Kelly Partners Group | An Australian Berkshire in the Making

This article is a review of the small cap Australian accounting firm KPG. Check it our for a full breakdown of their business and potential for returns.

Welcome to Busy Investor Stock Reports

In this article, we dive into Kelly Partners Group, a rising star among Australian small caps that’s not done yet. Stick around to see how Brett Kelly is guiding this company to success—and what that could mean for your portfolio.

If you like this type of content subscribe to get these posts right in your inbox. (Hint: Paid subscribers get the premium content!)

Company: Kelly Partners Group

Ticker: A$KPG

Market Cap: A$359.6 Million

Industry: Accounting`

Free Cash Flow: A$21.33

Revenue: A$108.14

The Business 📃

Kelly Partners Group was founded in 2006 by Brett Kelly who remains the CEO today. The company provides accounting and taxation services for small and medium size businesses. They operates mainly in Australia but is expanding in the US and globally.

Brett Kelly was reluctant to start the company initially but finally gave in, saying:

“The problem was that I didn’t think that accounting firms were run intelligently as businesses. They weren’t run to help their people and they weren’t run to really help their clients. They were really a place where a technically minded person could impress themselves with their own technical skills. I thought we could do better.”1

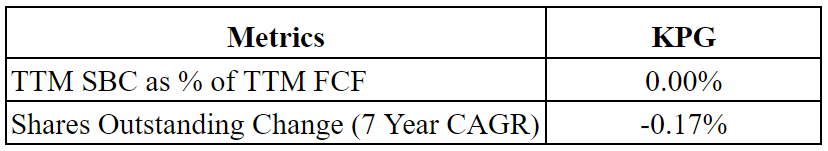

And do better he has, doubling the company’s revenue on average every 3.2 years since it was founded. With a service record on another world compared to competition.

The thing that really sets this company apart is the culture and management. I would put Brett Kelly up with some of the greatest managers of all time.

He built a company that provides services of higher quality and profitably than competitors. Has great long term vision. And has a lot of runway ahead. Kelly stated the following.

“I am really trying to build the next Berkshire/Constellation of the accounting industry and build Australia’s only global accounting firm for private business owners.”

His actions show his focus on the business models he admires. The company focuses on delivering products they know, accounting and taxation. And making many small acquisitions in that circle of competence. Those acquisitions, when combined, have had a large impact.

Since the founding of that first office KPG has completed 80 partnerships.

At each location KPG acquires they add significant value. Integrating proprietary systems and unified marketing to drive revenue growth. Along with optimization of back office functions to improve margins and cashflow. That is just part of the reason businesses keep knocking on their door.

The company has a fantastic story and the numbers to back it up. So let’s dive into the industry and company a little deeper.

Industry Forecast 🔮

Kelly Partners Group operates in the massive and fragmented accounting industry. The total addressable market sits at around $600 billion globally. Nothing to sneeze at!

On a global industry level accounting will likely grow a little faster than global GDP.

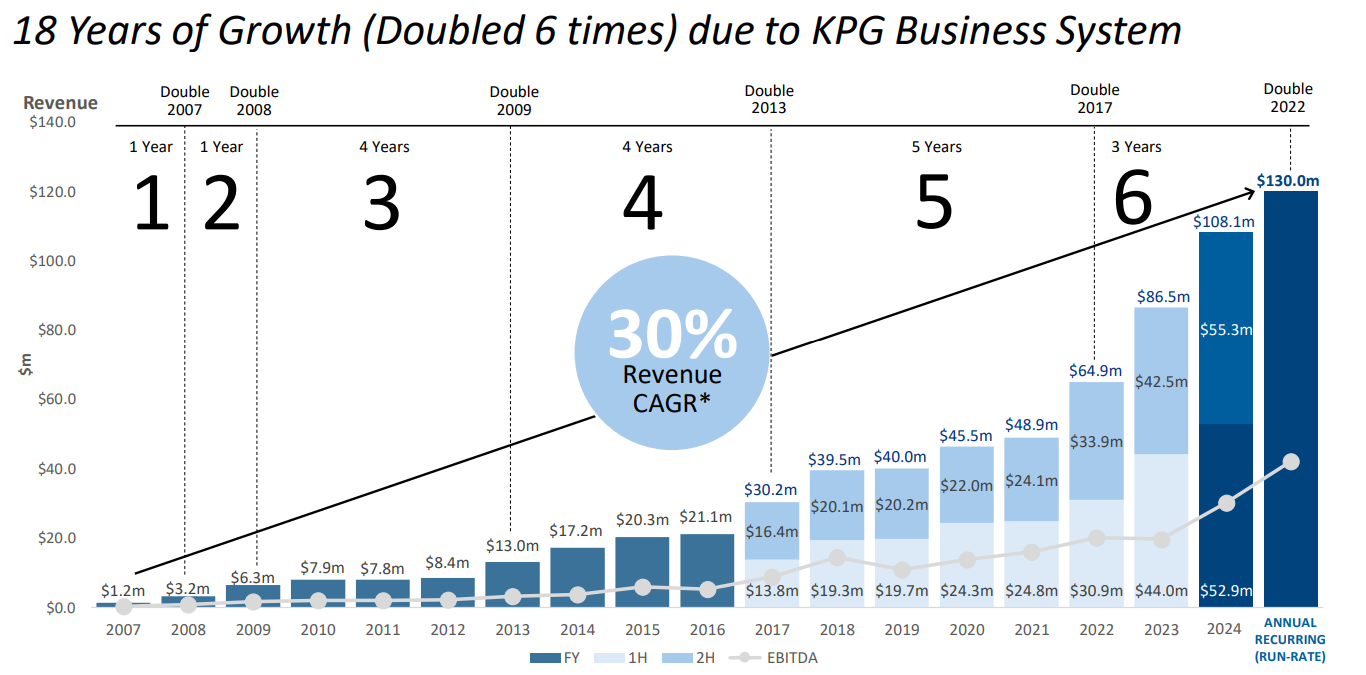

This growth is driven by a few tailwinds. Technology integration in emerging markets making accounting more important and realistic. Along with continued lengthening of tax codes in already developed markets.

Those combined factors tell me it is realistic for the industry to grow at about 5% annually. This is supported by several different forecasts calling for 9.2% growth2, 7.15% growth3, and 4.4% growth4. Which discuss similar growth drivers.

(P.S. KPG will likely dwarf that baseline growth assumption.) 📈

Risks ⚠️

Whenever I analyze a company, I focus on what could go wrong. If the risks can be overcome or seem unlikely, you might be looking at a great business. For KPG, here are the three key risks.

Rapid technology innovations that disrupt the industry.

Deterioration of Kelly Partners Group reputation.

Key man risk.

There are probably other risks that come to your mind, like economic downturns. I did not feel any others are worth exploring as they didn't feel likely to have an impact. Or were covered in addressing the others mentioned.

Addressing Risks 🛠️

Rapid technology innovations that disrupt the industry. 🤖

Technology innovations will change every industry in some way over the next 10 years. Accounting is no exception.

Assuming a company is able to build an AI tool to perform accounting tasks I do not think they eliminate the need for humans.

Tax laws change often and can have many exceptions, gray areas, and loopholes. On top of this accounting firms often personalize reports, data, and advice to a company’s needs or industry. Those needs require conversations and a deep understanding of options available.

I don’t think AI will be able to take over an industry so nuanced. But will enhance already running operations, not put them out of business.

Deterioration of Kelly Partners Group reputation. 🤝

A deterioration of the Kelly Partners Group reputation would likely be the worst case scenario for the company. They command a fantastic reputation currently with a net promoter score of 72. The average accounting firm is -18. This means almost all of their customers give the company 9 or 10 out of 10 ratings.

If they were to falter and lose reputation it could hinder their ability to retain and acquire new clients.

When you dive deep into the company though, I don’t believe this will or is even somewhat likely to happen. A decline in reputation would likely come from bad acquisitions that dilute the high quality work they are doing.

To combat this the CEO said in an interview, he makes it very hard to become a partner. This filters out anyone looking to offload a company, make a quick buck, or those with bad intentions. Only those with long term focuses who see the value Kelly Partners Group offers follow through.

On top of this the company has no revenue targets, no profit targets, and no acquisitions goals with deadlines of any kind. Goals like those push management to get a deal done even if it is questionable. This means they can and have sat on their hands until attractive deals come their way.

These are both intentional moves by the company. They preserve operational integrity and allow the company to maintain its key advantage. Providing a critical product their clients love with unmatched expertise.

Key man risk. 👨💼

The only other risk I feel is worth mentioning is the key man risk of the CEO Brett Kelly. He is the center and driver of this quality company. So it is reasonable to consider what would happen if he were gone.

While I do believe if Brett was no longer in the picture the future would not be as bright. I do not think it would have as large an impact as it seems.

Much like how Berkshire is set up to run without Charlie and Warren, KPG is set up to run without Brett.

It is the culture and reputation of the company, not Brett Kelly, that will bring new partners to their door. And keep them providing incredible service to their clients.

So to me this is not as large of an issue as it seems. Although I think everyone can agree, losing a CEO as talented as Brett will have negative consequences.

Financial Health ❤️🩹

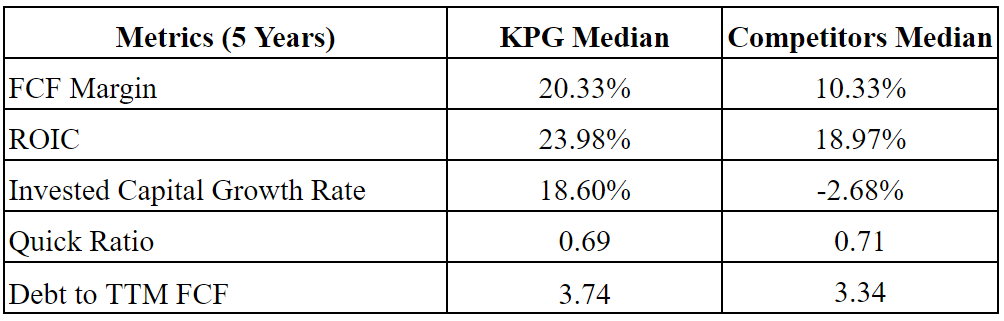

When you look at the numbers for KPG compared to other competitors things look promising. The only area where they are average is in their debt levels which are very close to their competitors5.

These numbers tell me KPG is twice as profitable. And can make more money than their competitors investing back into their business. They have the money to meet their debt obligations and continue to invest back into the company. All good news.

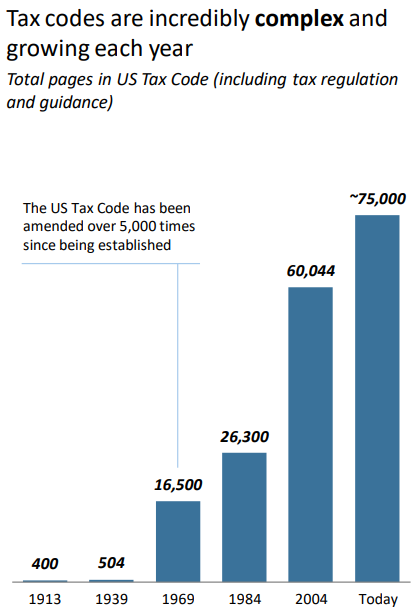

Taking a look at share count and stock based compensation things still look fantastic. They do not issue stock as compensation and have bought back a small amount of shares. Great news for shareholders as you know management is protecting your interests.

Potential Growth 📈

To understand Kelly Partners Group we need to go beyond industry growth. I hinted at their strategy of acquiring companies in the fragmented accounting industry. But how does that affect their growth?

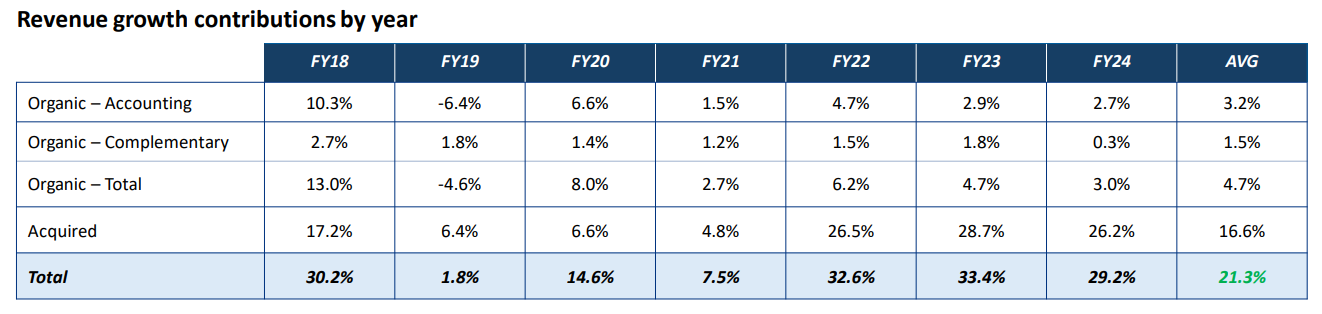

When you look at what KPG has done over the last 18 years it is pretty impressive.

And they don’t plan on stopping anytime soon. Their goal is to become a top 10 accounting firm in Australia. Largely driven by acquisitions.

They expect to have many opportunity to buy accounting firms as so many are facing succession concerns. The accounting professionals are aging with no one to replace them.

On top of this tax codes are not getting any more simple. This means the need for experts is only growing.

And lastly as the nail in the coffin. The top 10 companies in the industry only account for about 21% of the market share. In fact in the US there are about 52,200 CPA firms. 85% of which have less than 10 employees. Those small firms are what KPG is focused on and there are plenty of them.

So it is clear they will have an opportunity to grow but what will that contribute to revenue growth? Their past record indicates they can grow significantly faster than the industry.

I expect they can continue this trend although at a slightly slower pace of about 14% growth through acquisitions. This is down from average revenue growth contribution from acquisition of 16.6% over the last 8 years.

I am assuming a slightly slower pace to be conservative. And because as anything gets larger moving at a quick pace usually becomes more difficult. I would be happy for them to prove me wrong though.

In total with organic growth this comes out to a 19% revenue growth rate for the company. An exciting prospect for a company trading at 17x FCF.

Valuation 💰

Now to the fun part. Can we get a good rate of return by buying the company?

First let’s look at revenue growth. Assuming revenue growth at 19% over the next 10 years you would get the following revenue in 2035.

2035 Revenue: A$615.82 Million

Now on that revenue what free cash flow margin could we expect? Over the past 5 years 20% margins is a good place to start. I suspect as they are able to continue to improve, add new tech, and acquisitions become less of a drag this will rise. 25% FCF margins feel very reasonable.

2035 FCF: A$153.96 Million

Lastly, on this FCF what is a reasonable multiple? This is a high quality company. They have a top tier CEO, great culture of efficiency, high return on capital, and deliver a fantastic product. A 20 time FCF multiple or a 5% FCF yield is reasonable. Especially when you consider the stability of the industry and their high growth rate. At that multiple you get the following share price and market cap in 2035.

Share Price: A$68.61

Market Cap: A$3.08 Billion

This implies a 757% return over the next 10 years or a 24% CAGR from the current A$8 share price. A very intriguing return especially for such a long period. Even after which returns will likely look very attractive.

In this scenario I am making the following assumptions.

KPG can continue to acquire quality accounting firms.

Tax law remains complex.

KPG continues to provide high quality services.

KPG operates with a high level of efficiency and makes marginal improvements.

Conclusion 🏁

From the research I have done it has been hard finding something I didn’t like. From every angle I look at the worst they were average. At best they sit right alongside some of the most well run companies in the world.

I am excited to see the future the company has and expect great things from Brett Kelly.

Disclaimer: This content is for informational and entertainment purposes only. The opinions expressed are my own and not professional financial advice. I do not know your personal financial situation. Please do your own research and consult with a licensed financial advisor before making any investment decisions. Investing involves risk, including the potential loss of principal.

Advertising: Looking to advertise your product, service, or newsletter to a high quality audience? We have a 43%+ open rate with an average of over 300 views per post and growing quickly. Feel free to message me directly on Substack or email me at kylerjohnson4828@gmail.com!

Check out some of my other articles!

https://www.businessnewsaustralia.com/articles/kelly-partners-enters-us-market-amid-two-decades-of-berkshire-style-stealth-growth.html

https://www.prnewswire.com/news-releases/accounting-services-market-to-reach--1-5-trillion-globally-by-2032-at-9-2-cagr-allied-market-research-302004559.html

https://www.verifiedmarketresearch.com/product/accounting-services-market/

https://www.thebusinessresearchcompany.com/report/accounting-services-global-market-report

HRB, VERX, RKN, CBIZ

Interesting valuation calculations - I'm curious, how did you come up with your revenue growth model? Was looking at the numbers and wondering