📈International General Insurance ($IGIC) | A High-Quality Insurance Company

A full analysis of IGI as a business and potential investment.

International General Insurance was not a name I had heard of until

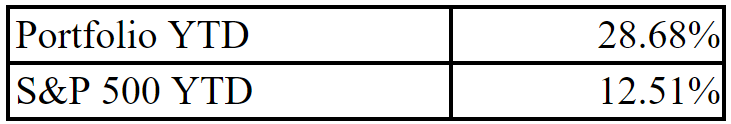

brought it to my attention. After several days of work I discovered a high quality insurance company I will be paying close attention to. This article will be an analysis of their business and potential for investment.If you like this type of content subscribe below and you will get these articles directly in your inbox each time I post them! It is this work and analysis that has allowed me to outperform the market by a wide margin so far this year

Summary of Business

Before you make any investment, it's crucial to understand the company and the industry in which it operates. If you don't have a solid understanding of both, you should stay away.

International General Insurance (IGI) operates in several key areas of the insurance industry. They provide coverage for specialty long-tail and short-tail risks. This means they insure unique and complex risks that either take a long time to resolve (long-tail) or are resolved relatively quickly (short-tail). Additionally, IGI offers reinsurance services, helping other insurance companies manage their risk by taking on some of their policies.

Industry Forecast

Growth in the property and casualty insurance industry, which I believe will serve as a good proxy for how fast IGI’s total addressable market (TAM) will expand, is forecasted to be about 6.5% annually, based on the average of five different forecasts.

IGI has grown at a faster pace than the market but has also cut back during years when prices were not favorable. To account for periods of both faster and slower growth, I will assume an 8% revenue growth rate for IGI over the next 10 years.

Insurance is becoming one of my favorite industries to invest in because of its predictability. I don't expect any ground-shaking changes to affect this industry in the next 20+ years, which gives me great confidence that high-quality companies will be around for a long time and continue to grow.

Management

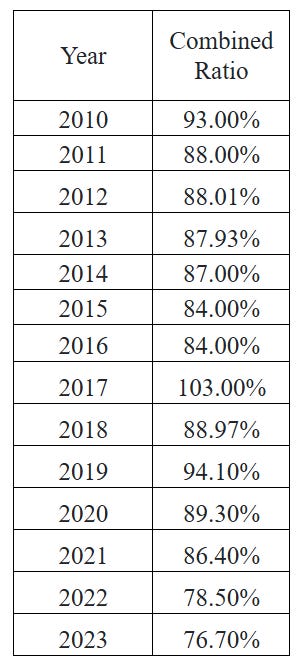

IGI has a strong history of excellent risk analysis, which I consider their best competitive advantage. This is evident in their combined ratio over the past 14 years, which has consistently outperformed industry averages. (Curious what float or combined ratio is check out this article here.)

While many companies in the industry have combined ratios at or above 100% each year, IGI has maintained a much better ratio. This indicates the company will be far more profitable than most.

In their 2023 annual report, management stated:

“Our primary objective is to underwrite specialty products that maximize return on equity subject to prudent risk constraints on the amount of capital we expose to any single event. We follow a careful and disciplined underwriting strategy with a focus on individually underwritten specialty risks through in-depth assessment of the underlying exposure.”

This focus on intense risk management does come with a double-edged sword. IGI operates with higher policy acquisition and underwriting costs than most companies. This could cause serious issues if they lost their touch in assessing risk of loss. However, their results speak for themselves. Their risk appears far lower than most insurance companies due to their niche focus and excellent policy underwriting, which makes them far more profitable than average.

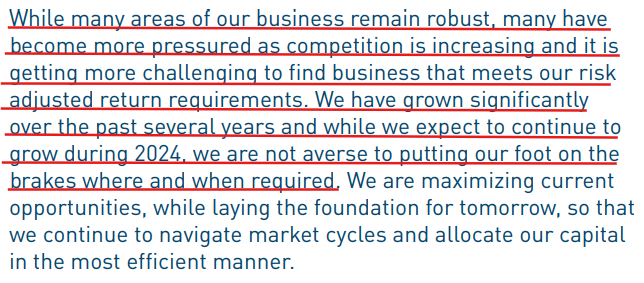

Another aspect of their management that sets them apart is their willingness to stop writing business when prices become unfavorable. In their 2023 annual report, they stated:

It is very easy for an insurance company to claim they will stop writing business when prices become unfavorable, but it is rare for them to act on this. However, from 2013 to 2016, IGI's gross written premium (GWP) actually decreased as rates were too low for them to write policies profitably. Many insurance companies feel pressured to continue writing business even if it is unprofitable. IGI operates differently, in a way that reminds me of how Warren Buffett describes their insurance operations.

If IGI continues to write business only when they are confident it can be profitable, even if it means writing less business some years, they will be incredibly successful.

Respect for Shareholders

I always like to evaluate how a company’s management treats shareholders. Are they being diluted, or is management buying back shares?

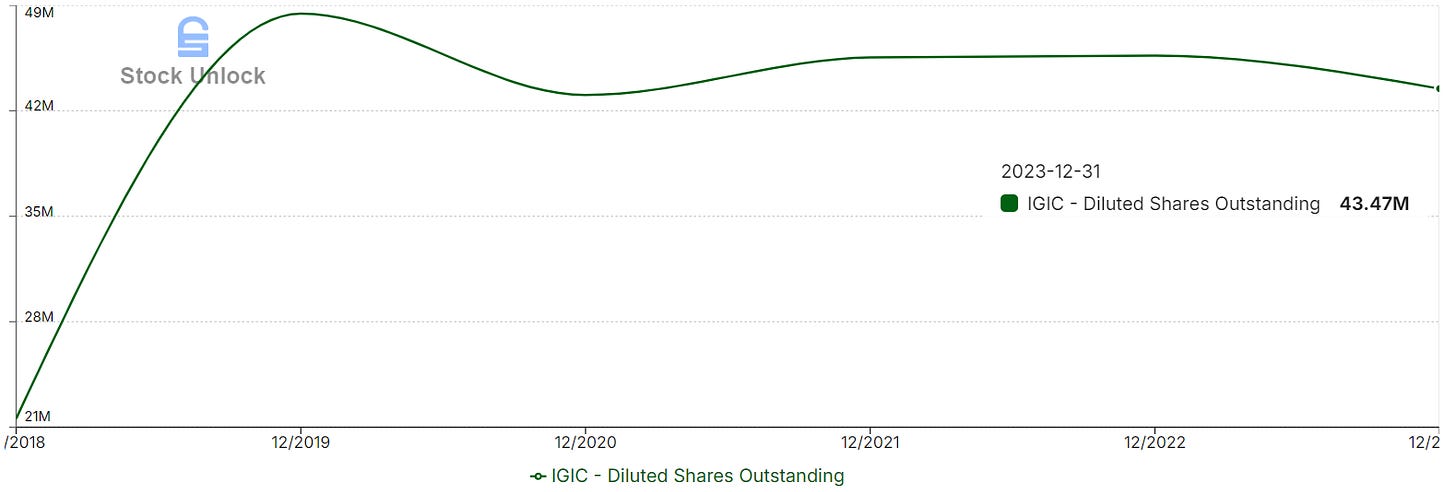

IGI presents a tale of two stories in this regard. In 2018, the company merged with Tiberius Acquisition Corporation to become publicly traded, more than doubling their outstanding share count in the first year and significantly diluting shareholders. However, since then, the share count has decreased by an average of over 2% per year, with the company committing to additional buybacks.

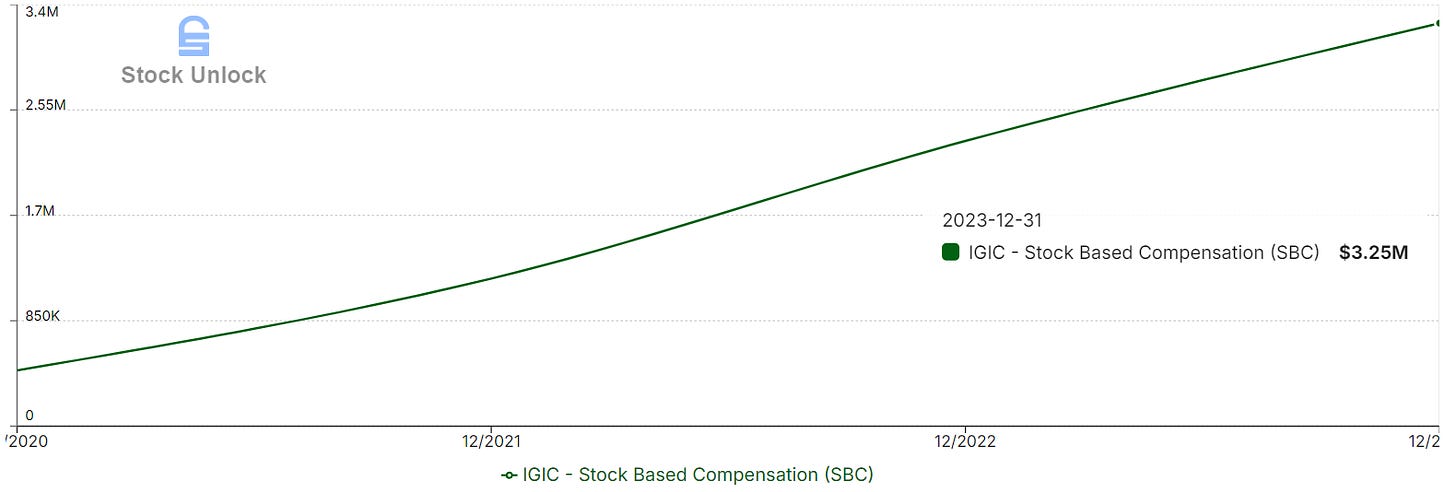

Turning to stock-based compensation, the company seems to issue more stock each year, which I find a little concerning. This practice forces the company to use cash to buy back shares just to maintain the same share count. It would be more effective to issue cash bonuses instead of additional stock.

In the company’s annual earnings reports over the years, they have repeatedly stressed their commitment to shareholders, which leads me to believe they will continue the trend of share buybacks (hopefully only while shares are undervalued). So, while it may not be the most efficient approach to issue shares as compensation and also buy back shares at the same time. They are treating shareholders well in the big picture after their initial issuance.

Summary

IGI is a very high-quality insurance company that excels in managing the aspects it can control: risk management and writing business with strong expected returns. If they can continue this focus and buy back shares when appropriate, the long-term outlook for the company looks very promising.

The reason they currently trade at lower valuations may be due to their headquarters being in the Middle East and concerns about insuring a region often prone to violence and turmoil, which could lead to significant losses for an insurance company. However, when you look deeper, you'll find that less than 9% of their exposure is to this region, with most of their policies covering Europe and North America.

The most important question here is whether this business has a sustainable competitive advantage.

As mentioned, IGI's advantage lies in their ability to manage risk effectively and avoid writing business with poor expected returns. This advantage, as highlighted in their annual reports, likely stems from the company's culture and their rigorous employee selection process. Since the business was recently passed from father to son and continues to improve each year, I suspect the management will do everything possible to preserve this culture.

Therefore, I believe this represents a sustainable competitive advantage—or a moat—that will allow IGI to outperform other insurance companies in the future like they have in the past. Many competitors write business with poor expected returns to avoid showing revenue declines to shareholders and lack the same rigor in risk analysis, resulting in significantly higher losses as a percentage. IGI sets themselves far apart in both aspects in the best way.

Valuation

I will assume IGI grows their revenue at 8% per year, achieves a free cash flow (FCF) margin of 26%, which is the average of their last 6 years, and receives a 12x FCF multiple. Based on these assumptions, the projected share price and market cap in 10 years would be:

Share Price: $72.68

Market Cap: $3.34 Billion

If these assumptions hold true, this implies an approximately 345% return from current levels over the next 10 years, equating to about a fantastic 13.2% compound annual growth rate (CAGR).

Currently, I have an incredibly good insurance company, Kinsale Capital, in my portfolio. Despite how impressive IGI is, I believe Kinsale Capital is of even higher quality with a much wider economic moat, though it comes at a higher price, and I expect a low return over the next 10 years for the company.

I will keep a close watch on IGI for potential investment opportunities now and in the future. For now, however, I will pass on IGI due to other opportunities with higher expected returns, although IGI may be of higher conviction due to its quality.

If you enjoyed the article, consider becoming a paid subscriber! You can cancel anytime in the first MONTH and you will get my famous Punch a Puppy Guarantee! If you wouldn’t punch a puppy to keep getting my articles I will refund your subscription in full no questions asked so go check it out. There is absolutely zero risk and incredible content to take your investing game to the next level.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed here are my own and not professional financial advice. I do not know your personal financial situation. Before making any investment decisions, you should do your own research and consult with a licensed financial advisor. Investing involves risk, including the potential loss of principal.

Never heard of it. Thanks for the short analysis!