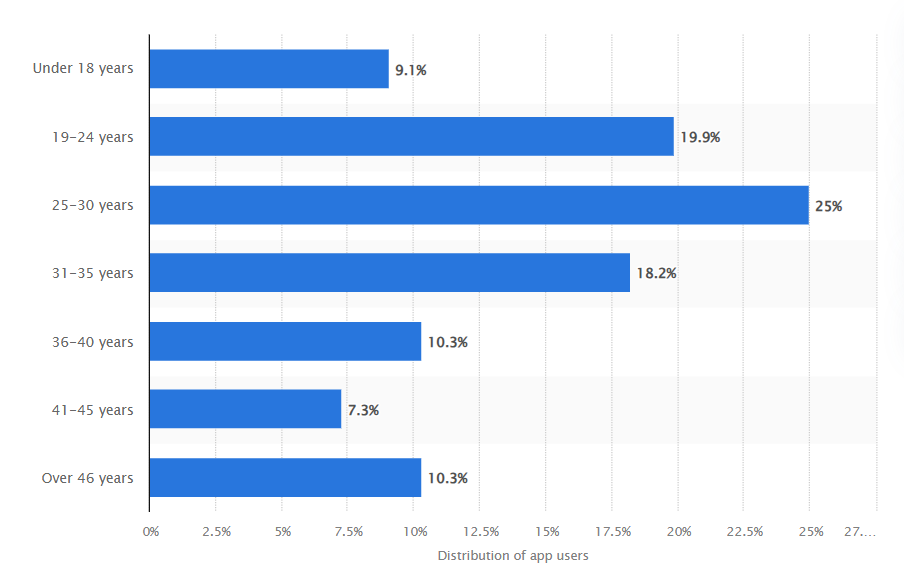

You might be concerned that the spending decline among the older generation could offset this growth. To address this, let’s examine the age groups that use Taobao.

Younger age groups are the primary users of Taobao, so the decline in spending among older generations will likely have minimal impact on Alibaba’s revenue from commerce and wholesale.

Summary

While there are concerns about Alibaba, it’s crucial to focus on the core business rather than getting distracted by external noise. The key factor is the business itself, and as you have seen, the fears might be overblown.

Revenue continues to grow, and with the revamping of Taobao and Tmall, combined with favorable demographic trends, I expect growth to accelerate in the coming years compared to the recent past.

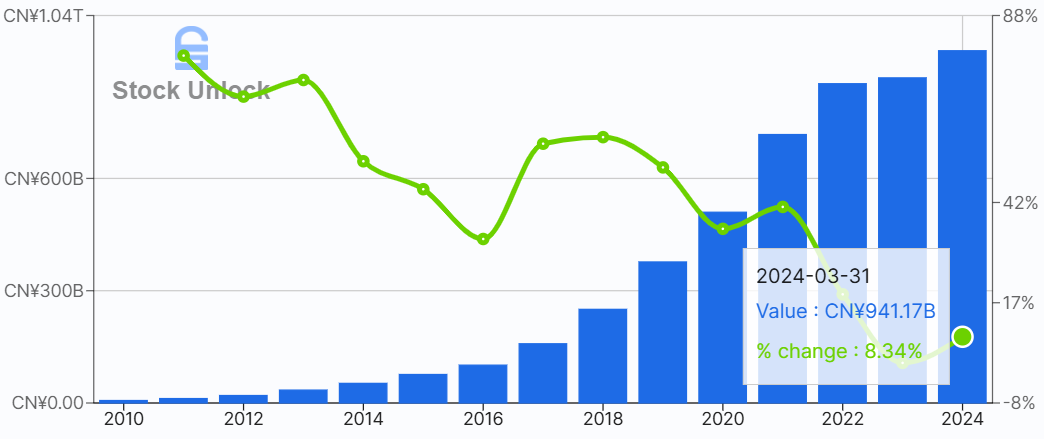

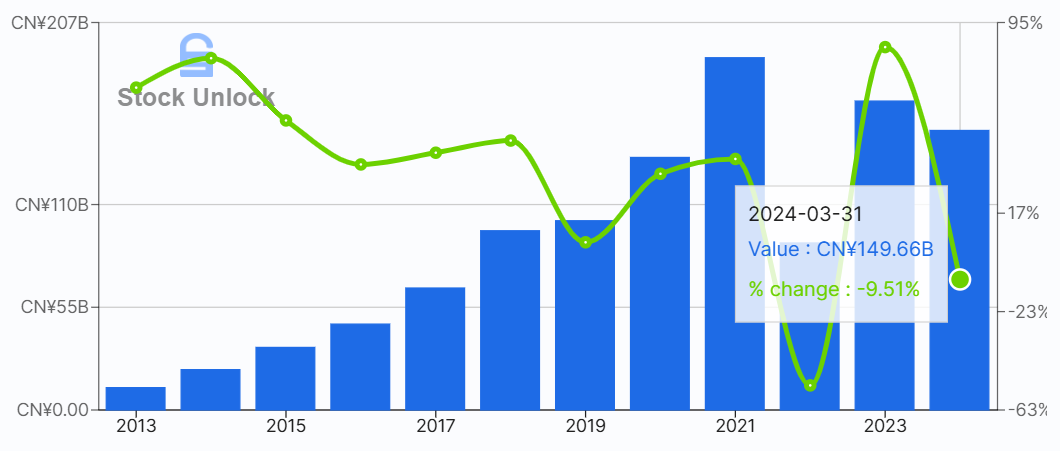

Free cash flow remains near all-time highs and is expected to recover once Alibaba completes what could be called its “year of efficiency.” The company is actively trimming unprofitable customers and businesses and investing in revamping operations for profitable growth. While this has required some investment, it positions Alibaba well for future success.

Understanding Alibaba takes some effort, but when you break things down clearly, the concerns seem overblown. Despite the stock trading at levels similar to 2015, Alibaba’s revenue has surged over 12x, and its free cash flow has increased more than 5x since then.

Valuation and Assumptions

Based on my assumptions above, below are the details of how revenue will fall for the 2029 fiscal year in USD1.

Commerce and Wholesale: $110,565,000,000

Cloud: $23,984,000,000

Logistics: $24,430,000,000

Other: $48,829,000,000

Total: $207,808,000,000

Next, let's examine free cash flow (FCF) margins. An investment is only worth the cash it generates. Given Alibaba’s efforts to remove unprofitable growth, I expect margins to improve from the 15% to 18% range seen over the past two years to around 22%. Based on these assumptions, here’s the projected FCF for Alibaba in 2029:

Free Cash Flow: $45,717,000,000

Applying an 18x FCF multiple and an 8% decline in share count over the next 5 years (a conservative estimate based on management’s target of 3% annual buybacks per year), we get the following projections:

Share Price: $375

Market Cap: $823 Billion

This implies a potential return of 370% from the current share price of around $80. Alibaba presents the chance to buy a large, high-quality company significantly below its fair value. This estimate only reflects fair value; the full value could be much higher, especially considering Alibaba’s unaccounted investments in AI and other growth areas.

Overall, Alibaba offers a compelling opportunity at these levels. Understanding what you’re investing in is crucial; otherwise, negative headlines might unsettle you and prompt you to sell out. For investors like me, such negative press creates opportunities to buy great companies at exceptionally low prices. What more could you ask for?

Disclaimer

This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.

Based on 1 RMB = 0.14 USD

I always wondered when the money will start flooding back to China. Seems the China bear market is endless.

I included your post in my Monday links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-august-5-2024 I don't have any experience with Alibaba - I use when Shopee in Malaysia and Temu (expanded to Malaysia) or Amazon in the USA which I wrote about some months ago: Can Temu Take on Amazon.com & the Rest of the World? https://emergingmarketskeptic.substack.com/p/can-temu-take-on-amazon-and-the-rest-of-world