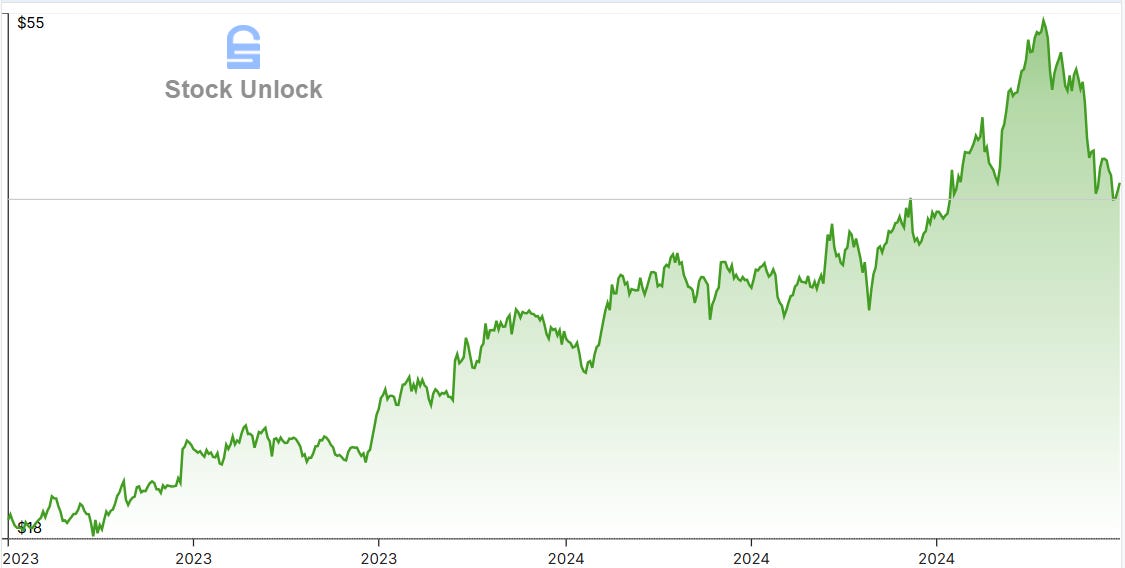

Niche Insurer Dominating | 16% Growth, 2x P/B, 91% Combined Ratio

My investment thesis on a niche insurance company that is worth keeping an eye on.

Every month I put out investment reports to uncover undervalued stocks with 100%+ upside. Saving you hours of research with sharp, actionable analysis grounded in proven value strategies. This week is no exception, so let's dive into Skyward Specialty Insurance.

P.S if you don’t have time to read the full analysis check out the TLDR section after the business description.

Ticker: SKWD

Market Cap: $1.74B

Stock Price: $43.48

TTM Revenue: $1.07B

Based in Houston, Skyward Specialty Insurance Group has been tackling unique insurance challenges since 2006. They specialize in covering risks that most insurers won't touch. From renewable energy projects to cutting edge life science companies.

In their 2023 annual report this is how they state what they do.

“Our customers typically require highly specialized, customized underwriting solutions and claims capabilities. As such, we develop and deliver tailored insurance products and services to address each of the niche markets we serve.”

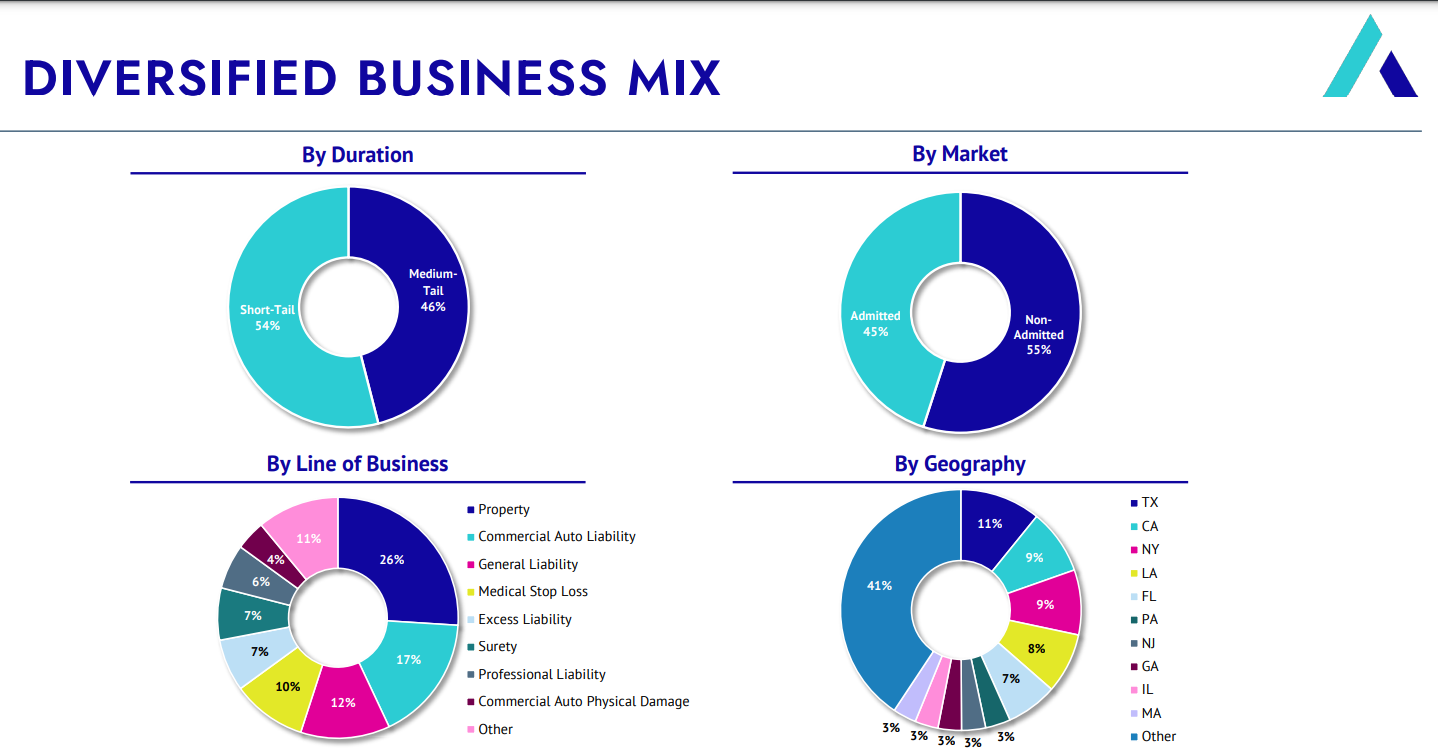

They break their business into two categories.

Admitted (45%) - State regulated insurance lines.

Non-Admitted (55%) - Excess and surplus insurance lines for unique risks.

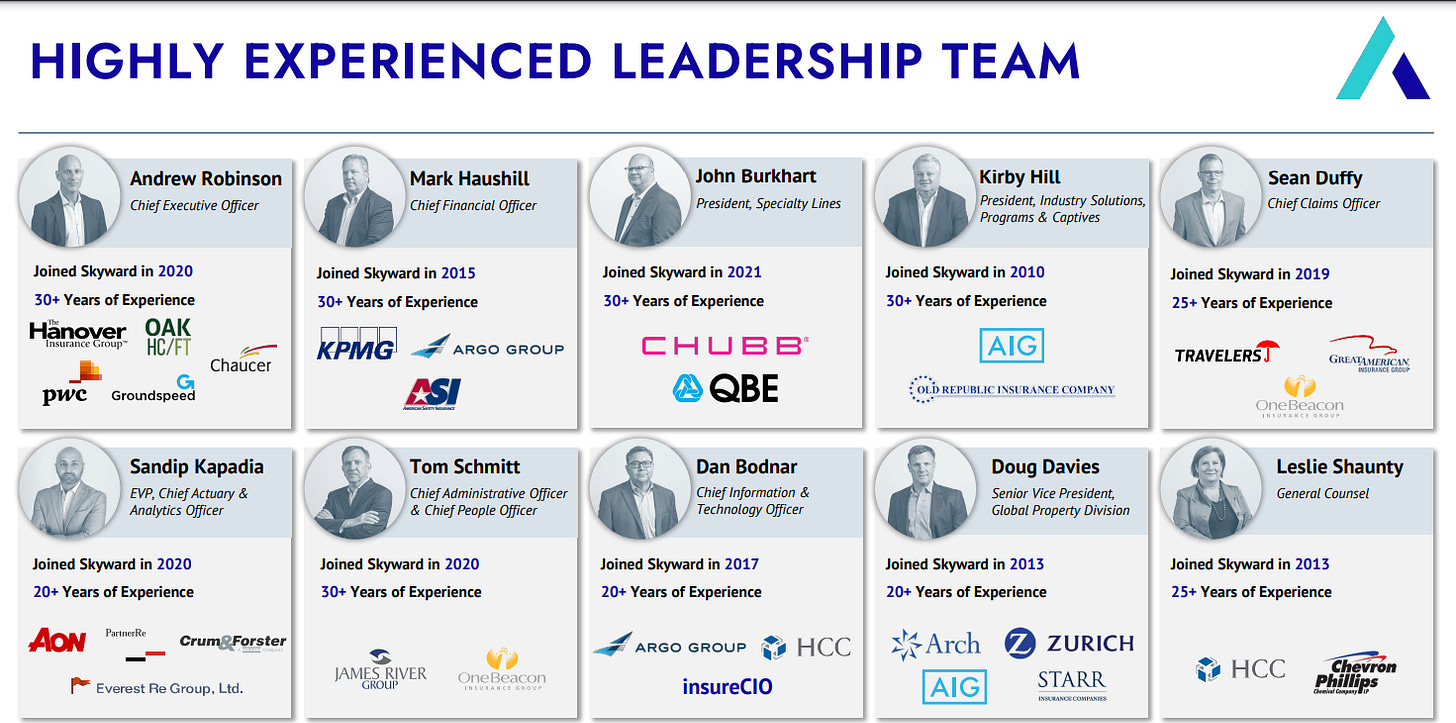

Their leadership team brings deep experience from major insurance companies, combining market knowledge with fresh thinking. That leadership has allowed Skyward to build its name by stepping up in markets where others step back.

AM Best, the go-to insurance rating agency, gives Skyward an "A" rating for financial strength. This speaks to how well they manage their risks and maintain their finances.

I had previously taken a quick peek at this company and passed on it. But after their recent 20% drop and comments from

(Check his content out if you haven’t.) I had to give them a second look.And I have to say I was a little disappointed in myself. This is a high quality insurance company with a long runway so lets get into my investment thesis and expectations for the company.

Check out some of my other articles!

Sabio Holdings (SABOF) | The Asymmetric Opportunity of a Lifetime

Daqo New Energy | The Cheap Polysilicon Stock

TLDR

🎯Skyward thrives by focusing on high-margin policies in the E&S market. They leverage deep expertise, disciplined underwriting, and advanced technology to consistently outperform industry profitability.

🎯The E&S insurance market is growing driven by rising demand for specialized coverage and insurer pullbacks from high-risk areas. Trends that align perfectly with Skywards expertise and disciplined growth strategy.

💰These advantages and industry trends will drive growth for many years to come. My 2029 stock price is $107.23, a 19% CAGR from the current share price of $43.48.

Investment Thesis

My thesis for this company is really simple. That they will continue have far better than average under writing profitability and ride industry growth. If these two things continue this company has an incredibly bring future.

Profitable Underwriting

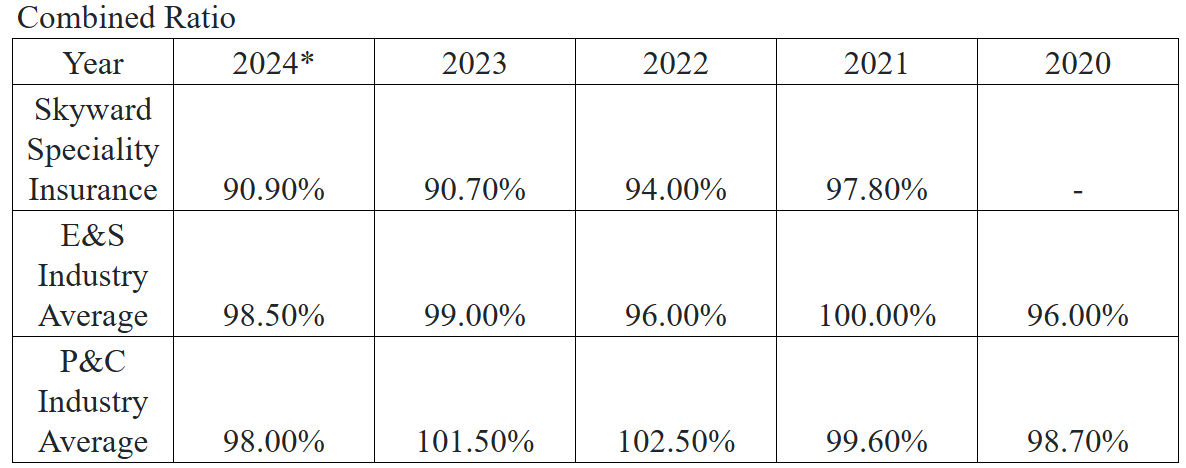

The insurance industry is plagued by companies that make very little or even lose money on the policies they write. This profitability is measured using a combined ratio.

If you want to learn more about underwriting profitability and float I wrote and in depth article here.

I put together the table below comparing Skywards combined ratio to industry averages.123

Skywards underwriting excellence is clear in the numbers. While many P&C insurers lost money on underwriting in 2023 with a combined ratio of 101.50%. Skyward achieved a 90.70% combined ratio. This means they earned about 9.3 cents of profit for every premium dollar they collected.

Their success isn't luck. They've consistently beaten industry averages by 5-10 percentage points for several years running. At the core of this performance is their focus on specialty insurance niches that require deep expertise.

Unlike standard P&C insurance where policies are similar across companies, Skyward writes complex policies that few insurers can handle properly.

This specialty focus, particularly in the E&S market, gives them significant pricing power. Since these complex policies require specialized knowledge to write correctly, Skyward can maintain higher profit margins than insurers who sell standard policies. But maintaining these margins requires strict discipline.

That's where Skyward stands out from competitors. While many insurers chase growth at any cost, Skyward is selective about their expansion. If a line of business isn't meeting their profit standards, they'll exit completely. Which they are actually doing with their withdrawal from the personal auto insurance business currently.

They back up this disciplined approach by hiring specialists who deeply understand their specific markets rather than general insurance experts.

Adding to the advantages, Skyward has invested in technology. Their commitment to data analysis tools and digital systems enhances their specialist knowledge. Together, these elements create a business model that competitors struggle to replicate.

Growing Industry

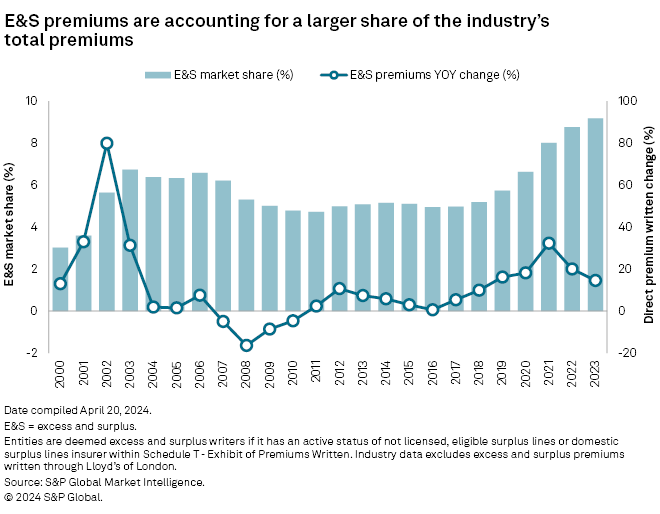

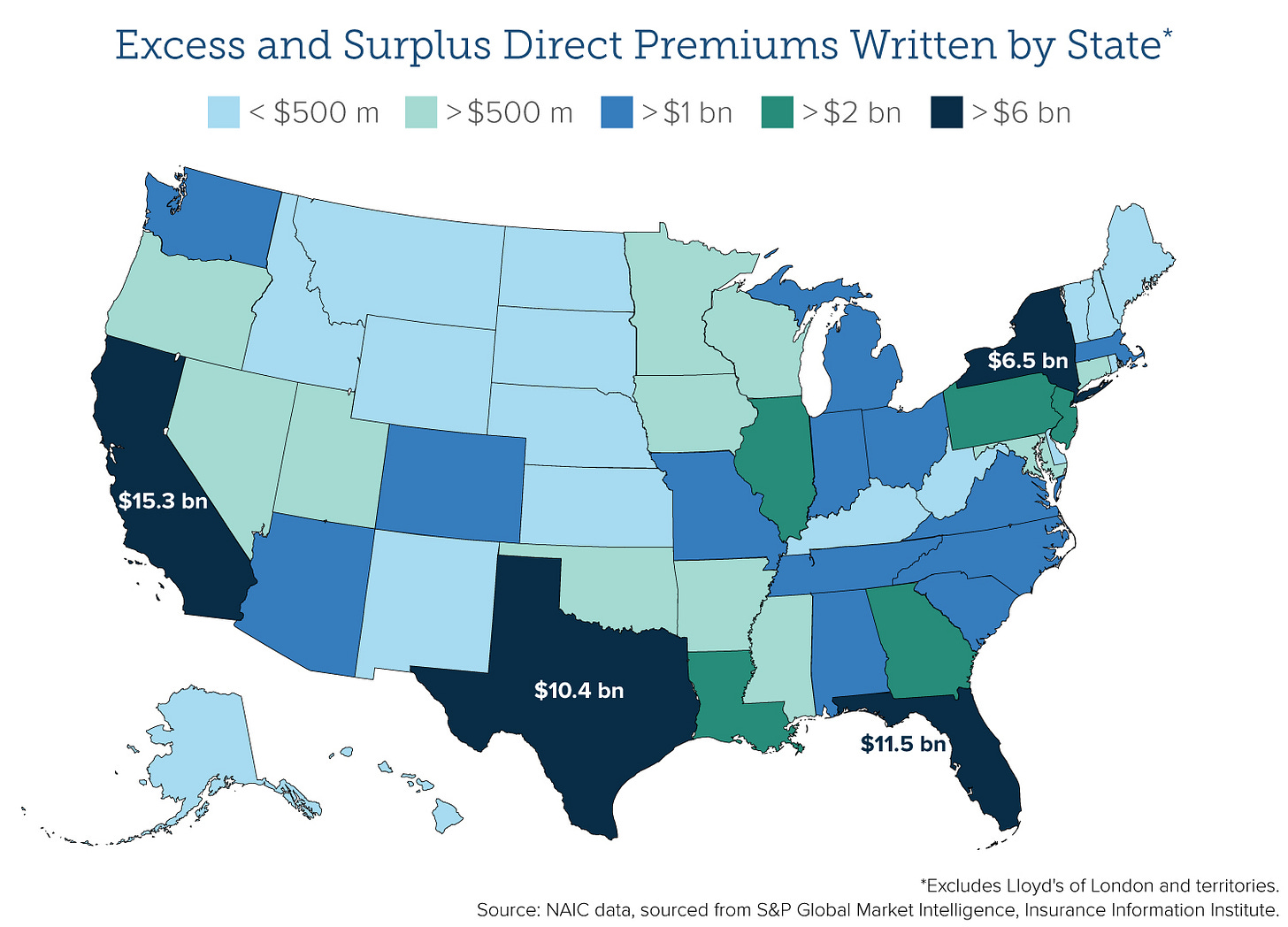

The E&S insurance market's impressive growth shows no signs of stopping. Over the past decade, E&S has grown from 5.2% of total P&C premiums in 2013 to 9.2% in 2023. This growth recently hit a milestone with the market exceeding $100 billion in premiums for the first time, reaching over $115 billion in 2023.

While the market's rapid expansion has slowed from its peak of 32.3% growth in 2021, it's still posting impressive gains with 14.5% growth in 2023. Several factors are pushing more business toward E&S insurers like Skyward.

Traditional insurance markets are pulling back from risky areas like Florida property insurance and cyber coverage. This creates opportunities for E&S insurers who can properly price and manage these risks.

Adding to this trend, many industries now need specialized coverage that standard insurers simply can't provide. The increasing severity of natural disasters and emerging risks like cyber attacks only accelerate this shift toward E&S solutions.

My baseline assumption for the industry is low teens growth for at least the next 5 years.

These market trends play perfectly into Skyward's strengths. Not only have they historically grown faster than the overall E&S market. But they've done so while maintaining better underwriting results.

Their specialized focus and disciplined approach position them to capture an outsized share of this growing market. While maintaining their superior underwriting performance well into the future.

So where will their advantages and industry growth lead? Simply put, a stock price that goes up and to the right.

Skyward stock is down due to the California fires and concerns it could impact profitability. It will certainly affect the company short term but insurance inherently involves risks. They have proven they understand how to price their policies to get compensated for the risks. So I don’t expect it to be anything more than just another natural disaster they will pay some claims out on.

Valuation

Now down to the important part, does the company present an attractive buying opportunity right now?

To find the value of insurance companies I like using book values. The baseline for an average insurance company sits at 1x price to book. Skyward is far more profitable than most so its not a stretch for them to get 2.5x book value.

Over the past about 3 years book value per share has grown at 23% per year. It is very reasonable if the industry grows in the low teens for Skyward to grow book value at 16% per year.

Lastly I will assume 0.5% per year decline in share count since they plan on starting buybacks per their latest earnings call.

“I'm pleased that our Board of Directors has approved a share repurchase program of up to $50 million of Skyward ordinary shares. Authorizing a repurchase program is part of the maturation of Skyward as a public company and underscores our commitment to maximizing shareholder value.”4

Base on these assumptions we come up with the following valuation by 2030.

Share Price: $107.23

This comes out to a solid 19% CAGR from the current share price of $43.48. A very solid return for such a quality company.

For my personal portfolio this company will definitely go on a watch list but is not cheap enough yet to add at this price. Something right around $35 though I will seriously considering taking a position.

Disclaimer:

This content is provided for informational and entertainment purposes only and should not be construed as professional financial or investment advice. The opinions expressed herein are solely those of the author, based on personal research and analysis, and do not reflect the views or advice of any financial institutions or licensed professionals. I do not have access to your personal financial situation, goals, risk tolerance, or investment preferences, and therefore cannot provide personalized investment recommendations. It is essential that you conduct your own research, carefully consider all relevant factors, and consult with a licensed financial advisor or other professional before making any investment decisions. Investing inherently involves risk, including the potential loss of principal, anmd past performance is not indicative of future results. I am not responsible for any decisions, actions, or outcomes resulting from the use of this content. Always ensure that your investments align with your personal financial situation and long-term objectives.

See you in the next edition!

Sources say all different kinds of numbers for each years average so the data you find might differ slightly

https://www.insuranceinsiderus.com/article/2d1vg86ayyadc6ahjjpq8/e-s/e-s-2023-data-shows-double-digit-growth-underwriting-outperformance

https://content.naic.org/sites/default/files/2023-annual-property-and-casualty-insurance-industries-analysis-report.pdf

https://capedge.com/transcript/1519449/2024Q3/SKWD

Thanks for the thesis.

I am curious though. In a world where KNSL exists, why would one own SKWD?

KNSL's combined ratio is far superior (77% vs 90%), and if the thesis is around E&S market growth, they are 100% concentrated on E&S vs 55% for SKWD.

Also, in my view, the biggest point one should look for in insurance before anything else is risk management. In this post I only see "deep expertise, disciplined underwriting" which doesn't mean much.

I would like to know if they outsource their underwriting for example, as that is a big sign of whether the company is in control of it and considers it a core competency or not. Nevertheless, I appreciate the breakdown of their underwriting by line of business and geography.

The point I would see in SKWD's favour is valuation as KNSL's is considerably higher. The quality of the business is better though, so it should command a higher multiple.

Disclaimer: KNSL is a big part of my portfolio, but I am always looking for added perspectives.

Disclaimer 2: I don't know anything about SKWD besides what you wrote in your piece, hence the questions.