📝Disney ($DIS) | Can the House of Mouse Turn Things Around?

Once the king of entertainment, Disney has hit a rough patch. Can they restore the magic and captivate the world again? This article details Disney as a company and potential investment.

Welcome to Busy Investor Stock Reports

Disney has shaped hundreds of millions of childhoods, but will current struggles be too much? Or can they keep they magic alive?

If you like this type of content subscribe to get these posts right in your inbox.

Company: Disney

Ticker: DIS 0.00%↑

Market Cap: $167.8 Billion

Industry: Media and Entertainment

FCF: $8 Billion

TTM Revenue: $90.03 Billion

Summary of the Business 📃

Disney, what can I say that you don’t know? They shaped hundreds of millions of childhoods. With their parks, movies, tv shows, and other experiences Disney offers something for everyone.

Operating Segments Breakdown 2023

Entertainment ($39.64 Billion)🎥

This segment includes Disney+, Hulu, TV Networks, movie sales, and content licensing.

Sports ($17.11 Billion)🏈

This segment’s revenues come from ESPN and Star. (Star is an India based sports network.)

Experiences ($32.55 Billion)🎢🛳️

This segment includes their parks and cruises.

Sports and entertainment generate revenue through subscriptions, advertising, and content licensing contracts. One-time purchases, such as park tickets and cruise bookings, drive revenue in the experiences segment.

Industry Forecast🔮

Understanding how the economics of the industries Disney operates in will evolve is crucial. If you can’t understand the economic outlook, finding intrinsic value is impossible.

Entertainment🎥

Many forecasters project strong growth for the streaming industry, with a CAGR of over 20% through 2030.

Remember though Disney’s entertainment segment is combined with its legacy TV. Which has far less attractive growth prospects. All together, it’s reasonable to expect this segment, to grow at about 8%.

Tailwinds for Disney will come from the shift away from cable toward streaming. As well as millennials entering their prime spending years.

The lower growth figure I’ve estimated is intentional. First, I want to remain conservative in my projections. Second, the streaming industry is highly competitive, which justifies a more modest outlook.

It will be a battle to capture people’s attention.

Sports🏈

The sports streaming industry has strong projected growth as well. But it has consistently underperformed expectations for Disney. Their revenue from 2022 to 2023 was -2%. Not impressive at all. I will assume low growth here of 3%, remaining flat vs inflation.

In part I am assuming growth far lower than forecasts to be conservative and account for competition. More important though is the declining popularity of sports.

Only 23% of Gen Z describe themselves as passionate sports fans.1 The lowest of any generation.

Despite the headwinds I still believe Disney will maintain revenue vs inflation. Driven by population increase and increasing advertisers spending.

Experiences 🎢🛳️

Global theme park revenue is projected to grow at 12%, cruises at about 9%, and other experiences at around 5%. Because Disney is investing heavily into their theme parks in the coming years, revenue growth of 10% is reasonable.

This growth will be driven by the Millennial generation entering peak spending years. They will begin forming families. With families comes another generation of kids growing up with Disney.

Company Challenges⚠️

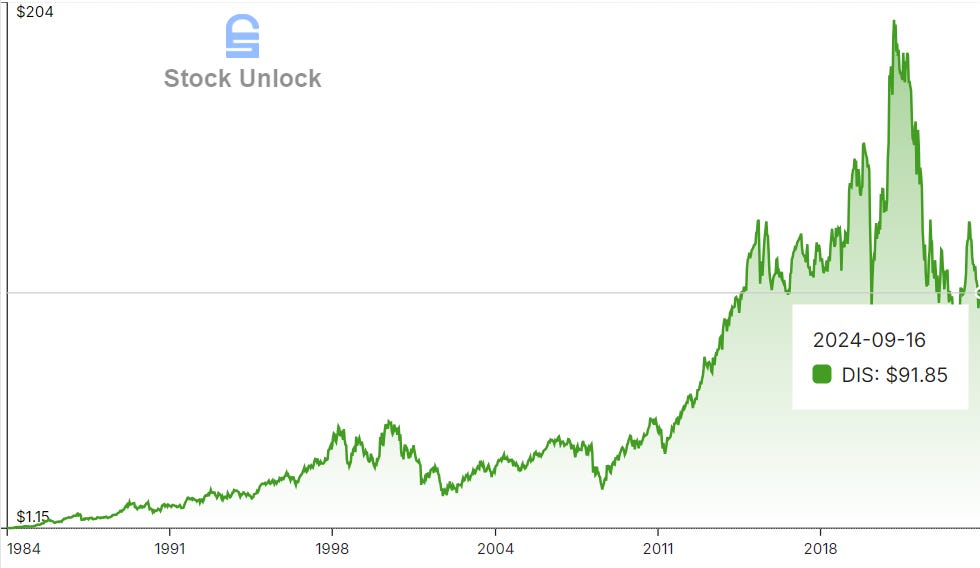

Since their 2021 peak, Disney’s stock is still down more than 50%. Yet, their revenue has jumped from $67.4 billion in 2021 to over $90 billion in the TTM. So, what’s going on?

Sustained streaming losses and declining TV profitability.

Worries about a slowdown for their parks.

Poor performance of new movies.

Increasing competition.

These are serious issues affecting the profitability of Disney. When you realize free cash flow is down from about $10 billion in 2018 to only $5 billion in 2023. It makes sense why they are down big.

Addressing the Issues🛠️

Are the issues Disney is facing permanent impairments? Or temporary blips?

Sustained streaming losses and declining TV profitability.

Their TV segment has declined in profitability from $9.4 billion in 2020 to $4.1 billion in 2023. During this time their streaming business has also lost a cumulative $10.5 billion with a $2.5 billion dollar loss in 2023.

What is the company doing to turn things around?

In recent years, Disney has made several changes to support its streaming business:

Introduced advertising for lower-tier subscribers.

Increased subscription prices (with another hike coming in Oct 2024).

Bundled services to reduce churn.

Cracked down on account sharing (benefits will mostly kick in by 2025).

These moves have had a major impact on the segment’s profitability. In Q4 2022, Disney’s DTC streaming lost $1.5 billion. But in Q3 2024, they turned profitable and expect continued improvement.

On recent earnings calls, Disney projected double-digit income margins for its streaming business. Which, based on current revenue, could mean an additional $2.5 billion in profit.

An important note as well, Disney+ core subscribers have jumped from 74.8 million in 2021 to 118.3 million in the TTM.

As for their legacy TV business, unfortunately, it’s dying. And I don’t think there’s much Disney can do to save it. They should focus on squeezing out whatever profit they can as it will likely be a slow motion crash.

Worries about a slowdown for their parks.

Since their peak attendance in 2019, Disney’s parks haven't fully recovered to the same levels. However, from a revenue standpoint, their experiences segment continues to hit all-time highs.

In 2019, operating income for this segment was $7.3 billion. In the TTM, it's now $9.4 billion.

While the dip in total attendance might raise some concerns, Disney has raised prices, and attendance remains strong.

People see Disney parks as a luxury experience they’re willing to pay for. Something they can’t get anywhere else. It’s a metric worth keeping an eye on, but their income numbers speak for themselves.

Looking ahead, Disney plans to invest heavily into this fast-growing part of their business. Through 2034, they’ll invest $70 billion into their parks, with $40 billion specifically for increasing capacity.

Poor performance of new movies.

Disney is most well known for their movies but recent performance has been disappointing.

In 2019 Disney generated about $11.1 billion in revenue from new movies. In 2023 that number remained below their peak at $9 billion. The real issue though, lies in profitability.

In 2019 operating income from movies was $2.7 billion. In the most recent quarter they made $250 million or a run rate of $1 billion. Significantly below their peak.

It seems though, Disney is starting to wake-up proven by two recent releases. Inside Out 2 and Deadpool & Wolverine.

Inside Out 2 is the highest grossing animated film ever and Deadpool is the highest grossing R rated movie ever. Both very good signs their creative engine is coming back to life.

This issue is probably the toughest to be confident in, but I believe Disney got the message that the direction they were headed wasn’t working. On earnings calls, management has emphasized that they’re cutting back on the number of films and TV series to focus more on quality.

It is always a good sign when you give creative people the space they need to work.

Increasing competition.

Disney is facing tough competition from all sides. Universal Studios is building a new theme park in Orlando to rival Disney World. In streaming, they’re up against Netflix, Warner Brothers, Amazon, and Paramount. And in the sports segment, competitors like NBC Sports, Fox, Warner Brothers, Paramount, and Amazon are all vying for attention.

Competition is just a fact of life when you operate in industries who target everyone. This is nothing new for Disney.

I believe the next decade will see massive consolidation for the streaming industry. Many industry participants are unprofitable or have big issues plaguing them.

Disney only needs to return to their original and popular new content. If they do that they will have no issues generating massive amounts of cash. Everything hinges on that. Original and popular new content.

Has Disney had a drawdown like this before?

The cycle we are watching Disney go through right now is not new. When you look back to the early 2000’s you see a similar drawdown in operating cash flow.

Graphic of Operating Cash Flow.

Before this period they had fast growth which led the company to try and expand aggressively. Like most companies that try to grow too quickly, margins suffered.

They then had to take a few years to sort things out, cut costs, and get back to making great content. Once they were back to that they saw about 14 years of great growth.

I expect a very similar growth coming again for the company.

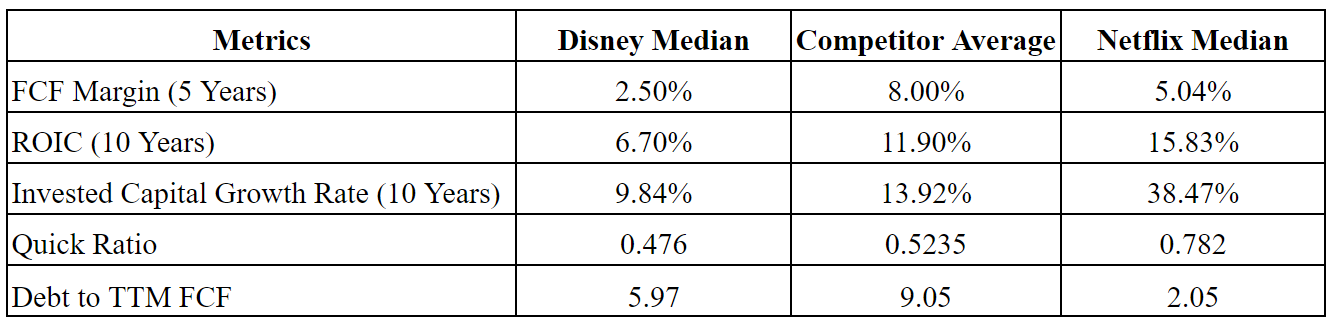

Financial Health❤️🩹

From a first look, things do not look great for Disney. The only metric where they are better than their competitors2 is their quick ratio. When you zoom out a though, things start to look a lot different.

From a 20 year perspective their median FCF is 10.9% and their ROIC improves to 9.2%. Both large jumps from the more recent struggling years.

This tells me if they can successfully overcome the challenges they are facing, Disney’s financials will look far more attractive.

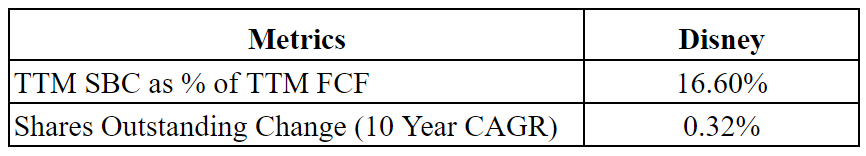

SBC is higher than I would like but manageable. Share count issuance is very minimal over the last 10 years. That is a good sign considering the company’s troubles.

Often when things get rocky companies bail themselves out by diluting shareholders, Disney has not done that.

Valuation📊

Now to the fun part. What is the company worth and can we get a better than average return buying it?

I laid out earlier my expected growth for each of their segments. If we assume that growth over the next 10 years you get the following revenue figures.

Entertainment 2035 Revenue (8%): $86.1 Billion

Sports 2035 Revenue (3%): $23.68 Billion

Experiences 2035 Revenue (10%): $88.37

Total 2035 Revenue: $198.15 Billion

Now that we have expected revenue figures what is a reasonable margin?

When we look at Disney’s margins before Covid and consider AI and tech advances will likely increase efficiency. Then 15% FCF margins feel like a conservative and realistic level to assume. Essentially in line with pre-Covid margins.

2035 FCF: $29.72 Billion

The only figure we need now is the multiple on FCF.

Disney has large competitive advantages because their library of content cannot be replicated. The franchises they own will continue to influence kids for generations to come. That influence leads to spending by parents on all things Disney.

All this makes Disney a quality company and worthy of a higher than average multiple. 22 times FCF, or 4.5% FCF yield feels like an appropriate level. This would mean the following share price and market cap.

Share Price: $360.53

Market Cap: $653.84 Billion

These levels imply about 280% upside or 14.3% CAGR over the next 10 years from $95 per share. A solid return for sure but nothing spectacular.

The following things need to happen for this scenario to play out at Disney:

Return to high quality content creation.

Investments in their parks yield good returns.

Margins are improved through cost cutting.

These are reasonable assumptions given the moves the company has already made.

Conclusion🏁

Disney for myself personally is a pass at these levels despite my high conviction. I would look to add a position though if the stock continues to fall.

I am passing right now despite the solid expected returns because my other investments are just more attractive.

Overall Disney sits in my watch list as a large economic moat because of their content library. They have and will continue to influence generations of kids. What’s not to like!

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

Check out some of my other articles!

https://www.usatoday.com/story/opinion/2024/01/07/gen-z-disinterested-sports-nfl-college-football-championship/72117123007/

Competitors: NFLX, PARA, WBD, FUN, CMSCA, SONY