Stock Idea #1 - Energiekontor | Clean Energy Comeback Opportunity

This article is a quick review of EKT as a business and potential for investment.

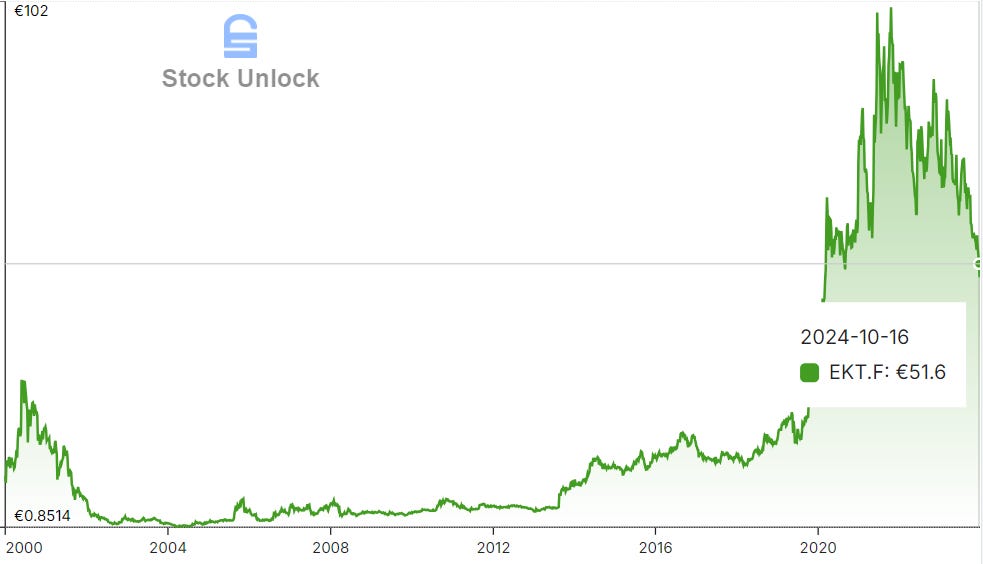

Energiekontor AG is down 50% from recent highs, could it be primed for a powerful comeback? In this article I will quickly break down the company's business and investment potential.

If you like this type of content subscribe to get these posts right in your inbox.

Paid Subscribers, do you have a stock you want me to review? Submit it below and I will include it in a quick review article.

The Business 📃

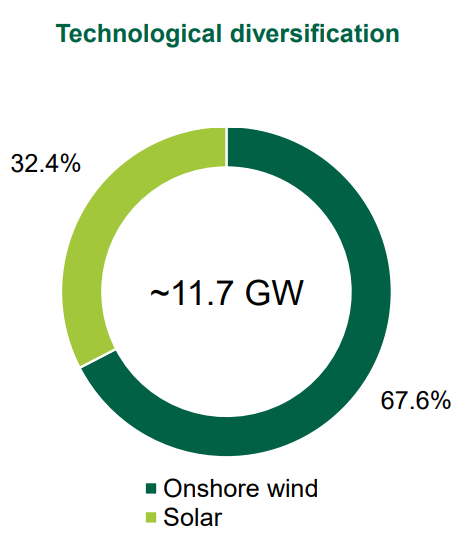

Energiekontor AG is a German clean energy company. Founded in 1990 with the goal of transitioning energy to more renewable sources. Specifically wind and solar.

Operating Segments (% of Revenue):

Project Development (65.2%): Planning and constructing wind and solar parks. Then selling completed projects.

Power Generation (32.7%): Operates their own wind and solar parks.

Operation(2.1%): Operational management services for wind and solar parks. Including those they've developed and sold to others.

Industry Forecast🔮

The solar industry has growth ahead although slowing from recent years. According to several sources solar growth will be about 8%. While wind energy generation will grow at around 12%.

Note: Did you know the globe is spending about $2 Trillion each year to transition to clean energy?

In Europe especially they continue to push towards clean energy. Moving away from other sources like coal. With this driver the estimated growth levels above feel reasonable.

Along with this growth there are other tailwinds that could prop up the profitability in the industry.

Tax Credits

Tech Advances

Risks⚠️

Energiekontor AG stock is down about 50% from highs in 2022. Likely on projected negative EPS growth in the near future. More than short term though what are long term risks?

Risks are likely as follows.

Removal of subsidies or tax credits.

Increased competition leading to lower margins.

Fading enthusiasm for clean energy leading to less demand.

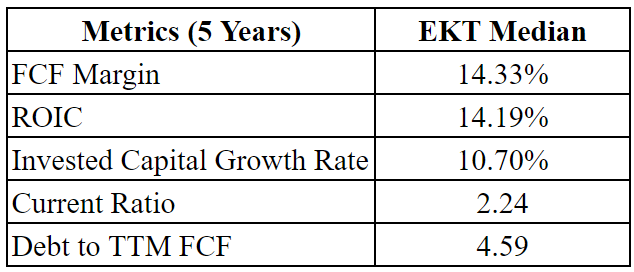

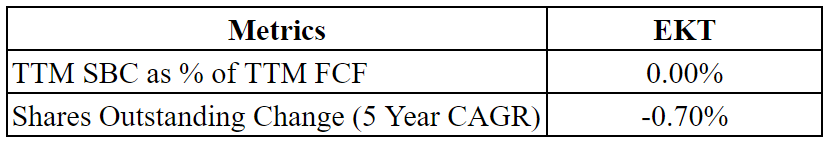

Financial Health Data 📊

Potential Growth and Valuation 📈

In 2023 the company pulled forward some revenue that was intended for 2024. Because of that I will assume a flat revenue growth in 2024. Followed by 12% revenue growth for the next 5 years.

Along with that I will assume a 17x FCF multiple and a 25% FCF margin. Those assumptions lead to the following 2029 numbers.

Revenue: €426.13 Million

FCF: €106.53 Million

Share Price: €132.08

Market Cap: €1.81 Billion

These levels imply a 160% return from current levels of €51 per share over the next about 5 years or a 21% CAGR.

This scenario assumes a few things that are important to consider.

Solar and wind continue to receive subsidies.

Tech advances to improve margins slightly from historical median.

Demand for wind and solar continues to grow.

Conclusion🏁

This company is in a solid position to capture growth in the transition to clean energy. Especially in Europe. And they sit at an attractive valuation.

There is concern about their long term margins. They have fluctuated dramatically even in the past 10 years from negative to now over 40%. Will the industry get crowded and force margins down? Will demand continue to grow as forecasted?

I would rate this as a medium conviction opportunity. There are enough variables that it is uncertain things will evolve as as projected. Despite the concern it is still an attractive opportunity.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.